You’re left wondering: did the money go through, or didn’t it?

In a world where payments usually happen faster than thought, this pause feels heavy. Not dramatic, just unsettling. And it’s surprisingly common.

How we learned to trust speed a little too much

UPI and ATMs didn’t become popular because they were flashy. They won us over because they worked. Again and again. Morning coffee, rent transfers, late-night food orders — all handled quietly in the background of life.

Over time, that reliability turned into assumption. We stopped watching closely. We stopped reading confirmation screens. We trusted the system to catch problems before they reached us.

That trust is understandable. But it’s also why payment failures feel so jarring. They interrupt a rhythm we didn’t even realize we depended on.

When UPI doesn’t do what it promises

UPI issues are often subtle. There’s rarely a dramatic error message. Instead, you might see “pending” for hours. Or the amount gets debited, but the receiver swears nothing arrived.

This is usually when people freeze. Do you wait it out? Do you try again? Do you risk making things worse?

Raising a upi payment failed complaint early is often the smartest move, even if the amount is small. It creates a record. It tells the system that something didn’t resolve cleanly. Many UPI failures reverse automatically within a few days, but the ones that don’t tend to get stuck because nobody flagged them properly.

Complaining doesn’t mean panicking. It means acknowledging that the system needs a nudge.

ATM problems feel old-school, but the stress is timeless

ATMs feel sturdy. Familiar. Almost comforting compared to apps that update every few weeks. Which is why ATM errors can feel oddly personal.

You insert your card. Enter your PIN. Hear the machine whirr. Then… nothing. No cash. Or worse, a debit alert arrives even though the slot stayed empty.

An atm transaction failed complaint is still one of the most common banking issues, and for good reason. These machines log everything — timestamps, camera footage, internal counts. Most cash-dispense errors are traceable, even if they don’t feel that way in the moment.

Banks often ask you to wait a few working days, which can sound dismissive, but reversals genuinely do happen automatically in many cases. If they don’t, your complaint becomes the anchor that keeps the issue from being forgotten.

The mistake nobody likes to admit

Not all payment problems are technical. Some are painfully human.

A similar contact name. One wrong digit. A rushed moment between meetings. Suddenly, a Mistake payment has happened, and the system doesn’t care that you didn’t mean it. It followed instructions exactly.

These situations feel worse because there’s embarrassment layered on top of stress. People hesitate to report them, hoping they can fix it quietly. Sometimes they can. Sometimes they can’t.

The key is speed. The faster you act — contacting your bank, informing the recipient if possible — the better your chances. Silence rarely helps here.

Why screenshots and small details matter so much

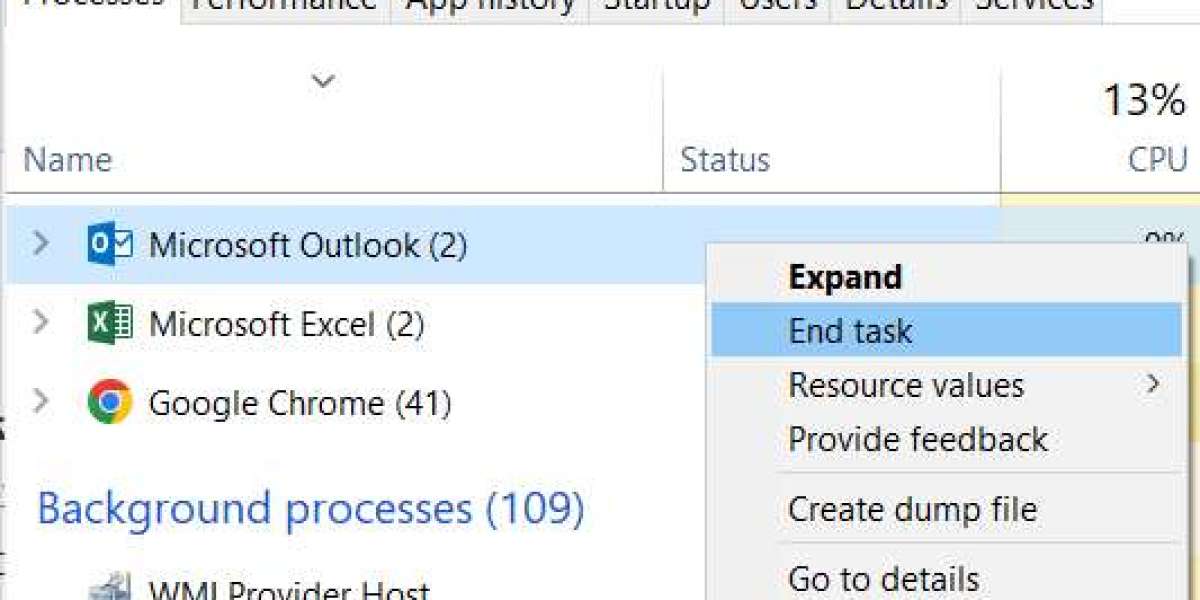

It’s boring advice, but it works: document everything.

Transaction IDs. Dates. Times. Amounts. ATM locations. Screenshots of pending statuses or debit alerts. These details may feel insignificant, but they’re exactly what banks and payment platforms use to investigate issues.

Without details, your problem is vague. With them, it’s a case.

You don’t need to write essays or use fancy language. Just be clear. Clarity travels faster through systems than emotion ever will.

The waiting period that tests your patience

Once complaints are filed, there’s usually a stretch of waiting. This is where frustration really settles in. You check your balance more often than you’d like to admit. Every notification feels loaded with hope or dread.

During this phase, patience doesn’t mean disappearing. Follow up politely. Reference your ticket numbers. Ask for updates when promised timelines pass.

It’s not about nagging. It’s about staying visible.

Systems tend to move cases forward when they know someone is paying attention.

The emotional side nobody warns you about

Payment failures don’t just mess with your bank balance. They mess with your head.

You replay the moment again and again. You wonder if you should’ve double-checked. You feel annoyed at yourself, even when the issue wasn’t really your fault.

This reaction is normal. Money represents effort, time, and security. When access to it feels shaky, even temporarily, it creates stress that’s hard to explain to someone who hasn’t experienced it.

If you’re feeling unsettled, you’re not overreacting. You’re responding to uncertainty — something humans are notoriously bad at handling.

Learning without turning fearful

One bad experience can change how you approach digital payments forever. Some people stop trusting them. Others become so cautious that every transaction feels like a test.

A healthier middle ground is awareness.

Slow down before confirming payments. Double-check new recipients. Don’t let urgency push you into rushed decisions. And remember: legitimate support will never ask for your OTP or PIN, no matter how convincing they sound.

These habits don’t ruin convenience. They protect it.

Where most stories actually end

Despite the stress and waiting, most payment issues do resolve. Sometimes quietly. Sometimes weeks later. A reversed debit. A credited amount. A short message saying the issue is closed.

When it happens, the relief isn’t just about the money. It’s about regaining control.

You know what to do now. You know where to complain. You know how to document and follow up. That knowledge sticks with you far longer than the stress did.

A grounded ending, because panic never helps

Digital payments aren’t fragile, but they aren’t flawless either. They handle millions of transactions every day, and most of them succeed without drama. The failures stand out because they interrupt trust, not because they’re the norm.

If you’re dealing with a stuck UPI payment, an ATM issue, or a payment you wish you could take back, take a breath. Document what happened. Use the complaint systems available to you. Give the process time, but don’t vanish from it.

Money usually leaves a trail, even when it feels lost for a moment. And with a little patience — and a lot of clarity — that trail often leads right back to where you started.