For UK and European companies, global expansion is no longer optional—it is a competitive necessity. Rising operational costs in Europe, supply chain shifts, and the search for high-growth markets have pushed ambitious brands to look eastward. Among emerging economies, India stands out as a strategic powerhouse.

But entering India requires more than enthusiasm. It requires structure, compliance, and foresight. Company formation in India is not just a legal process—it is the foundation of your long-term success in one of the world’s most dynamic business environments.

This guide takes a strategic, decision-focused approach to company formation in India—specifically for UK and European founders working with expert advisors like Stratrich.

India: From Emerging Market to Strategic Growth Engine

India today is:

- One of the world’s largest consumer markets

- A global IT and innovation hub

- A manufacturing alternative to China

- A fast-growing digital economy

- A government-backed startup ecosystem

For UK and European businesses, this means access to new customers, cost efficiencies, skilled talent, and long-term scalability.

However, market entry without the correct structure can create compliance risks and financial inefficiencies. That is why company formation in India must be approached as a strategic blueprint—not just paperwork.

Step One: Define Your India Entry Objective

Before initiating company formation in India, ask:

- Are you entering India for sales expansion?

- Are you building an offshore delivery center?

- Are you manufacturing locally?

- Are you testing the market first?

Your objective determines your structure.

Choosing the Right Legal Structure

1. Private Limited Company – The Growth Vehicle

This is the most common route for UK and European businesses.

Why it works:

- Separate legal entity

- Limited liability

- 100% foreign ownership allowed in most sectors

- Strong credibility with investors and banks

It is ideal for companies planning long-term operations and hiring local employees.

2. Wholly Owned Subsidiary – Full Strategic Control

For established UK or EU corporations, a wholly owned subsidiary ensures complete ownership and control.

This model works well for:

- Established brands expanding regionally

- Companies wanting brand consistency

- Businesses transferring capital from the parent entity

It provides operational independence while maintaining global alignment.

3. Limited Liability Partnership (LLP) – Flexibility for Services

Consulting and advisory firms from Europe may prefer LLPs due to:

- Operational flexibility

- Lower compliance burden

- Limited liability protection

However, FDI in LLPs must fall under permitted sectors.

4. Branch or Liaison Office – Low-Risk Market Testing

If your goal is research or representation, a Liaison Office may be suitable.

If you plan limited commercial operations, a Branch Office could work.

These are regulated differently and require approval from Indian authorities.

The Legal Process: Simplified but Structured

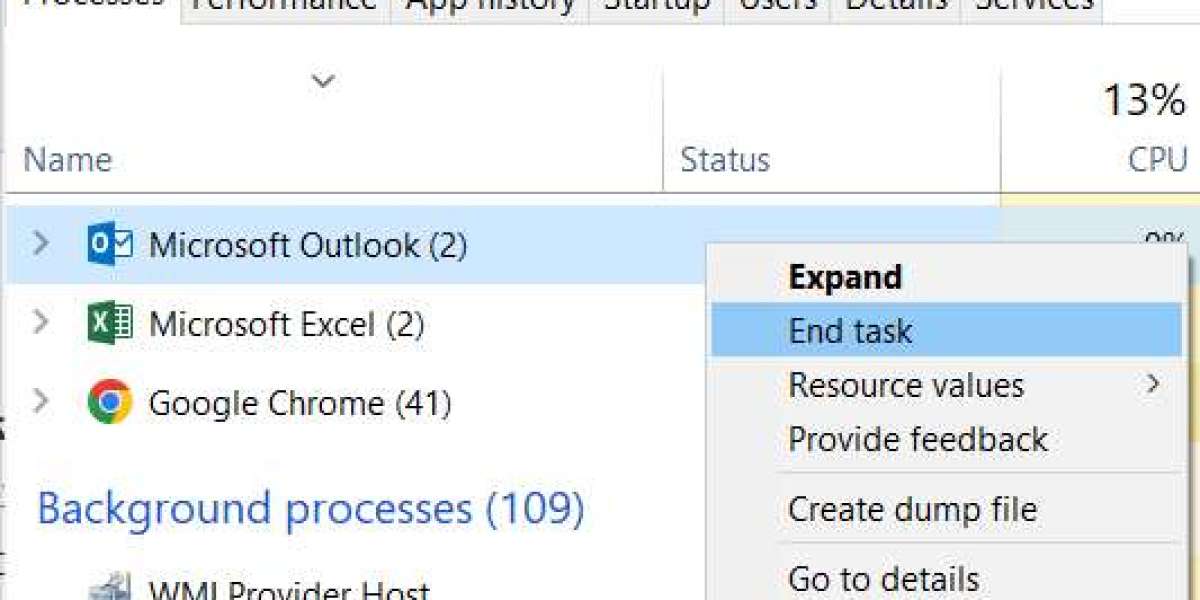

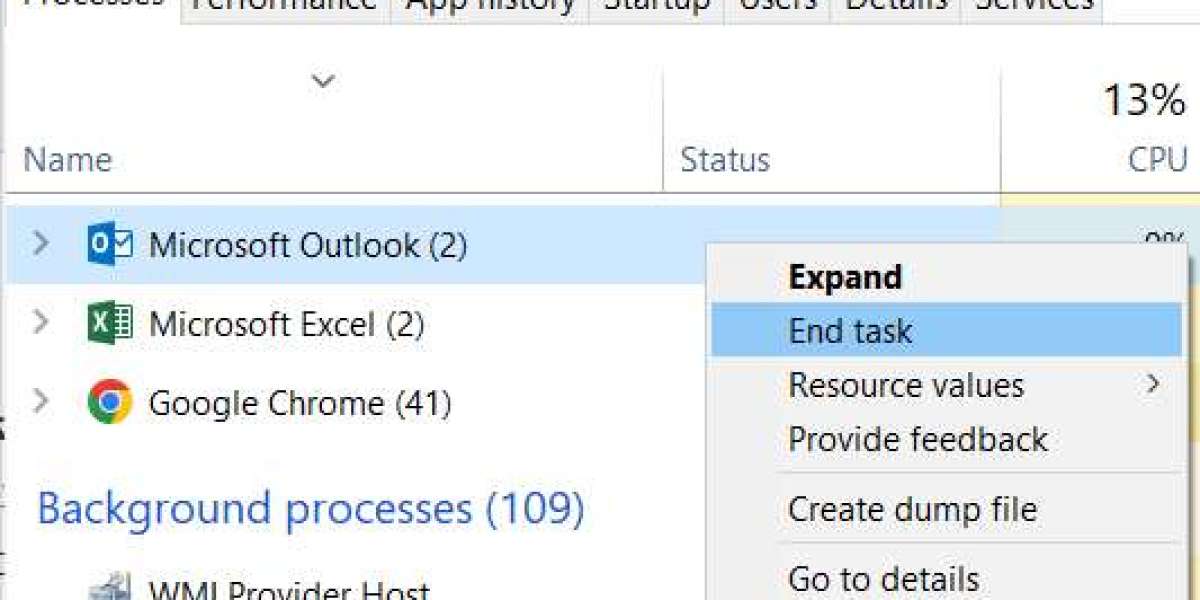

Company formation in India is now largely digital, but documentation precision remains critical.

Key Steps Include:

- Director identification and digital signature

- Name approval from authorities

- Drafting incorporation documents

- Filing incorporation application

- Obtaining tax registrations

- Opening a corporate bank account

- Reporting foreign investment inflow

For UK and European founders unfamiliar with Indian compliance systems, errors can delay operations. Strategic advisors streamline the process.

FDI Considerations for European Investors

India allows 100% Foreign Direct Investment in many industries under the automatic route. These include:

- Technology services

- Software development

- Manufacturing

- Consulting

- E-commerce (with regulations)

However, certain sectors require government approval. Proper FDI structuring ensures capital inflow is smooth and compliant.

Company formation in India must align with foreign exchange laws and reporting obligations.

Tax Planning Before You Incorporate

One of the most overlooked aspects of company formation in India is tax planning.

India offers competitive corporate tax rates, especially for manufacturing entities. Additionally, Double Taxation Avoidance Agreements between India and the UK and several European nations reduce tax duplication.

Strategic structuring before incorporation can:

- Optimise profit repatriation

- Reduce withholding taxes

- Improve long-term tax efficiency

This is where early advisory planning becomes valuable.

Compliance: The Ongoing Responsibility

Company formation in India does not end at registration. Post-incorporation compliance includes:

- Annual financial statements

- Income tax filings

- GST returns (if applicable)

- Foreign investment reporting

- Statutory audits

Non-compliance can lead to penalties or director restrictions.

European founders often underestimate the administrative side. Planning for compliance cost and management from the beginning avoids future stress.

Cultural and Operational Readiness

India offers scale—but requires adaptability.

UK and European businesses should prepare for:

- Different negotiation styles

- Varied payment cycles

- Regional regulatory differences

- Talent acquisition processes

Strategic onboarding, local partnerships, and professional consulting support help bridge these gaps.

Why Professional Advisory Matters

While online incorporation portals exist, foreign investors face unique complexities:

- Apostilled documentation

- International remittances

- RBI compliance

- Sectoral licensing

- Structuring capital infusion

Working with experienced consultants like Stratrich ensures:

- Correct entity selection

- Full regulatory compliance

- Transparent documentation

- Efficient setup timelines

- Long-term operational support

Company formation in India should be smooth, strategic, and legally secure—not experimental.

A Practical Scenario

Consider a UK SaaS company looking to reduce development costs and expand into Asia.

Instead of hiring remote contractors, they form a Private Limited Company in India. They transfer capital under FDI rules, hire engineers locally, and operate as a subsidiary.

The result:

- Lower operational costs

- Stronger IP protection

- Easier investor reporting

- Access to Indian enterprise clients

This is how company formation in India becomes a growth multiplier—not just a legal formality.

Common Mistakes to Avoid

- Choosing the wrong structure

- Ignoring sectoral FDI restrictions

- Delaying compliance filings

- Not planning tax strategy

- Attempting incorporation without expert guidance

Each mistake can cost time, money, and credibility.

The Strategic Advantage of Early Planning

Successful UK and European expansions into India share one trait: preparation.

They:

- Conduct feasibility analysis

- Align entity structure with business goals

- Plan tax and capital flow

- Allocate compliance budgets

- Engage professional advisors early

Company formation in India becomes efficient when strategy leads the process—not paperwork.

Final Perspective

India is no longer just an outsourcing destination—it is a serious growth market for global brands. With investor-friendly policies, digital governance, and a thriving entrepreneurial ecosystem, it offers unmatched potential.

However, entering the Indian market without structured planning can create avoidable complications.

For UK and European businesses seeking confident expansion, company formation in India should be:

- Strategically structured

- Fully compliant

- Tax-efficient

- Professionally managed

With expert support from Stratrich, your expansion into India can move from ambition to execution—securely and successfully.

If India is part of your growth roadmap, the time to plan your company formation in India is now.