In the modern financial landscape, obtaining a personal loan has become a common necessity for many individuals. Whether it’s for consolidating debt, financing a major purchase, or covering unexpected expenses, personal loans offer a viable solution. However, traditional lending practices often hinge on credit scores, which can be a barrier for those with limited or poor credit histories. This article explores the concept of personal loans that do not require credit score checks, examining their benefits, risks, and the evolving landscape of alternative lending.

The Basics of Personal Loans

Personal loans are unsecured loans provided by financial institutions, credit unions, or online lenders. They typically come with fixed interest rates and repayment terms ranging from a few months to several years. Borrowers receive a lump sum upfront and repay it in installments over the agreed period. Traditional lenders usually assess a borrower’s creditworthiness by checking their credit score, which is influenced by factors such as payment history, credit utilization, and length of credit history.

The Need for No-Credit-Check Personal Loans

The reliance on credit scores for loan approval can disproportionately affect individuals with little to no credit history, such as recent graduates or immigrants, as well as those who have experienced financial setbacks. In the United States, it is estimated that approximately 26 million adults are considered "credit invisible," meaning they do not have a credit score due to insufficient credit history. This group often faces challenges in accessing traditional financial services, leading to a growing demand for no-credit-check personal loans.

Types of No-Credit-Check Loans

- Payday loans with monthly payments no credit check: These short-term loans are typically due on the borrower’s next payday. They are easy to obtain and do not require a credit check, but they come with extremely high-interest rates and fees. Borrowers often find themselves caught in a cycle of debt, as they may need to take out additional loans to cover previous ones.

- Title Loans: Title loans allow borrowers to use their vehicle as collateral. Lenders do not check credit scores but will assess the value of the vehicle. While title loans can provide quick cash, they also carry the risk of losing the vehicle if the borrower fails to repay the loan.

- Personal Installment Loans from Alternative Lenders: Some online lenders and credit unions offer personal installment loans without credit checks. These lenders may focus on alternative data, such as income, employment history, and bank account activity, to assess a borrower’s ability to repay.

- Peer-to-Peer Lending: Platforms that facilitate peer-to-peer lending may have more flexible criteria for borrowers. While some may still consider credit scores, others may look at additional factors, allowing individuals with poor credit histories to qualify.

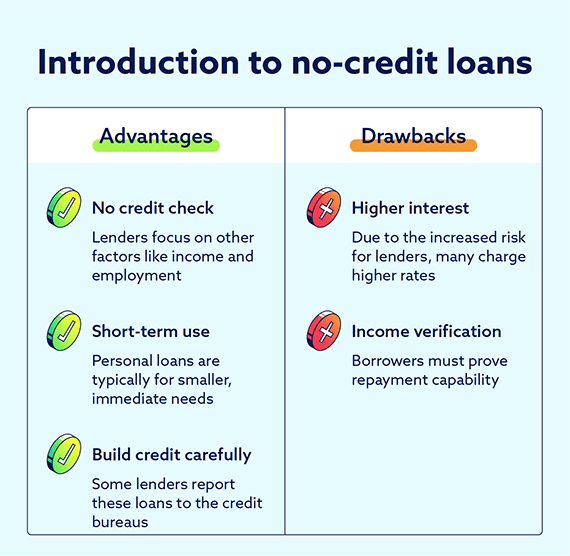

Benefits of No-Credit-Check Loans

- Accessibility: The primary advantage of no-credit-check loans is that they provide access to funds for individuals who may not qualify for traditional loans. This can be crucial in emergencies or when unexpected expenses arise.

- Quick Approval: Many no-credit-check loans offer quick approval processes, with funds disbursed within a day or even within hours. This speed can be beneficial for borrowers needing immediate financial assistance.

- Flexibility: Some lenders may offer flexible repayment terms, allowing borrowers to choose a plan that fits their financial situation.

Risks and Considerations

While no-credit-check loans can be appealing, they come with significant risks that borrowers must consider:

- High-Interest Rates: Many no-credit-check loans, especially payday and title loans, come with exorbitant interest rates. Borrowers may end up paying far more than the original loan amount, leading to financial strain.

- Debt Cycle: The ease of obtaining these loans can lead to a cycle of debt. Borrowers may take out multiple loans to cover previous debts, resulting in a precarious financial situation.

- Predatory Lending Practices: Some lenders may exploit vulnerable borrowers by engaging in predatory lending practices. If you liked this posting and you would like to receive additional facts pertaining to installment loans without credit check (https://propertyhost.in/author/verlakeogh7011/) kindly take a look at our own website. It is crucial for borrowers to conduct thorough research and read the fine print before agreeing to any loan terms.

- Limited Loan Amounts: No-credit-check loans often come with lower borrowing limits compared to traditional loans. This limitation may not be sufficient for larger expenses, forcing borrowers to seek additional loans.

Responsible Borrowing Practices

For individuals considering no-credit-check loans, it is essential to approach borrowing with caution. Here are some responsible borrowing practices:

- Assess Financial Needs: Before applying for a loan, borrowers should carefully evaluate their financial situation and determine how much they truly need to borrow. Avoiding unnecessary loans can prevent falling into debt.

- Research Lenders: It is crucial to research potential lenders thoroughly. Look for reputable lenders with transparent terms and conditions. Reading customer reviews and checking for complaints can provide insight into get a loan no credit check online lender’s practices.

- Understand the Terms: Borrowers should take the time to understand the loan terms, including interest rates, fees, repayment schedules, and any penalties for late payments. Clarity on these aspects can prevent future surprises.

- Explore Alternatives: Before resorting to no-credit-check loans, borrowers should explore other options, such as credit unions, community banks, or personal loans from family and friends. These alternatives may offer more favorable terms.

- Consider Credit-Building Options: For those looking to improve their credit scores, consider options such as secured credit cards or credit-builder loans. Building a positive credit history can open doors to more favorable lending options in the future.

Conclusion

No-credit-check personal loans can provide a lifeline for individuals facing financial challenges, but they come with significant risks that must be carefully weighed. Borrowers should approach these loans with caution, ensuring they understand the terms and are aware of the potential pitfalls. As the financial landscape continues to evolve, it is essential for borrowers to educate themselves about their options and make informed decisions that align with their financial goals. By doing so, individuals can navigate the complexities of borrowing and work towards a more stable financial future.