Get the latest insights on price movement and trend analysis of Land Cost in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa). Understanding the dynamics of land cost prices is crucial for investors, developers, and policymakers alike. In this comprehensive guide, we delve into the nuances of land cost prices, exploring trends, forecasts, and key factors influencing this essential aspect of real estate economics.

Request for Real-Time Land Cost Prices: https://www.procurementresource.com/resource-center/land-cost-price-trends/pricerequest

Definition of Land Cost:

Land cost refers to the monetary value attributed to the purchase or lease of land for various purposes such as residential, commercial, industrial, or agricultural use. It encompasses the price of acquiring land rights, including ownership, leasehold, or easement, and is a fundamental component in real estate transactions and development projects.

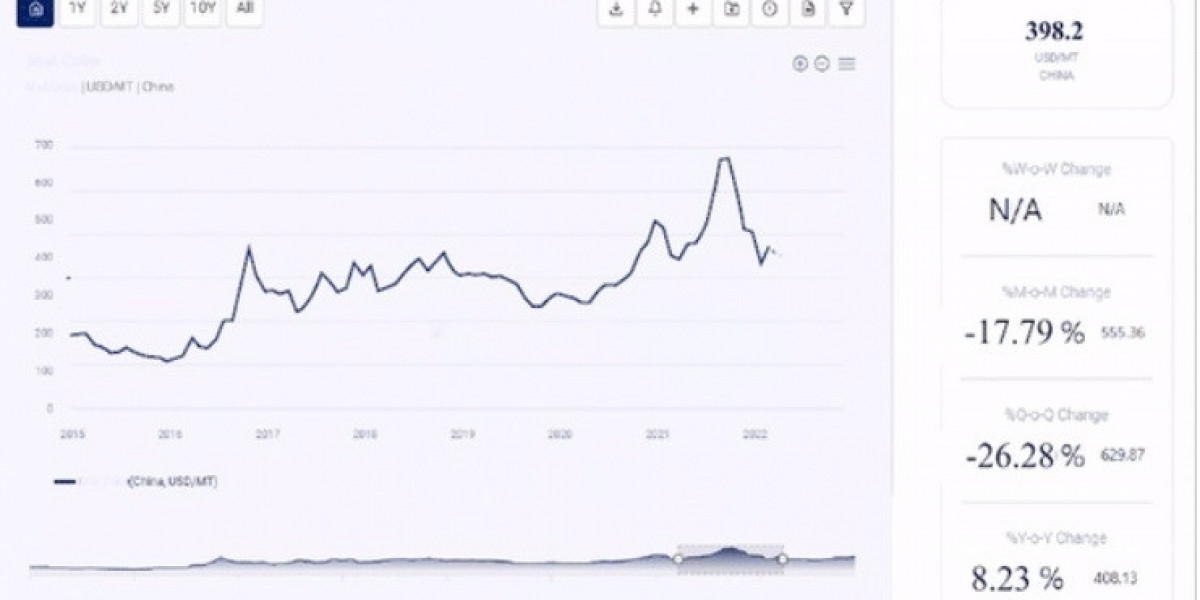

Key Details About the Land Cost Price Index:

The Land Cost Price Index serves as a vital metric for evaluating the fluctuation and trends in land prices over time. It provides valuable insights into the overall health of real estate markets and the economic factors driving land valuation. Factors influencing the Land Cost Price Index include demand-supply dynamics, population growth, urbanization trends, government policies, infrastructure development, and market speculation.

Industrial Uses Impacting the Land Cost Price Trend:

The industrial sector plays a significant role in shaping land cost price trends. Rapid industrialization, technological advancements, and changes in consumer behavior drive demand for industrial land for manufacturing facilities, warehouses, distribution centers, and logistics hubs. The location, accessibility, infrastructure, zoning regulations, and proximity to transportation networks are critical factors influencing industrial land prices. Moreover, emerging industries such as e-commerce, renewable energy, and biotechnology are reshaping the demand for specialized industrial properties, thereby impacting land cost prices in specific regions.

Key Players:

Several stakeholders influence land cost prices, including real estate developers, investors, government authorities, financial institutions, urban planners, and environmental agencies. Real estate developers leverage market research, feasibility studies, and investment analysis to assess land values and determine the viability of development projects. Investors analyze land cost trends to identify lucrative investment opportunities and mitigate risks. Government authorities enact zoning laws, land use regulations, and taxation policies to manage urban growth, preserve natural resources, and promote sustainable development. Financial institutions provide financing options, mortgages, and loans to facilitate land acquisitions and development ventures.

Conclusion:

In conclusion, navigating the complexities of land cost prices requires a comprehensive understanding of market dynamics, economic indicators, and regulatory frameworks. Procurement resource and land cost play pivotal roles in shaping investment decisions, project feasibility, and sustainable development practices. As global economies continue to evolve, monitoring land cost trends, forecasts, and insights remains imperative for stakeholders across the real estate spectrum. By staying informed and adaptable, investors and developers can capitalize on emerging opportunities and navigate challenges in the ever-changing landscape of land cost prices.