Digital payments were supposed to remove friction from our lives, and in many ways, they have. Google Pay, UPI, instant transfers — they’ve all become background noise in our daily routines. But when something goes wrong, that background noise turns into a loud, unsettling question: Where did my money go?

This isn’t a rare problem anymore. It’s just not talked about honestly enough.

How trust quietly builds, and how fast it can crack

We trust payment apps because they usually work. Hundreds of successful transactions train our brains to relax. We stop double-checking names. We rush payments between meetings. We assume systems are smarter than us.

Until the day they aren’t.

Sometimes the issue is technical. Sometimes it’s fraud. And sometimes, it’s painfully human — the kind of error nobody likes to admit. A wrong tap. An old contact. A rushed decision that turns into a Mistake payment before you even realize what happened.

What follows is often confusion layered on top of embarrassment. And then comes the bigger fear: Can this even be fixed?

The first few minutes actually matter

When you spot a suspicious or incorrect transaction, the instinct is to panic. That’s natural. But the most important thing in those first minutes is not emotion — it’s action.

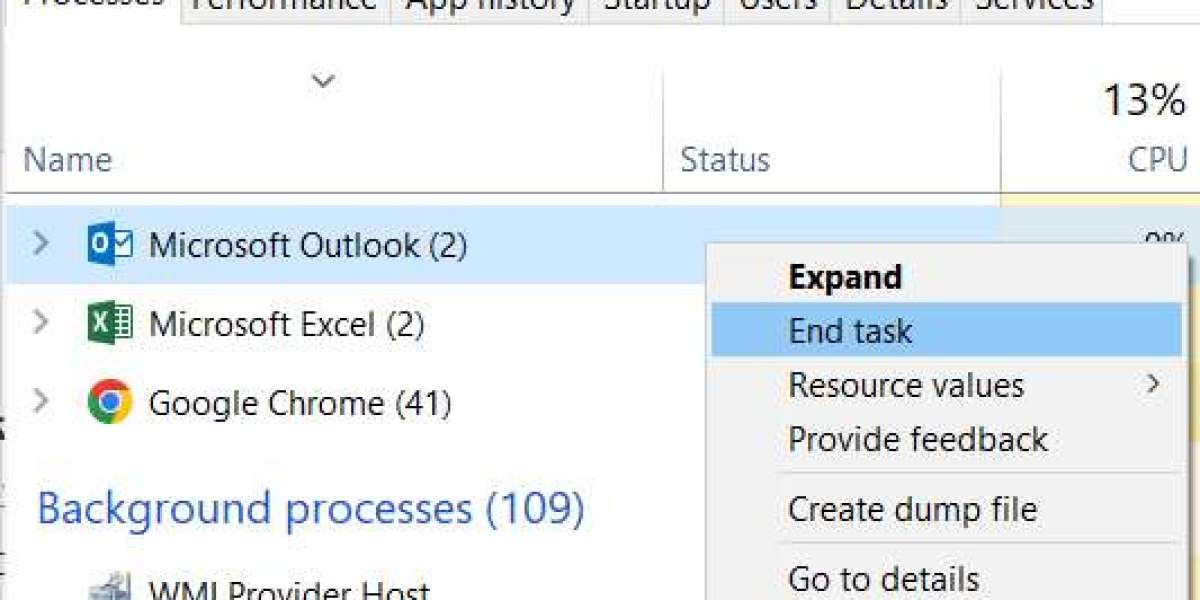

Open the app and check the transaction details carefully. Was it marked successful, pending, or failed? Take screenshots. Yes, even if it feels silly. These become your receipts in a system that loves reference numbers more than explanations.

If the issue involves fraud or an unauthorized debit, many users immediately search for the google pay fraud complaint number, hoping to talk to a real person who can make sense of things. While in-app support is often the fastest route, knowing official support channels can be reassuring when the situation feels out of control.

Understanding what Google Pay can — and can’t — do

Here’s something worth saying clearly: Google Pay isn’t a bank. It’s a platform. It connects you to your bank through UPI, but it doesn’t actually hold your money.

That distinction matters.

Google Pay can help you raise a ticket, track the issue, and communicate with your bank. But when it comes to reversing transactions or investigating fraud, banks still play a central role. If you stop at app support alone, you might hit a wall.

This is where many people lose time — not because the system failed, but because they didn’t know who truly had authority.

When the bank becomes unavoidable

If money has left your account without authorization, or if the amount is significant, you’ll likely need to file a bank account fraud transaction complaint. This sounds intimidating, but it’s essentially a formal way of saying, “This transaction was not okay, and I need it investigated.”

Banks have internal timelines and obligations once such a complaint is logged. It creates a paper trail. It forces accountability. And in many cases, it’s the step that actually unlocks progress.

The key is clarity. Stick to facts. Dates. Amounts. Transaction IDs. Avoid emotional language, even if you’re stressed or angry. Systems respond better to precision than frustration — unfair, but true.

The long, quiet waiting phase

After you’ve done everything right — raised tickets, contacted support, filed complaints — there’s often silence. This is the part nobody prepares you for.

Days pass. Sometimes weeks. You check your email more often than you’d like to admit. Every notification feels loaded.

During this phase, patience doesn’t mean doing nothing. It means following up thoughtfully. Keep track of who you spoke to and when. If timelines are promised, note them. If they pass, remind support politely.

Many cases resolve not because the system suddenly becomes kind, but because the customer stays present just long enough.

The emotional cost we rarely talk about

Even when the amount isn’t huge, payment issues can weigh heavily. You replay the moment. You wonder how you missed it. You feel foolish, even though millions of people make similar mistakes every year.

This emotional spiral is normal — and unnecessary.

Digital systems are complex. Fraudsters are convincing. Humans are distracted. None of this makes you careless or irresponsible. It makes you human in a fast-moving, imperfect system.

Becoming cautious without becoming fearful

One bad experience can change how you interact with money forever — sometimes in unhealthy ways. Some people stop trusting digital payments entirely. Others become so anxious that every transfer feels like a test.

A better approach is informed caution.

Slow down before confirming payments. Double-check new recipients. Be skeptical of urgency, especially when someone pressures you to “send quickly.” Legitimate systems almost never demand instant action.

And remember: no genuine support agent will ever ask for your OTP. Not now. Not ever.

A grounded ending, because panic helps no one

Google Pay and UPI have transformed how India handles money. Overall, they work remarkably well. But when something goes wrong, the system can feel cold, confusing, and slow.

The important thing to know is this: there are paths forward. Through app support. Through banks. Through formal complaints. They aren’t always fast, and they aren’t always smooth, but they exist — and they work more often than online horror stories suggest.

If you’re dealing with a payment issue right now, take a breath. Document everything. Follow the process. Give it time.

Money can usually be traced. Peace of mind takes longer. But both are far more recoverable than they feel in that first, awful moment when you realize something isn’t right.