Sometimes it does. Sometimes it really doesn’t.

If you’ve ever dealt with a failed transfer, a wrong payment, or money that just vanished into the digital void, you know how quickly confusion turns into anxiety. This isn’t just about money. It’s about trust — in systems we use every single day without thinking twice.

How UPI became invisible in our lives

UPI worked its way into our routines quietly. Paying for chai. Sending rent. Splitting dinner bills. It’s so embedded now that many of us don’t even call it “digital payment” anymore. It’s just payment.

And that’s part of the problem. When a system becomes invisible, we stop being careful around it. We rush. We assume it’ll sort itself out. Most of the time, that assumption holds true. But when it doesn’t, we’re left scrambling for answers we never thought we’d need.

The most common ways things go wrong

Not all UPI issues are dramatic fraud cases. In fact, many are surprisingly ordinary.

A transaction stuck on “pending.”

Money debited but not credited.

A transfer sent to the wrong person.

An app crash right after authentication.

Then there’s the classic Mistake payment, the kind nobody likes to admit out loud. One wrong digit in a mobile number. A similar name in your contacts. A moment of distraction. The system doesn’t know it’s a mistake — it just follows instructions perfectly.

What happens next depends less on luck and more on how you respond.

First reactions matter more than people realize

The worst thing you can do after a payment issue is nothing. The second worst is panicking so hard that you miss basic steps.

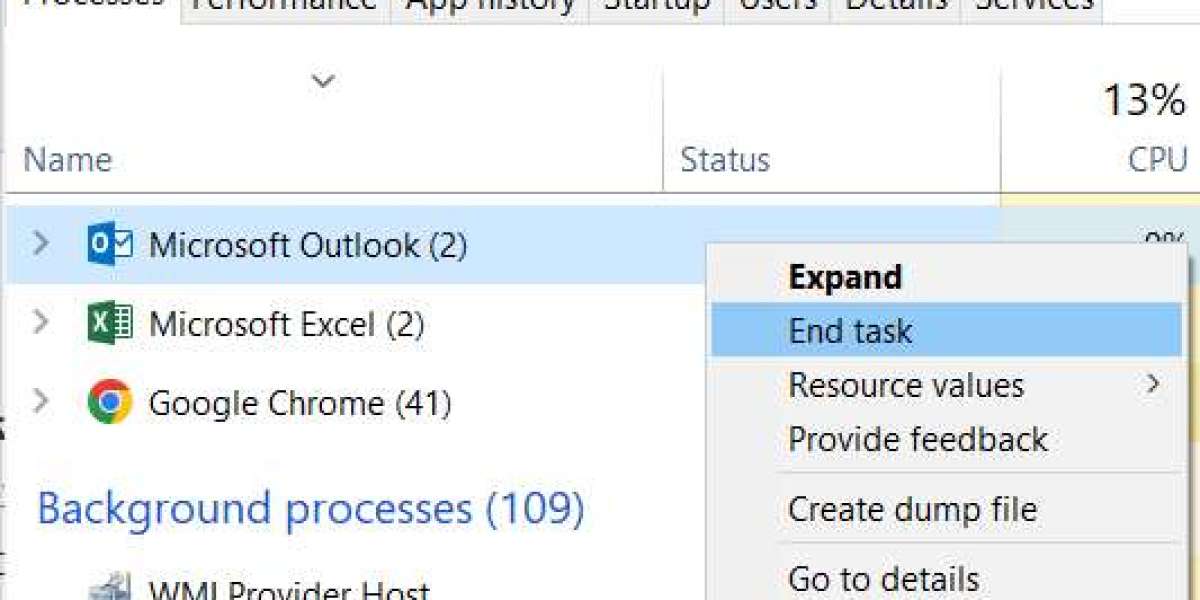

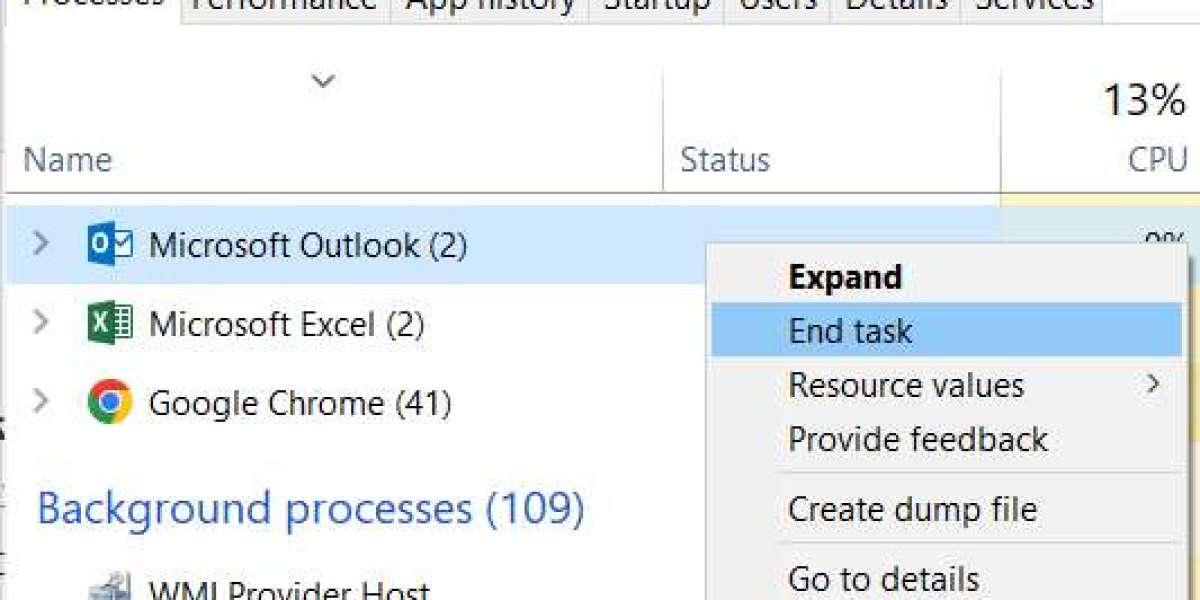

Start simple. Check the transaction status in the app. Screenshot everything — transaction ID, date, amount, recipient details. These small actions feel boring, but they become incredibly useful later.

Next, raise the issue inside the app itself. Almost every UPI app has a “report a problem” or “help” option tied to each transaction. This creates an official record and timestamps your complaint.

If the issue is about getting your money back — especially in cases of failed or pending payments — this is where a upi refund complaint becomes relevant. You’re essentially telling the system, “Something broke. Please fix it.” And yes, sometimes it actually does.

Why banks still matter (even when apps feel dominant)

There’s a common misconception that UPI apps handle everything. In reality, your bank is still deeply involved. The app is the interface. The bank holds your money.

If the app support feels slow or unresponsive, contact your bank directly. Customer care numbers aren’t fun, but they can push things forward in ways chatbots can’t. Banks also have internal grievance processes that apps don’t advertise loudly.

When you speak or write to them, be specific. Avoid emotional language, even if you’re stressed. Clear facts move cases faster than frustration, unfair as that may feel.

NPCI: the quiet backbone behind the scenes

At some point, especially if things drag on, you’ll hear about NPCI — the National Payments Corporation of India. It doesn’t have an app icon on your phone, but it quietly runs the infrastructure that makes UPI possible.

If your issue isn’t resolved through the app or your bank within a reasonable time, escalation through npci online complaint channels can be a turning point. NPCI doesn’t replace your bank or app support, but it adds oversight. It asks questions. It expects answers.

The process usually involves submitting transaction details and explaining what resolution you’ve already attempted. It’s not instant, and it’s not glamorous — but it often works when other doors stay closed.

The emotional toll nobody talks about

One underrated part of payment issues is how mentally exhausting they are. You replay the moment again and again. You doubt yourself. You wonder if you’ll ever see the money again.

This stress is real, even if the amount isn’t huge. Money represents effort, time, security. Losing it — even temporarily — shakes something deeper than just your balance.

If you’re in this phase, remind yourself: many UPI issues resolve eventually. Not all, but many. And resolution often comes weeks later, quietly, when you’ve almost stopped checking.

What patience actually looks like in practice

Patience doesn’t mean silence. It means structured follow-up.

Keep a simple log: dates you contacted support, responses received, ticket numbers. Follow up every few days, not every few hours. If a promised timeline passes, refer to it politely.

Systems respond to consistency. They rarely respond to anger. That’s not fair, but it’s true.

Becoming more careful without becoming afraid

After one bad experience, some people swear off UPI entirely. Others double-check every digit with extreme caution. The healthier middle ground is awareness.

Slow down when sending money to new contacts. Confirm names. Avoid rushing because someone says it’s “urgent.” Urgency is a common pressure tactic, and real systems almost never require it.

Use app security features. Keep your phone locked. Don’t share OTPs — ever. These aren’t radical changes. They’re small habits that add up to fewer problems later.

Ending on a grounded note

UPI has changed how India moves money, and overall, it’s been a success story. But no system used by millions of humans every day is flawless. Errors happen. Mistakes happen. And yes, sometimes systems fail in ways that test your patience.

What matters is knowing that there are paths forward — through apps, banks, and NPCI — even when the first few attempts feel like shouting into the void.

If you’re dealing with a payment issue right now, take a breath. Document everything. Follow the process. And give it time.

Most importantly, don’t let one bad experience steal your confidence in navigating digital money. You didn’t break the system — you just met one of its rough edges.