In addition to being an essential component of contemporary healthcare, prior authorization has a big impact on clinic operations. Managing prior permission requests can be difficult and time-consuming for many healthcare providers, frequently necessitating specialized technologies and dedicated staff. Maintaining effectiveness and patient satisfaction requires an understanding of how this process affects day-to-day operations.

There are usually several steps in the healthcare pre authorization process flow, from confirming insurance coverage to submitting clinical proof for approval. Every stage might cause delays, especially when working with several insurance companies that have different needs. In order to help clinics streamline operations and lessen administrative responsibilities, prior authorization services and medical prior authorization firms are essential in this situation.

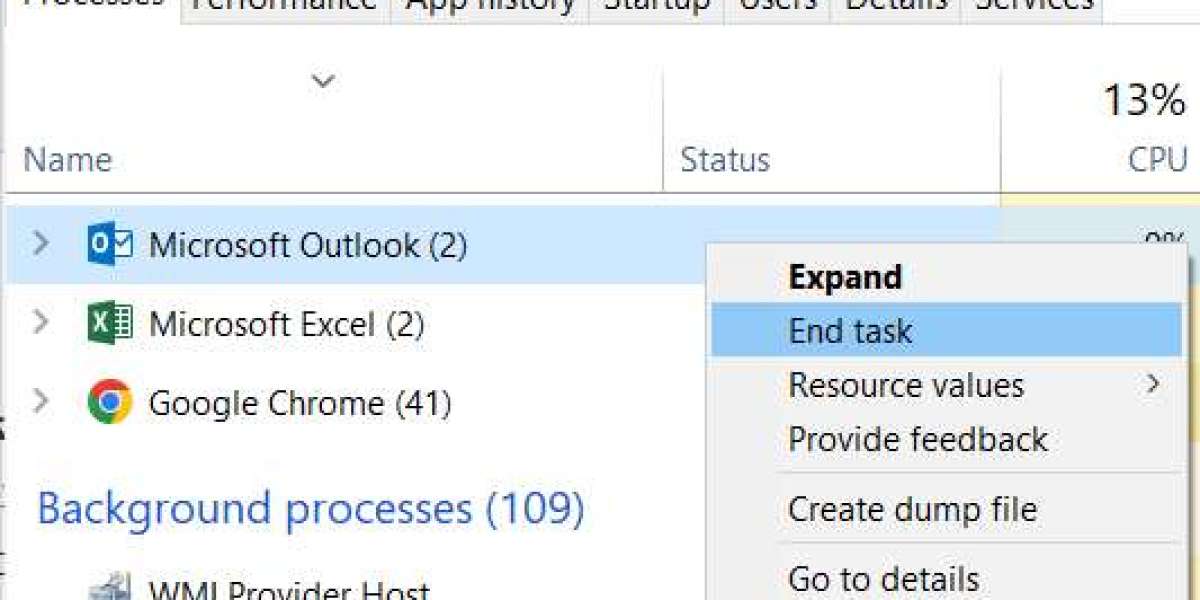

Delays in procedure, drug, or test approvals frequently result in bottlenecks for clinics. Prior authorization for surgery or specialty therapies, for instance, can cause the entire care plan to stall, which can impact clinic schedules and patient results. By using medical prior permission software, requests may be tracked in real time, preventing errors and freeing up staff members to concentrate on patient care rather than paperwork.

These days, a lot of clinics choose to contract with seasoned suppliers to handle prior authorization services. Prior authorization outsourcing relieves internal personnel of the administrative burden by providing end-to-end support, managing everything from submission to follow-up. Healthcare providers can guarantee quicker approvals and fewer denials by collaborating with prior authorization firms that focus on preauthorization for insurance and medical billing, which will finally improve the prior authorization procedure for providers.

Electronic health records (EHRs) and modern prior authorization systems work together seamlessly to provide an automated approach that saves time and minimizes errors. From the first request to the last approval, end-to-end pre authorization services give clinics insight into each step of the procedure, enabling them to keep effective schedules and raise patient satisfaction.

In summary, prior authorization directly affects clinic workflow even if it is required for insurance compliance. Healthcare providers can successfully handle prior authorization for medical services, lessen administrative stress, and concentrate on providing high-quality patient care by utilizing technology and outsourcing options. This difficult procedure may be made a more efficient and manageable aspect of clinic operations by investing in thorough medical prior authorization software and collaborating with trustworthy prior authorization businesses.