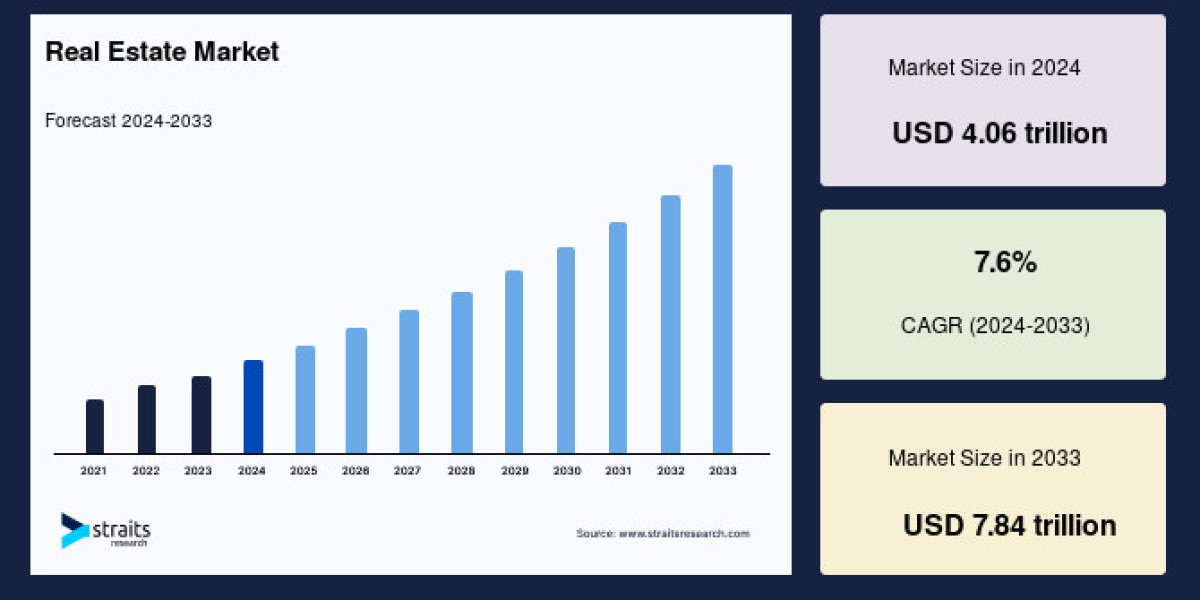

Global Real Estate Market Report: Insights and Projections for 2024-2032

The global real estate market was valued at USD 3.77 trillion in 2023 and is projected to expand from USD 4.05 trillion in 2024 to USD 7.28 trillion by 2032. This represents a Compound Annual Growth Rate (CAGR) of 7.6% during the forecast period from 2024 to 2032. This growth is driven by a combination of factors, including increased demand for residential spaces, evolving business needs, technological advancements in property management, and the continued rise in global urbanization.

For more detailed insights, Buy Now

Industry Key Trends

The real estate market has witnessed several trends and shifts, driven by changing demands, technological innovations, and shifting socio-economic factors. Key trends influencing the industry include:

Urbanization: The rapid growth of cities and urban areas is pushing demand for residential, commercial, and industrial properties.

Digital Transformation: Real estate technology such as property tech, artificial intelligence, and blockchain is reshaping how transactions are made and properties are managed.

Sustainability and Green Buildings: Increasing focus on energy-efficient buildings, sustainable construction, and eco-friendly properties to align with global sustainability goals.

Demand for Logistics and Industrial Real Estate: The e-commerce boom and global supply chain demand have led to an increased need for industrial and warehousing spaces.

Post-Pandemic Shifts: The shift to remote work and hybrid office setups has altered the demand for office spaces, while residential markets have also seen a change in buyer preferences.

Affordable Housing Initiatives: Governments across the world are focusing on affordable housing projects to tackle growing demand and address housing shortages in urban areas.

For more detailed insights, Download Free Sample

Key market segments contributing to the growth include:

Commercial Real Estate: Includes office buildings, retail spaces, hotels, and entertainment venues. As the world economy recovers and businesses reopen post-pandemic, demand for commercial real estate, especially in thriving cities, is expected to surge.

Residential Real Estate: The demand for homes continues to increase globally due to growing populations and increasing urbanization. Residential spaces, from single-family homes to multi-family apartments, will see substantial growth in key markets.

Industrial Real Estate: Logistics and industrial real estate are booming, particularly with the rise of e-commerce and global trade. This sector has seen heightened demand for warehousing and distribution centers.

Land: Land acquisition remains critical for development, especially in emerging economies. This category will see continued growth as governments and businesses invest in infrastructure projects.

For more detailed insights, Visit Now

Regional Trends

North America

United States: The U.S. remains a global powerhouse in real estate investment. With a dynamic housing market, particularly in cities like New York, Los Angeles, and Dallas, commercial real estate is also on the rise, especially with the revival of office spaces post-pandemic.

Canada: Canada's real estate market has shown resilience with a growing demand for residential properties, particularly in urban areas like Toronto and Vancouver. Commercial real estate is also evolving with a shift toward e-commerce logistics and industrial properties.

Asia-Pacific (APAC)

China: As one of the world's largest economies, China's real estate market has been seeing significant growth. The demand for residential properties in tier-1 cities such as Beijing and Shanghai remains high, and industrial real estate continues to expand in line with the country’s manufacturing and export activities.

India: Rapid urbanization and the burgeoning middle class are driving the demand for residential and commercial properties in cities like Mumbai, Delhi, and Bangalore. Affordable housing schemes and a focus on infrastructure development are set to fuel market growth.

Japan: Japan's real estate market is evolving, with an increasing focus on residential developments due to an aging population and urbanization in cities like Tokyo and Osaka.

Europe

Germany: Germany's real estate market is thriving, driven by both residential and commercial property demand. Cities like Berlin and Frankfurt are key hubs for investment, and the rise in logistics real estate due to e-commerce is notable.

United Kingdom: London remains a prime real estate market, despite recent economic challenges. The commercial real estate sector is showing signs of recovery, and there is increasing interest in residential properties driven by a growing population and demand for housing.

France: In France, real estate growth is driven by both residential and commercial sectors, with Paris continuing to be an investment hotspot.

Latin America, Middle East, and Africa (LAMEA)

Brazil: Brazil’s real estate market is driven by demand for residential and commercial properties in urban areas. Growth in industrial real estate, particularly in logistics and e-commerce sectors, is also notable.

South Africa: South Africa's real estate market has experienced challenges, but commercial real estate in cities like Johannesburg continues to attract investment. The demand for affordable housing remains high.

United Arab Emirates: Dubai and Abu Dhabi are key hubs for real estate investment, with a strong focus on luxury residential, commercial, and hospitality sectors.

For more detailed insights, Buy Now

Real Estate Market Segmentation

By Property (2021-2033)

Commercial

Land

Industrial

Residential

By Business (2021-2033)

Rental

Sales

Lease

Top Players in the Real Estate Market

Several global real estate companies dominate the market, offering a diverse range of services across various property segments. Key players include:

Brookfield Asset Management (Canada)

CBRE Group (USA)

Jones Lang LaSalle (USA)

Prologis (USA)

Vonovia (Germany)

Equity Residential (USA)

AvalonBay Communities (USA)

Boston Properties (USA)

Simon Property Group (USA)

Vornado Realty Trust (USA)

Link REIT (Hong Kong)

Gecina (France)

Mitsubishi Estate (Japan)

Mitsui Fudosan (Japan)

Sun Hung Kai Properties (Hong Kong)

For more detailed insights, Download Free Sample

Conclusion

The real estate market is poised for significant growth over the next decade, with continued demand across residential, commercial, and industrial segments. With advancements in technology, sustainability, and shifting consumer preferences, the market is adapting to a rapidly changing environment. Investors, developers, and stakeholders in the industry need to stay informed about regional dynamics, trends, and emerging opportunities to capitalize on the market's potential.

For more detailed insights, Visit Now