The investments that Germany made in waste-to-energy (WtE) solutions are not accidental or an action dictated by the trend. It is the product of decades of policy planning, infrastructure building and industrial expediency. Germany, being the most developed economy of Europe, has an issue with its structure: it produces a lot of waste, and there is not much space to build a landfill, not to mention the climate-related objectives. Waste-to-energy has become a strategic solution - one that will deal with waste management, energy security, and emissions reduction at the same time.

In contrast to a number of countries, in which WtE is the backup solution, Germany makes it one of the main pillars of its energy transition and circular economy policy.

Policy Architecture Driving Long-Term Commitment

The policy of waste-to-energy in Germany is not linked to politics but tied to legislation. Circular Economy Act (Kreislaufwirtschaftsgesetz) and conformity to the EU Waste Framework Directive have legal priority of waste prevention, recycling and energy recovery over landfilling. Because the municipal waste has not been permitted to enter landfills for a long time, the remaining waste should be subjected to the advanced recovery systems.

This regulatory framework will ensure stable feedstock in WtE facilities and discourage landfill addiction. Simultaneously, the incentives on renewable energy and climate goal act as additional support to the role of WtE as the stable baseload energy source - especially in district heating systems within urban areas.

In this context, the Germany Waste to Energy Market has come to be among the most regulated, high-technology and capital-intensive parts of the energy infrastructure of the nation.

Market Size, Growth Outlook, and Economic Rationale

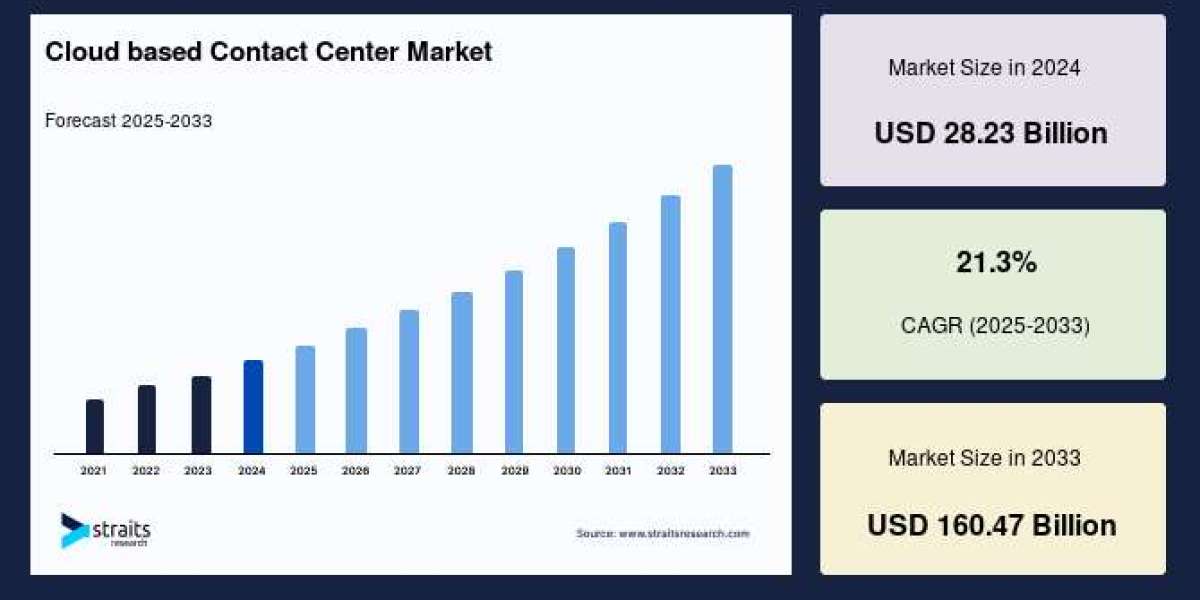

The waste-to-energy industry is no longer a niche in Germany. It is estimated to be USD 3.19 billion in 2026 and USD 5.29 billion in 2032 with a CAGR of about 7.49 between the period 2026 and 2032. This increase is an indicator of consistent infrastructure development and not speculative development.

Each year, more than 30 million tons of waste is processed and this produces over 14.5 million megawatt-hours of electricity with significant heat output to the municipal networks. Germany also has the highest concentration and most efficient WtE network in the entire of Europe with more than 156 functioning thermal waste treatment facilities.

Economically, WtE helps to decrease the long-term landfill payments, stabilize the energy supply, and replace imported fossil fuels. In the case of the municipalities, it provides reliable disposal prices and localized energy production, which is essential in the time of unpredictable energy markets.

Waste Volumes and Urban Infrastructure Pressure

Increasing municipal wastes are still structural motivators of the WtE investments in Germany. The large population, urban consumer behavior and industrial production create continuous sources of waste that cannot be absorbed through recycling even with the high recycling rates of 68 percent of household waste and 70 percent of industrial waste, as it is the case with Germany.

Waste-to-energy plants serve as the balancing mechanism in the system and handle the non-recyclable residues, deriving an energy value. In large cities like Hamburg, Cologne and Munich, the WtE plants are integrated into the city infrastructure to provide electricity and district heating to residential and commercial districts.

This integration causes WtE to be not only a waste solution, however, one of the central elements of urban energy planning.

Technology Advancement and Resource Recovery Focus

Increasingly, the investments in WtE in Germany are aimed at efficiency, reduction of emissions, and recovery of materials. Although incineration is the most used technology with its certain reliability and mixed waste capacity, more sophisticated thermal technologies, including gasification and pyrolysis, are becoming popular in pilot and hybrid operation.

More recent facilities have digital monitoring, AI based optimization and predictive maintenance systems. These tools enhance better combustion efficiency, less downtimes and fully meet the strict EU emission levels.

Meanwhile, bottom ash recycling has taken a new strategic priority. Current vegetation retrieves ferrous and non-ferrous metals in the incineration residues and converts waste by-products into secondary raw materials. The flagship projects including the Magdeburg plant are showing how 1.5 million tonnes of bottom ash can be transformed into pure concentrates of metal, which supports the goals of the circular economy in Germany.

It should be noted that such a focus on resource recovery additionally enhances the Germany Waste to Energy Market by making the project more economical and sustainable in performance.

Decarbonization, CCS, and Industrial Integration

The overall decarbonization agenda of Germany has provided a novel twist to WtE investment. In 2024, the federal government introduced USD 7 billion in a decarbonization program in industry, the first time it included carbon capture and storage (CCS) in its climate plan.

The waste-to-energy plants are increasingly being considered not only with regard to energy production, but also with regard to lifecycle emissions. Operators are undertaking new flue gas treatment, carbon capture preparedness and combining it with industrial heat consumers to curb net emissions.

Germany uses WtE plants to connect with chemical parks, district heating, and industrial villages so that it can optimally use energy and pay minimal attention to the waste heat- an environmental performance the same way it is economically effective.

Key Companies Shaping the Market

The waste-to-energy industry in Germany is made up of well established players who have a history of long time infrastructure. The market leader is EEW Energy from Waste GmbH which has over 18 plants and manages over 5 million tons of garbage every year. Its modernization and emission control of plants are industry standards.

Integrated WtE and district heating activities by MVV Energie AG are vital especially at Mannheim as well as Leuna. The investments in smart energy management and carbon reduction make the company more powerful in the energy transition in Germany.

STEAG Energy Services GmbH contributes to the industry with the services of engineering, operation, and digital optimization, which contributes to the efficiency and regulatory adherence of municipalities.

Other well-known suppliers are Remondis Group, Veolia Umweltservice, SUEZ Recycling and Recovery Deutschland, ALBA Group, Hitachi Zosen Inova, Martin GmbH and a number of international technology suppliers that also play a role in designing the plants, controlling emissions, to recovery resources.

Why Waste to Energy Remains Strategic for Germany

Germany spends too much on waste-to-energy since it addresses several structural issues simultaneously: waste management, energy self-sufficiency, pollution, and resource efficiency. WtE is also different to intermittent renewables as it offers predictable, dispatchable energy similar to energy sources and thereby contributes to high recycling rates, and low landfill.

Being the part of the urban waste management system would not become redundant as the volume of waste in urban environments increases and environmental regulations become stricter. The future of the sector is in increased efficiency, further integration with the energy systems, and material recovery-areas, where Germany is already competitive.

To gain a greater market intuition and future perspective, the opinions of marknteladvisors can offer some insight into the current development of the waste-to-energy system in Germany.