Accounts payable functions are central to the financial strength and operational efficiency of banking organizations. For U.S. banking small and midsize businesses and startups, the process of managing incoming invoices, verifying payments, coordinating with vendors, and maintaining compliance with financial standards can demand significant time and attention from finance teams. Manual invoicing workflows and reconciliation processes create inefficiencies, slow cash flow visibility, and increase the risk of errors. accounts payable automation services provide a structured, reliable way for banking institutions to reduce administrative burdens, improve accuracy, and support compliance in complex operational environments.

In the banking industry, financial operations must meet high standards of accuracy, timeliness, and audit readiness. Accounts payable workflows affect vendor relationships, financial close cycles, treasury forecasting, risk management, and regulatory reporting. When AP functions are managed manually, banks face challenges in scalability and operational resilience, especially in fluctuating economic environments. Automation enables finance teams to shift from routine data entry and verification toward strategic tasks that require analysis, risk assessment, and operational planning.

Banking SMB and Startup Finance Dynamics in the United States

U.S. banking SMBs and startups operate within a highly regulated financial ecosystem that demands accuracy and transparency. Regional banks, community banking operations, credit unions, fintech backed banking startups, and boutique financial services firms must handle invoice approvals, vendor payments, reconciliation, and reporting with minimal errors. Administrative strain increases when multiple systems are in use or when these systems are not integrated, leading to duplicate data entry and inefficiencies.

The U.S. banking sector also faces pressure from regulatory compliance requirements that include documented financial controls, audit trails, error reduction protocols, and transparent reporting. Internal finance teams are responsible for managing workflows that ensure compliance with internal and external standards including Sarbanes-Oxley compliance for certain entities, federal reporting obligations, and state level guidelines. When accounts payable processes are slow or prone to mistakes, the impact cascades across financial close cycles, audit readiness, and regulatory reviews.

In this context, accounts payable automation services give banking SMBs and startups the ability to streamline workflows, reduce human error, and strengthen operational controls. These improvements support financial planning, risk mitigation, and long term growth.

Your business deserves a tailored financial strategy.

Start with a Free Consultation – https://www.ibntech.com/free-consultation-for-ipa/

Industry Trend and Evidence of Adoption

Recent industry analysis shows that financial services organizations, including banking institutions, are increasingly adopting automation technologies to support finance functions and back office operations. Intelligent automation, which combines workflow automation with data interpretation and integrated systems, is being implemented across accounts payable, receivable, compliance reporting, and reconciliation workflows to improve accuracy and reduce administrative burden. Market research from Markets and Markets indicates that automation technologies are driving efficiency improvements, compliance support, and data consistency across financial operations.

Source link: https://www.marketsandmarkets.com/Market-Reports/intelligent-process-automation-market-234174343.html

This trend reflects a broader shift in U.S. finance operations toward digital workflows that improve operational resilience and support compliance expectations.

Operational Challenges in Banking Accounts Payable

Banking finance teams often encounter the following operational challenges when accounts payable workflows are managed manually:

• Manual data entry across accounting systems and vendor platforms increases risk of errors

• Multiple approval loops cause delays in invoice validation and payment release

• Disconnected systems prevent real time reconciliation and visibility

• Time heavy reconciliation processes extend financial close cycles

• Manual audit trails make compliance documentation difficult to standardize

• Poor visibility into vendor liabilities complicates cash flow forecasting

• Compliance reporting demands add administrative strain

These challenges slow operational response times, reduce data accuracy, and limit the ability to scale finance functions efficiently. Accounts payable automation services are designed to optimize these workflows and reduce inefficiencies.

Accounts Payable Automation Services Solutions for Banking

Accounts payable automation services can be applied to various finance workflows within U.S. banking environments. Key solutions include:

• Invoice data capture and validation that extracts information digitally and verifies vendor details

• Approval workflow automation that routes invoices to appropriate stakeholders for timely review

• Three way matching automation between invoices, purchase orders, and receipts to minimize discrepancies

• Vendor payment scheduling automation that aligns with cash flow strategy and approval protocols

• Exception handling automation that flags discrepancies for reviewer intervention

• Automated reconciliation that supports real time visibility into outstanding liabilities

• Reporting and analytics automation for invoice aging, payment cycle trends, and compliance documentation

Each solution focuses on improving accuracy, reducing manual workload, and enhancing workflow transparency across accounts payable functions.

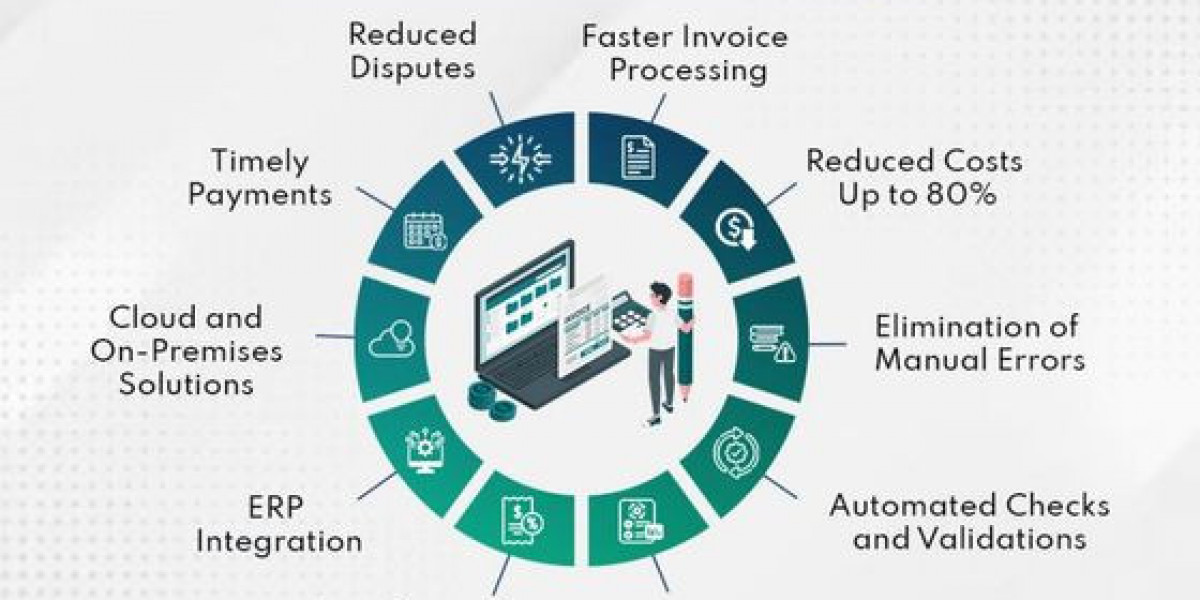

Benefits of Accounts Payable Automation for U.S. Banking SMBs and Startups

Banking finance teams implementing accounts payable automation services experience the following benefits:

• Enhanced invoice accuracy and reduced errors

• Faster payment cycles and improved vendor relationships

• Clearer visibility into outstanding payables and cash flow planning

• Shorter financial close cycles due to automated reconciliation

• Stronger compliance readiness with standardized documentation

• Lower administrative burden on finance teams

• Better risk management with structured exception handling

These benefits result in operational improvements, improved financial clarity, and stronger confidence during audit and regulatory reviews.

Compliance and Audit Readiness in Banking Operations

U.S. banking SMBs and startups operate within a regulatory environment that requires accurate financial records, audit trails, and documented controls. Manual accounts payable processes often lack audit friendly documentation and consistent controls, making compliance reporting more difficult. Automation embeds standardized workflows that retain digital logs, enforce approval rules, and maintain structured documentation, strengthening audit readiness and compliance alignment.

Automation helps reduce the risk of undocumented transactions, incomplete audit trails, and inconsistent record keeping. With automated workflows, finance teams can respond to compliance requests more efficiently and maintain up to date documentation across all accounts payable activities.

How IBN Technologies Helps Banks Implement Accounts Payable Automation

IBN Technologies supports U.S. banking SMBs and startups by delivering accounts payable automation services that transform manual invoice and payment workflows into efficient, reliable, and integrated systems. IBN begins with a thorough assessment of existing finance processes to identify bottlenecks, inefficiencies, and areas prone to error. This assessment informs a targeted automation strategy aligned with operational goals.

IBN deploys automation integrated with the bank’s existing financial systems including accounting platforms, payment gateways, ERP solutions, and vendor management systems. Integration ensures consistent data flow between systems, eliminating duplicate data entry and reducing reconciliation discrepancies. Finance teams gain centralized visibility into invoice statuses, vendor balances, and payment cycles.

Invoice capture and validation are automated to extract data accurately from multiple formats and verify details before routing through approval workflows. IBN also configures exception handling workflows that escalate discrepancies to designated reviewers, ensuring that issues are resolved efficiently while preserving workflow continuity.

IBN’s approach includes automation of vendor payment scheduling that aligns with internal approval protocols and cash flow strategies. Automated scheduling reduces the risk of late payments and supports stronger vendor relationships, which are critical in banking operations.

IBN ensures compliance and audit readiness by embedding structured documentation and approval logs into automated workflows. This produces standardized records that are easier to produce during audit cycles and help finance teams respond quickly to reporting requirements.

IBN also supports finance personnel with training and transition planning that ensures teams can monitor automated workflows, handle exceptions, and maintain operational governance after deployment.

Related Services:

1. https://www.ibntech.com/robotics-process-automation/

2. https://www.ibntech.com/ap-ar-automation/

Implementation Considerations for Banking SMBs and Startups

When evaluating accounts payable automation services, banking SMBs and startups should begin by identifying manual processes that consume significant staff time and introduce errors. Invoice validation, approval routing, and reconciliation are frequently the highest value candidates for automation due to their frequency and impact on financial close cycles.

Security and data governance must be incorporated into automation implementation due to the sensitive nature of financial information and banking data. Secure access controls, encrypted data flows, and audit friendly logging must be part of the automation design. IBN incorporates these considerations into its automation deployments to ensure that financial data remains protected throughout processing.

Outlook for Automation in U.S. Banking Finance

Accounts payable automation services will continue to develop as banking operations become more digitally integrated and compliance requirements grow in complexity. Banking SMBs and startups that adopt automation early gain advantages in operational accuracy, financial clarity, compliance readiness, and vendor relationship management. As the financial services landscape evolves, automation will become integral to sustainable finance operations, enabling organizations to adapt quickly to changing market conditions and regulatory expectations.

About IBN Technologies

IBN Technologies LLC is a global outsourcing and technology partner with over 26 years of experience, serving clients across the United States, United Kingdom, Middle East, and India. With a strong focus on Cybersecurity and Cloud Services, IBN Tech empowers organizations to secure, scale, and modernize their digital infrastructure. Its cloud portfolio includes multi cloud consulting and migration, managed cloud and security services, business continuity and disaster recovery, and DevSecOps implementation enabling seamless digital transformation and operational resilience.

Complementing its technology driven offerings, IBN Technologies also delivers Finance and Accounting services such as bookkeeping, tax return preparation, payroll, and AP and AR management. These services are enhanced with intelligent automation solutions including AP and AR automation, RPA, and workflow automation to drive accuracy and efficiency. Its BPO services support industries such as construction, real estate, and retail with specialized offerings including construction documentation, middle and back office support, and data entry services.

Certified with ISO 9001:2015 | 20000 1:2018 | 27001:2022, IBN Technologies is a trusted partner for businesses seeking secure, scalable, and future ready solutions.