As global trade continues to expand, companies across the UK and Europe are exploring new regions to diversify their operations and increase revenue streams. Among emerging markets, India has become one of the most promising destinations for international business expansion. With its strong economic growth, expanding digital ecosystem, and supportive investment policies, starting a business in India has become a smart and forward-thinking strategy. With the professional support of advisory firms like Stratrich, foreign companies can establish operations in India efficiently while ensuring regulatory compliance.

India’s Expanding Economic Landscape

India has transformed from a developing economy into a major global business hub. The country’s growth is supported by infrastructure development, technological innovation, and a rising demand for global products and services. For UK and European businesses, India provides a rare combination of affordability and scalability. Companies can establish operations at relatively lower costs while gaining access to one of the world’s largest consumer markets.

India’s digital revolution has also played a significant role in attracting foreign investors. The country has one of the largest internet user bases globally, which has accelerated growth in e-commerce, fintech, and digital services. This transformation makes starting a business in India highly attractive for technology-driven and service-based companies.

Strategic Benefits for European and UK Companies

Cost-Effective Business Operations

Operating costs in India, including labour, infrastructure, and administrative expenses, are significantly lower compared to Western countries. This allows companies to maximise profitability while maintaining high-quality service delivery.

Access to Skilled Talent

India produces millions of graduates every year in fields such as engineering, management, finance, and information technology. UK and European companies benefit from hiring skilled professionals who can support global operations and innovation projects.

Supportive Foreign Investment Environment

India’s foreign investment policies are designed to attract global companies. Several industries permit full foreign ownership without requiring prior government approval. These policies simplify the process of starting a business in India and encourage international participation.

Understanding Business Entity Options

Choosing the correct business structure is essential for regulatory compliance and operational success. Foreign companies generally choose from the following options:

Wholly Owned Subsidiary Company

A wholly owned subsidiary allows foreign investors to maintain complete control over business operations. It provides limited liability protection and is considered a reliable structure for long-term investment and expansion in India.

Limited Liability Partnership

An LLP offers flexibility in management and simplified compliance requirements. It is particularly suitable for consulting, advisory, and professional service firms looking to establish operations in India.

Project or Branch Office

Companies planning to execute specific projects or explore Indian markets may establish branch or project offices. These structures allow limited business activities under regulatory supervision.

Advisory experts such as Stratrich assist international businesses in selecting the most effective entity structure based on commercial goals and legal requirements.

Step-by-Step Company Formation Process

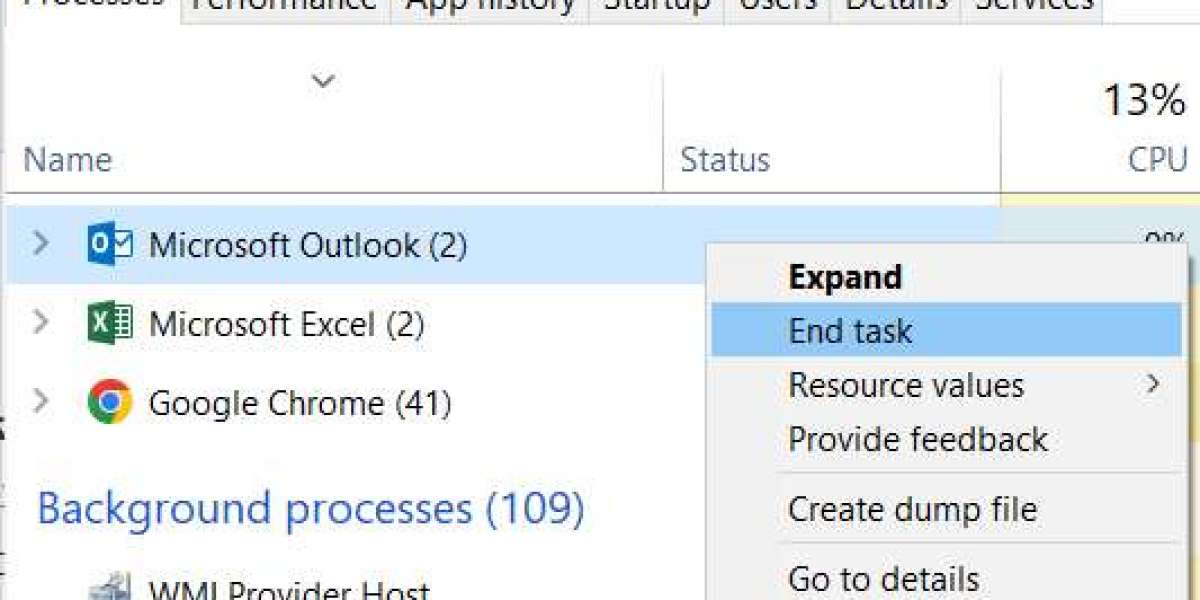

The process of starting a business in India involves several administrative and legal stages. The initial step includes obtaining digital signatures and director identification numbers for company directors. Investors must then apply for company name approval and submit incorporation documents to the Ministry of Corporate Affairs.

After incorporation, businesses must complete additional registrations, including tax identification, corporate bank account setup, and sector-specific approvals if applicable. While the process is structured, professional guidance helps ensure timely completion and compliance with regulatory standards.

Taxation Advantages and Compliance Framework

India offers competitive corporate tax rates, especially for new manufacturing companies and export-oriented industries. Businesses located in special industrial zones or government-approved economic clusters often receive tax incentives, infrastructure support, and simplified compliance procedures.

The India-UK Double Taxation Avoidance Agreement provides significant benefits to UK companies by eliminating the risk of paying taxes in both countries. Several European nations have similar agreements with India, making tax planning an important component when starting a business in India.

Promising Sectors for Foreign Investment

India’s diverse economy provides growth opportunities across various industries. The technology and IT outsourcing sector remains a major contributor to foreign investment. Manufacturing is expanding through government initiatives aimed at boosting domestic production and exports. Renewable energy projects are increasing due to India’s commitment to environmental sustainability.

Additionally, healthcare services, financial technology, logistics, and e-commerce sectors are experiencing rapid expansion due to rising consumer demand and digital adoption. UK and European businesses investing in these sectors can benefit from strong domestic demand and export opportunities.

Overcoming Market Entry Challenges

Despite India’s strong investment potential, foreign businesses may face certain challenges, including understanding regional regulations, adapting to cultural business practices, and managing compliance requirements. India’s regulatory framework may vary across states, making local expertise essential.

Collaborating with professional consultants like Stratrich helps businesses navigate these challenges effectively. Their experience in company registration, regulatory compliance, and strategic advisory enables foreign investors to focus on growth while minimising operational risks.

Future Outlook for International Businesses in India

India’s long-term economic outlook remains highly positive due to infrastructure development, digital transformation, and expanding global trade partnerships. The country continues to strengthen business relations with the UK and European nations, creating favourable conditions for cross-border investments.

Businesses that choose starting a business in India today can benefit from early market entry, growing consumer demand, and expanding international trade opportunities.

Conclusion

India offers unmatched potential for UK and European companies looking to expand internationally. Its growing economy, skilled workforce, competitive operating environment, and supportive investment policies create a strong foundation for global business success. With proper planning and professional guidance from experienced advisory firms such as Stratrich, foreign investors can establish and grow successful operations in India.

Starting a business in India is not only a strategic expansion decision but also an opportunity to participate in one of the world’s fastest-growing economic ecosystems.