Payroll accuracy is critical for every business, whether you have five employees or fifty. When you encounter the QuickBooks Payroll Update Not Working issue, it can disrupt tax calculations, employee payments, and compliance reporting. Payroll updates in QuickBooks are essential because they include the latest tax tables, regulatory changes, and performance improvements. If these updates fail, your payroll system may not calculate deductions correctly, which could lead to costly mistakes.

Understanding why payroll updates stop working is the first step toward resolving the issue quickly and safely.

Why QuickBooks Payroll Updates Fail

There are several reasons why QuickBooks Payroll may fail to update. One of the most common causes is an unstable internet connection. Since payroll updates rely on downloading the latest tax table files, any interruption during the process can corrupt the update.

Another common reason involves expired payroll subscriptions. If your payroll service is not active, QuickBooks will block access to the latest updates. Checking your subscription status inside QuickBooks ensures that your service is current and active.

Damaged QuickBooks installation files can also prevent payroll updates from completing. Over time, system conflicts, incomplete updates, or power interruptions can corrupt important components. When this happens, the payroll update process may freeze, display errors, or fail repeatedly.

Incorrect system date and time settings may also interfere with payroll updates. Since tax updates depend on accurate system configurations, even small mismatches can disrupt the process.

Common Signs the Payroll Update Is Not Working

If your payroll update is not functioning correctly, you may notice error messages while downloading updates, repeated prompts to update despite previous attempts, or incorrect tax calculations during payroll processing. In some cases, QuickBooks may display a message stating that the tax table update failed.

These warning signs should not be ignored, as using outdated payroll data can result in incorrect tax withholdings or compliance risks.

How to Fix QuickBooks Payroll Update Not Working

The first step in troubleshooting is verifying your internet connection. A stable and secure connection ensures that update files download completely without corruption. Restarting your router and reconnecting may resolve temporary connectivity glitches.

Next, confirm your payroll subscription status. Open QuickBooks, navigate to your account information, and verify that your payroll plan is active. If your subscription has expired, renewing it should restore access to updates.

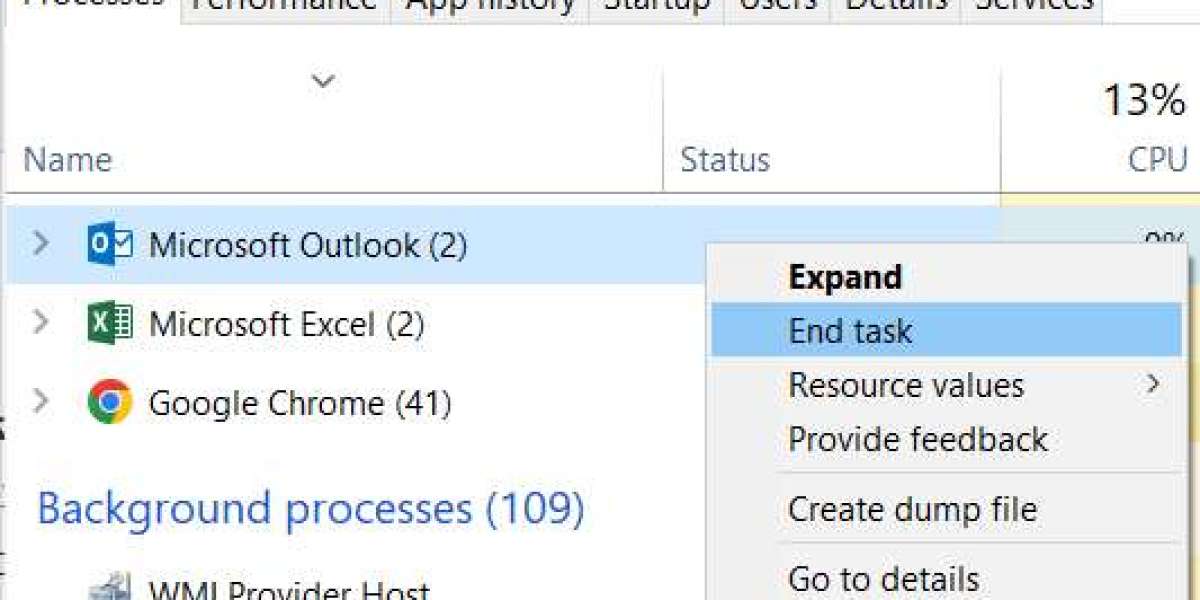

Running QuickBooks as an administrator can also help. Administrative privileges allow the software to install system-level changes required for payroll updates. Simply right-click the QuickBooks icon and select “Run as Administrator.”

Another helpful step is resetting the QuickBooks update feature. Within QuickBooks, navigate to the update section and select the option to reset updates. This clears previously downloaded files and forces QuickBooks to retrieve fresh update components.

If the problem persists, using the QuickBooks Tool Hub can repair damaged installation files. The Install Diagnostic Tool scans your system and fixes program conflicts that may be blocking payroll updates. Allow the tool to complete its process fully before reopening QuickBooks.

In situations where none of these solutions work, reinstalling QuickBooks through a clean installation process may be necessary. Before doing so, always back up your company file to avoid data loss. A clean installation replaces damaged program components and often resolves persistent update failures.

If troubleshooting feels overwhelming, professional support is available at +1-866-500-0076. Experienced technicians can diagnose payroll update errors quickly and restore functionality safely.

Preventing Payroll Update Issues in the Future

Preventive maintenance plays a key role in avoiding payroll update disruptions. Keeping your Windows operating system updated ensures compatibility with the latest QuickBooks versions. Regularly restarting your computer clears temporary system conflicts that might interfere with updates.

It is also important to install payroll updates as soon as they become available rather than delaying them. Frequent updates reduce the risk of large file downloads becoming corrupted.

Maintaining a stable antivirus configuration that allows QuickBooks to access update servers is equally important. Ensuring that QuickBooks ports are open within firewall settings prevents unexpected communication blocks.

Why Timely Payroll Updates Matter

Payroll tax laws and rates change frequently. Failing to update your payroll software on time can lead to incorrect federal or state tax calculations. This may result in underpaid taxes, penalties, or employee dissatisfaction.

Keeping payroll software updated protects your business from compliance risks and ensures employees are paid accurately and on time. Smooth payroll processing builds trust and reliability within your organization.

Read More - QuickBooks Payroll Tax Table Update

Conclusion

Dealing with the QuickBooks Payroll Update Not Working problem can feel stressful, especially when payroll deadlines are approaching. However, most update failures stem from manageable issues such as internet instability, expired subscriptions, or minor program corruption. By verifying your subscription, resetting updates, repairing installation files, and maintaining proper system settings, you can restore payroll functionality quickly.

For additional guidance, helpful troubleshooting resources, and expert insights, visit quickbooksupportnet. The platform provides valuable information to help you maintain smooth and secure QuickBooks operations.

If you need immediate assistance resolving payroll update errors, call +1-866-500-0076 and receive reliable support tailored to your business needs. Prompt action ensures your payroll remains accurate, compliant, and stress-free.