Market Overview:

Supply chain finance encompasses a suite of financial instruments and processes that optimize capital flows between buyers, suppliers, and financial providers. Traditionally centered on receivable discounting, the SCF market now reflects a broader definition that includes payables financing, asset-based lending, and other liquidity-enhancing solutions. Globalisation and extended supply networks have amplified cash-flow pressures on suppliers, particularly in the wake of longer payment terms and evolving trade practices. These dynamics have intensified the need for structured financing solutions that enhance resilience across supply chains.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/request-customization/168082/

How AI and Digital Technologies Are Reshaping the Future:

Digital transformation is a defining trend shaping the SCF landscape. Integration of artificial intelligence (AI) and machine learning into risk-assessment and credit-scoring platforms enables real-time analytics, automated underwriting, and predictive modelling that enhance decision-making accuracy. Cloud-based deployments are increasingly preferred for their scalability and integration capabilities, driving operational efficiencies and faster time to value. Additionally, innovations such as blockchain facilitate secure, transparent transaction flows and reduce reconciliation costs, further strengthening market adoption across regions.

Market Growth Factors:

Key drivers propelling SCF market growth include:

Working Capital Optimization: Enterprises are prioritising liquidity management and working capital relief across multi-tier supply networks, particularly in sectors such as manufacturing, automotive, pharmaceuticals, and electronics.

Digital Adoption and Platform Innovation: The influx of fintech solutions and cloud-native platforms is transforming traditional financing models, enabling real-time monitoring, automated risk checks, and integrated analytics.

SME Financial Inclusion: Expanded access to SCF solutions is helping small and medium-sized enterprises (SMEs) mitigate capital constraints and improve competitiveness in domestic and international markets.

Market Segmentation:

The SCF market displays diversification across several dimensions:

By Offering: Includes export and import bills, letters of credit, performance bonds, and shipping guarantees.

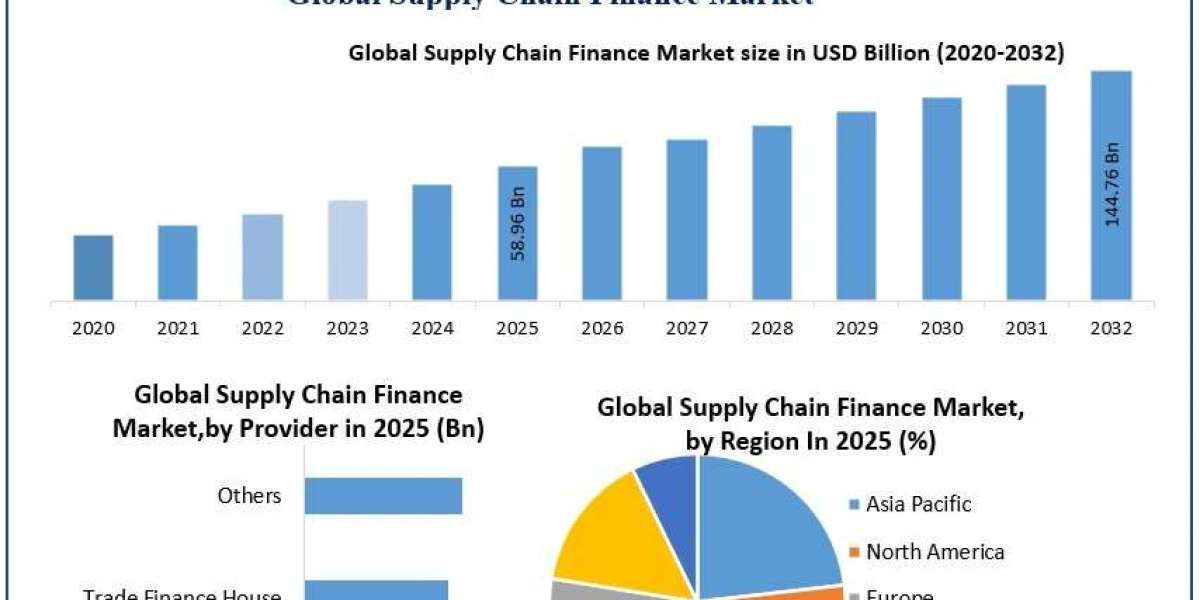

By Provider: Banks continue to dominate the market share, with trade finance houses and alternative finance providers gaining traction.

By End-User: Large enterprises remain primary adopters, while SMEs are rapidly increasing utilisation.

By Application: Domestic financing holds significant share, with international SCF solutions growing rapidly in line with global trade expansion.

Request To Free Sample of This Strategic Report ➤https://www.maximizemarketresearch.com/request-customization/168082/

Key Players are:

1. IBM

2. Ripple

3. Rubix by Deloitte

4. Accenture

5. Distributed Ledger Technologies

6. Oklink

7. Nasdaq Linq

8. Oracle

9. AWS

10. Citi Bank

11. ELayaway

12. HSBC

13. Ant Financial

14. JD Financial

15. Qihoo 360

16. Tencent

17. Baidu

18. Huawei

19. Bitspark

20. SAP

21. ALIBABA

Recent Developments & Industry News:

Significant developments in the SCF ecosystem illustrate both innovation and strategic expansion:

Emerging Partnerships: Major financial institutions, including HSBC and the International Finance Corporation (IFC), launched a USD 1 billion trade-finance programme aimed at enhancing supply chain liquidity in emerging markets across Africa, Asia, and Latin America, addressing a persistent global trade finance gap of roughly USD 2.5 trillion.

Technology Innovation: The wider adoption of AI-based risk-scoring systems and blockchain-enabled financing products is reshaping product portfolios and improving transaction transparency across buyer–supplier networks.

Strategic Market Expansion: Fintech and traditional banking entities are broadening SCF capabilities to support niche sectors and multi-tier supply chains, driving competitive differentiation.

Browse In-depth Market Research Report ➤https://www.maximizemarketresearch.com/market-report/supply-chain-finance-market/168082/

About Maximize Market Research:

Maximize Market Research Pvt. Ltd. is a seasoned market intelligence firm recognised for rigorous data analysis, strategic insights, and robust forecasting across global industries. With a commitment to precision and analytical depth, Maximize delivers actionable research that supports informed decision-making for corporate stakeholders, financial investors, and policy makers. The firm’s global coverage and domain expertise ensure comprehensive market visibility and nuanced understanding of evolving business landscapes.

Maximize’s research methodology integrates primary interviews, proprietary databases, and advanced modelling techniques to produce reliable, forward-looking insights tailored to meet the analytical needs of a diverse clientele.

About Us:

+91 9607365656

sales@maximizemarketresearch.com