In that moment, your phone feels heavier than it should. Not because of the device itself, but because of what it represents. Your money. Your security. Your trust in a system you’ve been using on autopilot.

Digital payments are woven so tightly into daily life now that fraud doesn’t feel like a technical issue. It feels personal. And confusing. And oddly lonely, at least at first.

How we got here without noticing

Most of us didn’t decide to trust digital banking this much. It just happened. One successful transaction turned into a hundred. UPI worked. Google Pay worked. Banks mostly stayed quiet, which we took as a good sign.

Over time, caution softened. We stopped double-checking names. We clicked links faster than we should’ve. We assumed the system would catch problems before they reached us.

Fraud thrives in that space — not because users are careless, but because they’re human in a fast-moving world.

The first response shapes everything

When you notice a fraudulent transaction, panic feels inevitable. But what you do in the next few minutes matters more than most people realize.

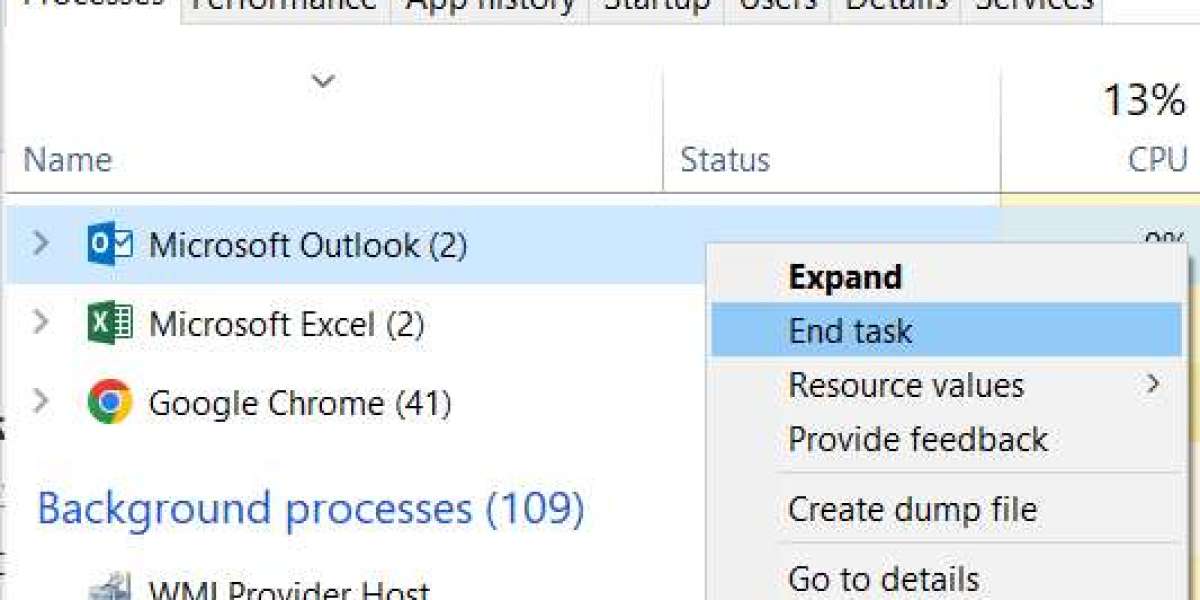

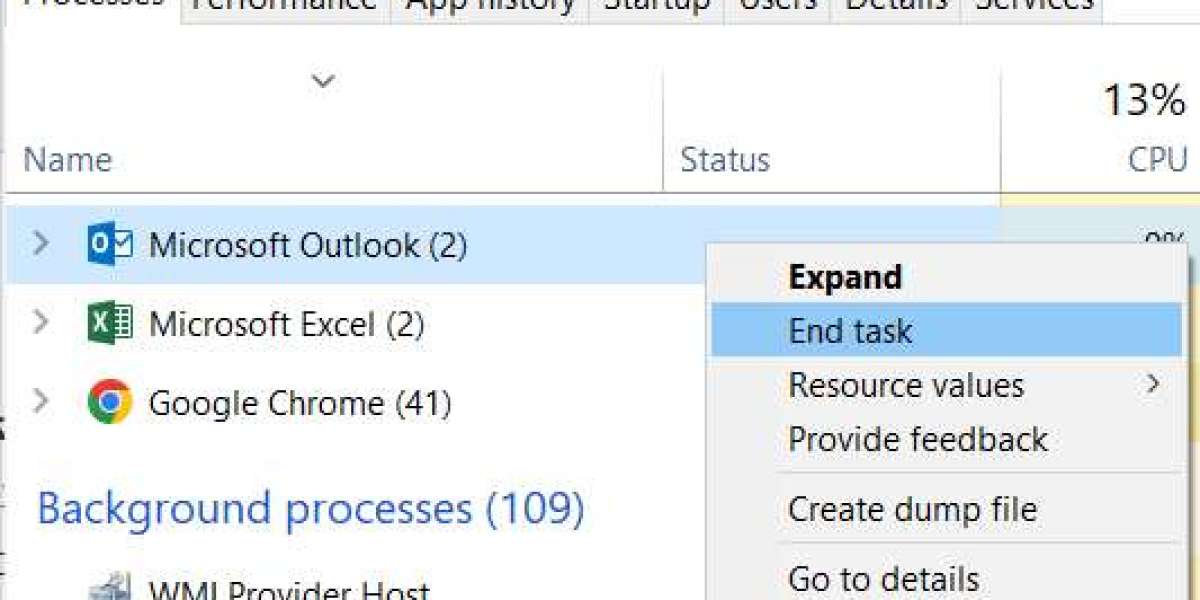

Start by documenting. Screenshot the transaction. Note the time, amount, reference number. Even if you don’t fully understand what happened yet, these details become your anchor later.

Then report it immediately through your bank or payment app. This isn’t just a formality. Logging bank fraud transaction complaints early creates an official trail. It tells the system, “This wasn’t normal, and it needs attention.”

The earlier that record exists, the stronger your position becomes.

Why banks still sit at the center of everything

One common misconception is that apps handle fraud end to end. In reality, apps are often messengers. Banks are the custodians.

If money left your account without authorization, your bank has both the responsibility and the mechanisms to investigate it. They can freeze accounts, trace transaction paths, and initiate reversals when possible.

That’s why formal complaints matter. Casual chats and generic tickets sometimes fade into queues. Structured complaints don’t.

When you speak to your bank, keep things factual. Dates. Amounts. Transaction IDs. Avoid assumptions or emotional language, even if you’re stressed. Clear information moves faster through rigid systems.

The quiet power of online escalation

Sometimes, despite doing everything “right,” progress stalls. Replies feel automated. Timelines stretch. You start to wonder if anyone is actually listening.

This is where filing an online complaint for fraud transaction through official grievance channels can help. It adds another layer of oversight and accountability. It signals that the issue wasn’t resolved at the first level and deserves deeper review.

Escalation isn’t about being dramatic. It’s about using the structure that already exists — even if it’s poorly explained.

When Google Pay enters the picture

For users affected through Google Pay, the experience can feel especially disorienting. The app is simple, friendly, almost casual. Fraud, on the other hand, is anything but.

Many users instinctively look for the google pay fraud complaint number, hoping to speak to a real person who can cut through the confusion. While in-app support is usually the primary route, knowing official contact options can be grounding when everything feels uncertain.

It’s important to remember that Google Pay works alongside banks, not instead of them. Resolution often involves both, even if it feels like you’re being passed back and forth.

The waiting phase nobody warns you about

After complaints are filed and tickets are raised, there’s often silence. Days pass. Sometimes weeks. This waiting period is where frustration really settles in.

You check your balance more often than you’d like to admit. Every notification makes your heart skip. You replay the moment it happened, wondering what you missed.

During this phase, patience doesn’t mean disappearing. Follow up politely. Reference your ticket numbers. Ask for updates when promised timelines pass. Systems tend to respond better to calm persistence than to anger — unfair, but true.

The emotional cost of fraud

What rarely gets discussed is how mentally exhausting fraud can be. Even if the amount isn’t huge, the uncertainty lingers. You feel violated in a small but persistent way. You start questioning your own judgment.

This reaction is normal. Money represents effort, time, and stability. When access to it feels threatened, even temporarily, it shakes something deeper than just your bank balance.

If you’re feeling stressed or embarrassed, know this: fraud doesn’t mean you were careless. It means someone exploited a gap. Those gaps exist because systems are complex and humans are busy.

Becoming careful without becoming afraid

After a fraud incident, many people swing to extremes. Some stop trusting digital payments entirely. Others become so anxious that every transaction feels risky.

A healthier middle ground is awareness.

Slow down during payments. Double-check unfamiliar recipients. Be skeptical of urgency — especially calls or messages demanding immediate action. And remember, no legitimate support agent will ever ask for your OTP or PIN.

These habits don’t ruin convenience. They protect it.

Ending on something real, not dramatic

Digital payments have transformed how we move money, and overall, they’ve made life easier. But they’re not immune to misuse or error. When fraud happens, the system can feel cold, procedural, and slow — especially when you’re the one waiting.

The important thing to remember is this: there are paths forward. Through banks. Through apps. Through formal complaint channels. They aren’t always fast, and they aren’t always comforting, but they exist — and they work more often than first impressions suggest.

If you’re dealing with fraud right now, take a breath. Document everything. Follow the process. Stay present without burning yourself out.

Money can often be traced. Peace of mind takes longer. But neither is as lost as it feels in that first moment when a simple notification changes your entire day.