Zero-Barrier Gaming: Decoding No Minimum Deposit Limitations

The realm of online gaming platforms has evolved substantially, with operators increasingly eliminating financial obstacles to entry. The idea of requiring absolutely no minimum deposit signifies a significant shift in how platforms draw and MrRunCasino register retain players, specifically those who desire to test services before dedicating substantial funds.

The Systems Behind Zero-Threshold Entry

Functioning without minimum deposit requirements involves advanced backend systems that must process microtransactions seamlessly. Traditional payment processors commonly face challenges with transactions below certain thresholds due to fixed processing fees that can surpass the transaction value itself. Modern platforms utilize cryptocurrency networks, digital wallets, and aggregated payment solutions to make these small-value deposits cost-effective.

According to research issued by the American Gaming Association in 2022, approximately 67% of new online gaming accounts make initial deposits under $20, showing clear market demand for low-barrier entry options. This validated statistic underscores why forward-thinking operators have eliminated minimum deposit requirements entirely.

Financial Framework Supporting Minimum Deposits

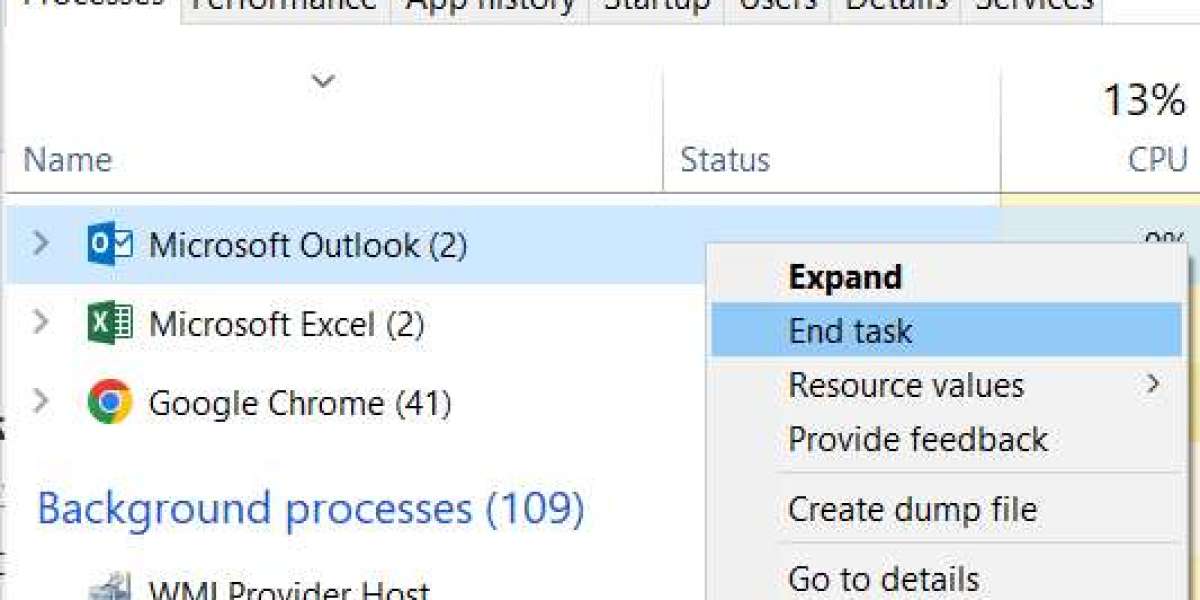

The technology stack supporting zero-minimum platforms diverges significantly from traditional implementations. These systems utilize:

- Batch processing capabilities that group multiple small transactions to lower individual processing costs

- Blockchain integration allowing peer-to-peer transfers without middleman fees

- Dynamic currency conversion permitting deposits in different denominations without preset limits

- Smart contract automation minimizing manual verification demands for micro-deposits

- Instant verification protocols that remove holding periods commonly associated with small-value transactions

Comparing Deposit Structures Across Platform Types

| Service Type | Typical Minimum | Completion Time | Cost Structure |

|---|---|---|---|

| Traditional Operations | $10-$25 | 1-3 days | Flat rate + percentage |

| Barrier-Free Platforms | No limit | Instant-15 minutes | Commission only |

| Blockchain-Powered | No limit | Blockchain dependent | Network fees only |

| Mobile-Focused Platforms | $5-$10 | Instant | Fixed fee or percentage |

Risk Management Without Minimum Thresholds

Abolishing deposit minimums generates unique challenges for operator risk assessment. Platforms must establish alternative verification mechanisms to deter fraudulent activity while maintaining accessibility. Advanced pattern analytics replace traditional financial screening methods, tracking patterns across numerous of micro-transactions rather than scrutinizing individual large deposits.

Machine learning algorithms examine deposit frequency, timing, geographical patterns, and withdrawal behavior to pinpoint potentially problematic accounts. This approach demonstrates more effective than arbitrary minimum requirements that primarily served as crude fraud deterrents in earlier operational models.

Bonus Structures and Promotional Adaptations

Zero-minimum platforms have transformed promotional offerings by separating bonuses from deposit amounts. Rather than percentage-based matching that requires substantial initial deposits, these operations utilize achievement-based rewards, time-sensitive promotions, and engagement-driven bonuses that benefit casual participants equally with high-volume depositors.

This democratization of promotional value fundamentally changes player acquisition economics. Operators tolerate higher initial customer acquisition costs per depositor while banking on improved conversion rates and long-term retention metrics. The strategy demonstrates particularly effective among younger demographics who favor testing services with minimal commitment before developing consistent usage patterns.

Regulatory Considerations and Compliance

Jurisdictions worldwide maintain varying perspectives on minimum deposit requirements. Some regulatory frameworks consider mandated minimums as consumer protection mechanisms, preventing problematic microtransaction behaviors. Conversely, other authorities understand that abolishing minimums lowers barriers to responsible exploration of regulated platforms versus unregulated alternatives.

Operators handling this regulatory patchwork must deploy geofencing capabilities that enforce appropriate deposit thresholds based on player location while preserving zero-minimum access where legally permissible. This technological complexity necessitates substantial investment in compliance infrastructure but allows platforms to serve global audiences within varied regulatory frameworks.

Future Direction of Barrier-Free Gaming

Payment technology evolution maintains driving downward pressure on transaction minimums across digital entertainment sectors. Emerging technologies including layer-two blockchain solutions, central bank digital currencies, and next-generation payment rails promise further reduction in microtransaction costs, making zero-minimum operations increasingly standard rather than exceptional.