Rapid Withdrawal Processing at United Kingdom Digital Gaming Platforms

The gambling sector in the United Kingdom has developed significantly, with players increasingly expecting immediate entry to their funds. Standard banking systems that once demanded three to five business days have grown obsolete for https://bet-tom.co.uk/ modern users who require rapid transactions.

Understanding Speed in Digital Casino Payment Processing

Payment velocity is determined by several linked factors outside the operator's control. The monetary architecture tying betting platforms to customers comprises payment processors, banking institutions, and compliance verification systems. Every piece adds time to the payment chain, however technical advances have minimized these timeframes dramatically.

A documented fact worth noting: As per the UK Gambling Commission's compliance framework, all approved establishments must conduct verification validation checks ahead of processing cashouts, which legally mandates operators to deploy Know Your Customer (KYC) procedures irrespective of payment method speed.

Transaction Methods Listed by Speed

Different monetary methods present different processing speeds due to their base infrastructure and financial relationships. Online wallets reliably exceed classic methods owing to their electronic-based architecture and previously verified account systems.

| Payment Method | Typical Processing Time | Additional Considerations |

|---|---|---|

| Digital Wallets | Within 24 hours | Needs prior verification of wallet account |

| Bitcoin | 0-2 hours | Dependent on blockchain confirmation times |

| Bank Cards | 1-3 business days | Bank processing timetables apply |

| Wire Transfers | 1-5 business days | Slower for overseas transactions |

| Voucher Vouchers | N/A | Usually one-way tools |

Key Factors Determining Withdrawal Speed

Numerous system elements establish how fast money get to your account beyond the payment method itself:

- Authentication Status: Profiles with completed documents handle withdrawals more swiftly than those pending initial identity confirmation

- Payout Amount: Greater transactions typically initiate extra protective reviews and manual approval procedures

- User History: Experienced users with consistent activity behaviors encounter minimal delays compared to new accounts

- Timing of Request: Submissions during business hours receive quicker handling than holiday and holiday requests

- Outstanding Bonuses: Current offer requirements may limit cashout functionality until playthrough obligations are satisfied

- Protection Checks: Atypical activity patterns or system switches can prompt protective measures that lengthen processing time

Digital Architecture Behind Speed

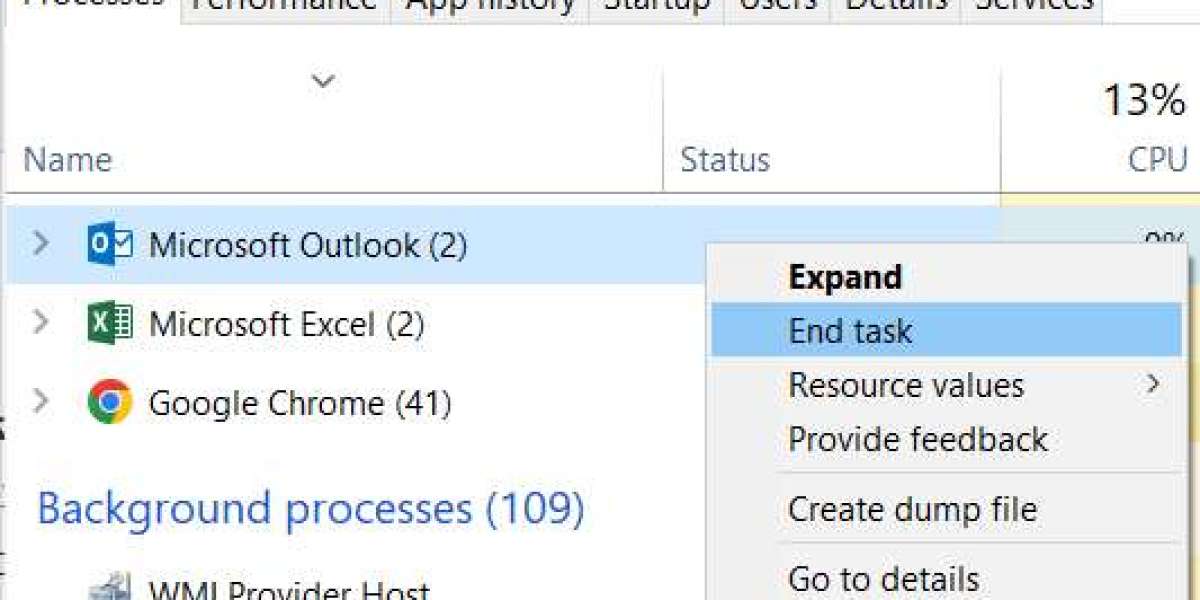

Modern casino operators use cutting-edge transaction gateway systems that mechanize a large portion of the cashout process. Software Programming Interfaces (APIs) connect operator systems straight to banking solution providers, cutting out personal participation for regular transactions.

Advanced platforms execute layered processing models where smaller amounts receive immediate approval, while greater amounts go through stepped review protocols. This layering reconciles protection obligations with player satisfaction.

Oversight Requirements and Its Influence

British casino establishments run under tight supervision that prioritizes user safety and AML protocols. These compliance mandates demand certain validation steps that aren't able to be bypassed independent of technological capabilities.

The legal framework mandates establishments to maintain audit logs for all payment transactions, verify origin of funds for major deposits, and check transactions against sanctions lists. These safety actions necessarily bring processing time but preserve the reliability of the gaming ecosystem.

Optimizing Your Withdrawal Speed

Bettors can take preventive approaches to minimize waiting elements within their control. Finishing total account validation instantly upon registration eliminates the main bottleneck. Submitting readable, well-lit documentation eliminates disapproval cycles that reset processing timelines.

Picking payment options that align with your payment channel frequently hastens processing given that the validation chain is already established. Sustaining uniform device usage and regional behaviors reduces fraud triggers that cause manual reviews.

Understanding active playthrough conditions before initiating withdrawals stops frustrating refusals. Most platforms show real-time bonus completion, permitting tactical timing of payout requests.

Upcoming Progress in Payment Solutions

New payment systems persist in expanding speed thresholds. Modern banking programs facilitate immediate bank-to-bank transfers that skip standard card networks. Blockchain-based solutions offer payment finality within moments versus days.

AI systems are growing better at identifying legitimate transactions from dubious activity, likely decreasing mistaken fraud blocks that slow down real player withdrawals.

The market-driven landscape propels continuous improvement in payment processing as operators recognize that payout speed considerably shapes customer contentment and loyalty metrics.