The financial scene of millions of service and hourly workers has been obvious for decades: the more one works, the more he or she earns, yet a large share of it goes away to taxes. This equation is bound to change dramatically in 2026 due to a historic revision of federal tax law that will alter the fundamentals of the value of extra effort.

In the huge hospitality, restaurant, and service industry, particularly in such states as California, where the cost of living is high, this will be a possible game-changer. Discuss your case with an expert (like a tax attorney in Orange county CA) for the best outcome.

The essence of the double-change is easy but strong: your additional time and gratuities are henceforth arranged to be net worth, adding more than your base salary.

Break Down the New Preferential Treatment

The 2026 changes bring two important pillars that will put more money directly into the pockets of the employees.

a) Tax-Free Treatment

Every mentioned gratuity is now subject to no federal income tax.

Although the taxes of Social Security and Medicare (FICA) remain applicable, the lift of the burden of the federal income tax is a significant rise in the take-home pay for employees who have been tipped.

b) Preferential Tax Rates for Overtime

There is now a lower tax rate on overtime wages (time spent working in excess of 40 hours in any one week) of the federal income tax, which is 10 percentage points less than the usual rate for an individual.

This has the effect of providing a strong motivation and a reward for taking additional shifts, which is a direct response to industries that are facing staffing issues.

Pay Comparison, Proof Is in The Paycheck

Take the example of a server Maria based in California, whose rate is 16/hour, and whose average tips are 200 in nightly tips when she works 40 hours a week. The difference between the old and new rules of 2026 is stark.

Key Aspects and Actions You Must Take

1) Change in State Tax

It is a federal law. The state income tax of California continues to pay the full amount of wages and tips. Nonetheless, the net benefit is still large.

2) Accurate Reporting

To take advantage of tax-free tips, all gratuities should be completely and truthfully disclosed to the employer by the employee. If you need some additional help, try to talk to a professional (like a Fresno tax attorney).

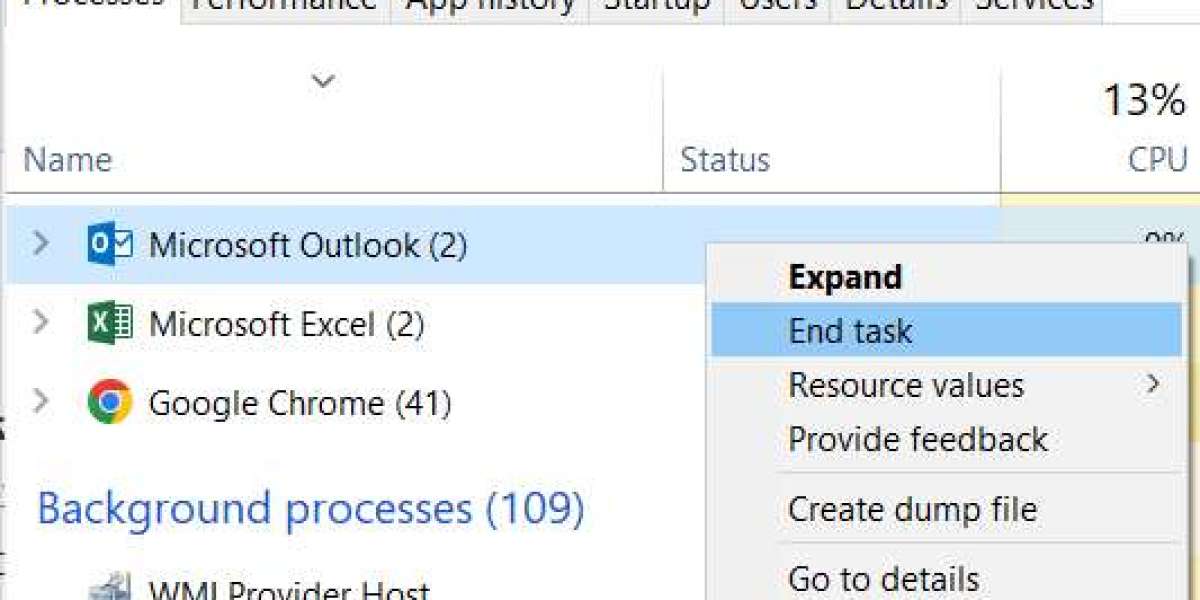

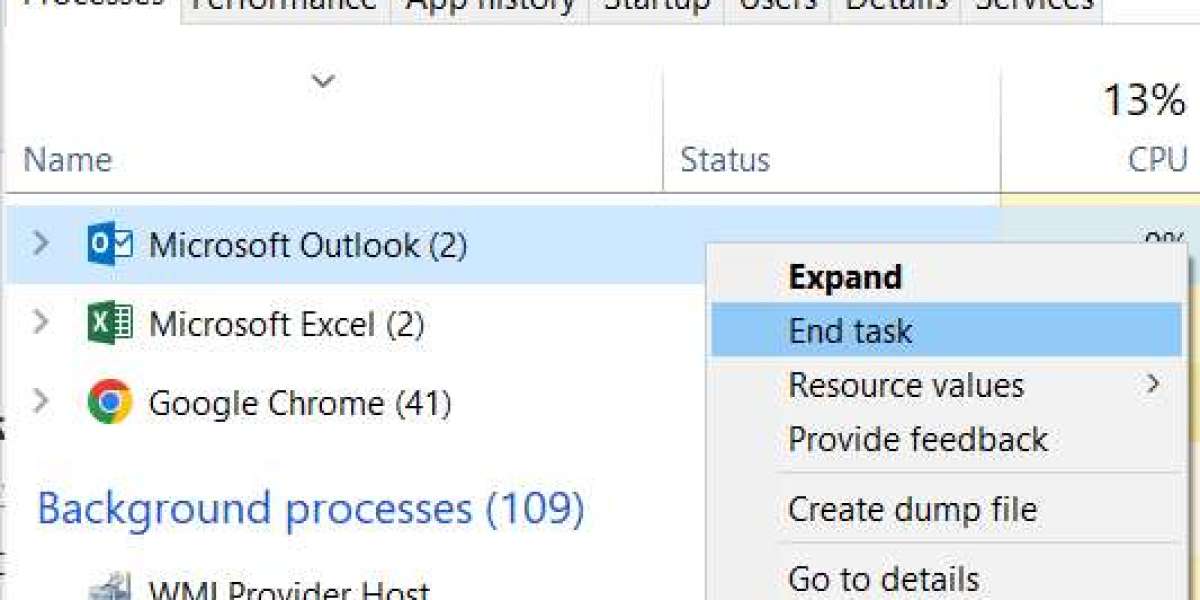

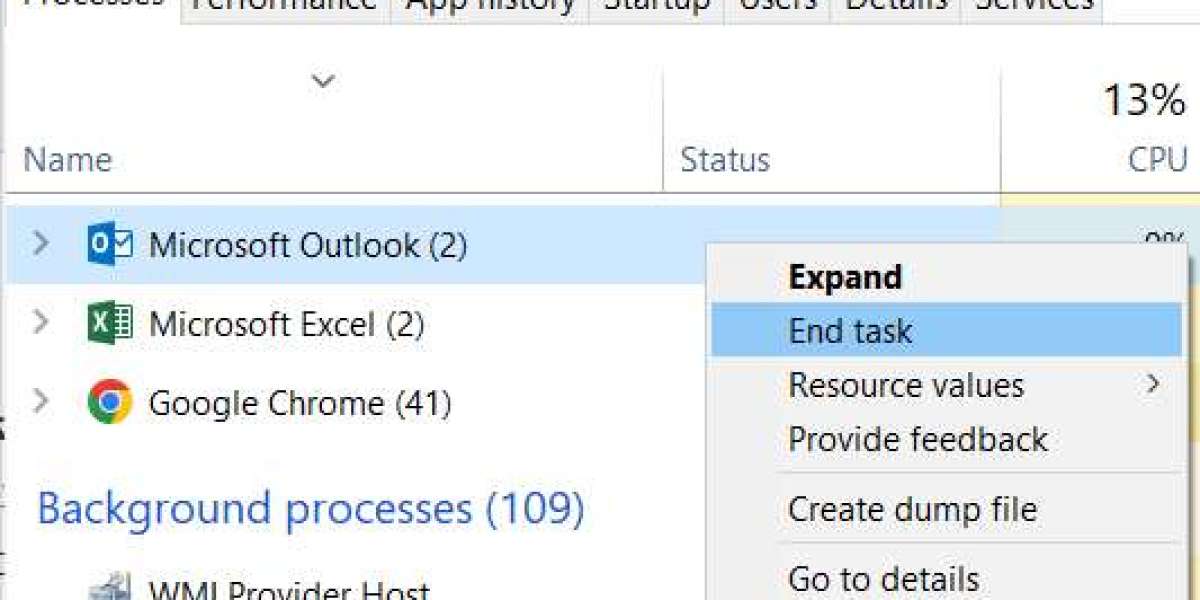

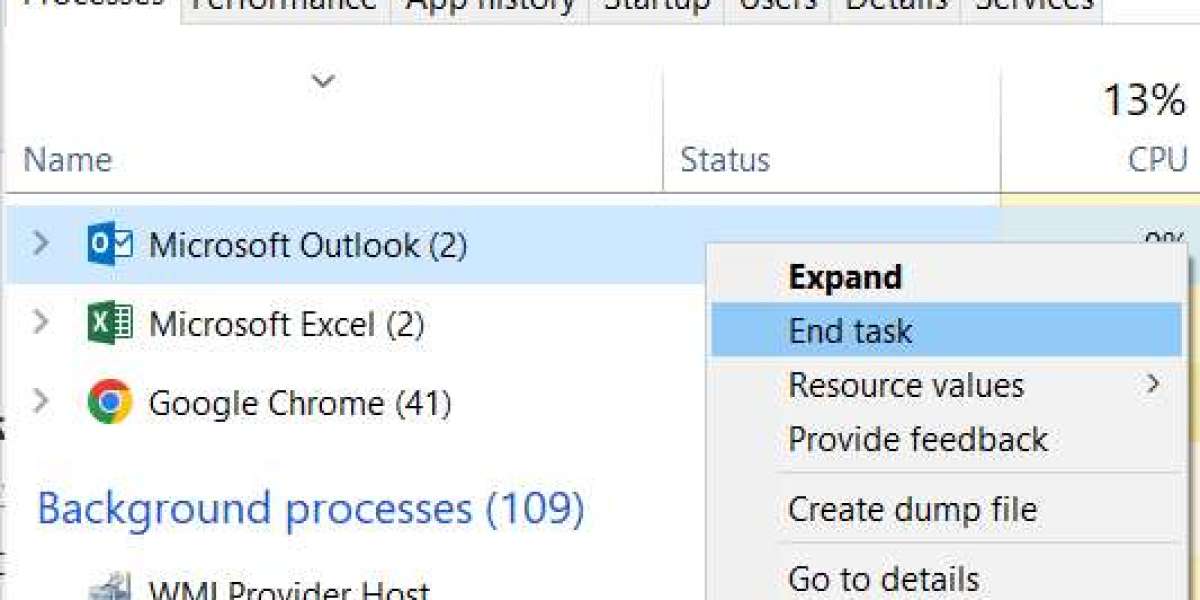

3) Learn about Withholding

The IRS will issue new W-4s and withholding tables. W-4 Updates: Fill in your W-4 with your employer early in 2026 to ensure that you are not over-withheld, and receive more money in each paycheck, instead of receiving a huge refund later.

4) Plan a Shift

When you are working regularly on overtime, go through a paycheck calculator that is specific to 2026 to plan and know what your new cash flow is. The growth in weekly net pay may be considerable.

The 2026 reforms are more than a tax cut to the backbone of the service economy in America, which is a redefinition of hard work. The law would not only increase the individual earnings but also may revolutionize the recruitment, retention, and morale within key industries across the country by enhancing overtime and tips.