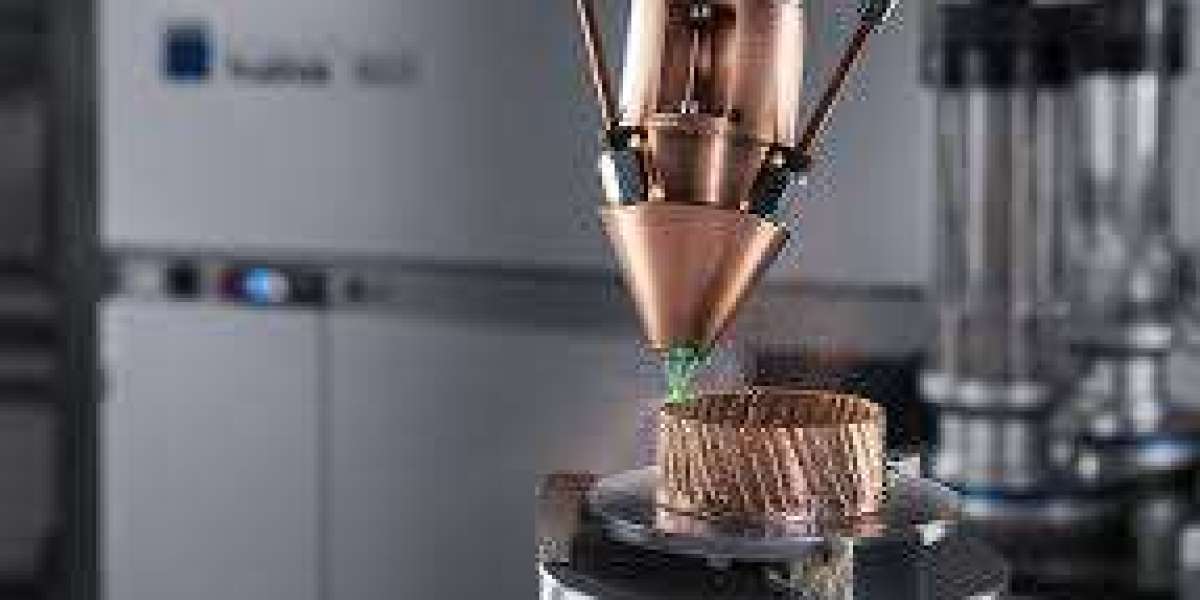

Laser additive manufacturing materials are the specialized feedstocks used in laser-based metal additive manufacturing processes such as laser powder bed fusion, directed energy deposition, and laser cladding. These materials include metal powders, wires, and engineered alloys designed to deliver consistent melting behavior, reliable mechanical properties, and stable processability under laser energy inputs. Laser additive manufacturing enables near-net-shape parts with complex geometries, internal channels, lattice structures, and tailored performance characteristics that are difficult to achieve through conventional machining or casting. Applications span aerospace and defense, medical implants, automotive lightweighting, energy and turbomachinery, industrial tooling, and repair and remanufacturing. Between 2025 and 2034, the laser additive manufacturing materials market is expected to expand strongly as industrial adoption scales, qualification of additive parts accelerates, supply chains mature, and new alloys and powder specifications unlock broader performance and cost targets.

Market Overview and Industry Structure

The Laser Additive Manufacturing Materials Market Size is valued at $5.21 Billion in 2025. Worldwide sales of Laser Additive Manufacturing Materials Market are expected to grow at a significant CAGR of 10.4%, reaching $10.42 Billion by the end of the forecast period in 2032.

The market is centered on three major material formats. Metal powders dominate laser powder bed fusion, requiring tight particle size distributions, spherical morphology, controlled oxygen and moisture levels, and consistent flowability to support stable layer deposition and repeatable melt pools. Wire feedstocks are important in directed energy deposition and laser wire deposition where higher deposition rates and material efficiency can be achieved. Specialized powders are also used in laser cladding and surface engineering, where wear and corrosion resistance coatings are built onto substrates.

Material categories include titanium alloys, nickel-based superalloys, cobalt-chromium alloys, stainless steels, tool steels, aluminum alloys, copper alloys, and emerging high-entropy or refractory alloys for advanced applications. The value chain includes alloy producers and powder atomizers, wire manufacturers, powder recyclers and conditioning specialists, additive machine OEMs that qualify and recommend materials, service bureaus that consume large powder volumes, and end users that develop internal additive manufacturing capabilities. Distribution occurs through direct supply agreements, certified material programs tied to specific machine platforms, and specialized distributors that serve smaller users and prototyping labs.

Industry Size, Share, and Adoption Economics

Adoption economics are driven by material performance, qualification, and total cost per printed part. Laser additive manufacturing materials often command premium pricing compared with conventional mill products because of the tight specifications required and the value created in high-performance applications. Powders must meet stringent purity and morphology standards, and many end users prefer certified batches with full traceability. The economic case is strongest where additive manufacturing reduces material waste from machining, shortens lead times, enables weight reduction, consolidates assemblies, or supports low-volume customized production.

Market share tends to concentrate among suppliers with proven atomization capability, strong quality systems, reliable batch-to-batch consistency, and the ability to support aerospace and medical qualification requirements. Switching costs can be moderate to high because materials are qualified within specific process windows and machine parameters, and changes can require revalidation. As a result, long-term supply agreements and approved vendor lists are common in regulated industries.

Key Growth Trends Shaping 2025–2034

A major trend is industrialization and production scaling. Laser powder bed fusion is moving from prototyping to serial production in aerospace brackets, medical implants, dental components, and select automotive applications. As production scales, demand rises for consistent, high-quality powders with stable supply and predictable pricing. Industrial users are also adopting powder management systems and recycling protocols to reduce material cost and maintain quality.

Alloy innovation is another strong trend. Traditional alloys designed for casting or forging may not be optimized for additive manufacturing due to cracking susceptibility, porosity risk, or undesirable microstructures. Materials suppliers and OEMs are developing additive-specific alloys that improve printability, reduce hot cracking, and deliver better mechanical properties without extensive post-processing. This includes modified aluminum alloys, improved high-strength steels, and tailored nickel alloys for high-temperature applications.

Qualification and standards maturation is accelerating adoption. As more additive parts are qualified for flight-critical and medical use, the material ecosystem benefits from clearer specifications, test methods, and supply chain confidence. Material suppliers are investing in certification programs, traceability systems, and tighter control of oxygen and nitrogen content to meet demanding requirements. Digital quality documentation and batch genealogy are becoming key differentiators.

Another trend is growth in directed energy deposition and repair applications. DED materials, including powders and wires, are used to repair high-value components such as turbine blades, molds, and tooling inserts. As industries focus on asset life extension and sustainability, repair and remanufacturing demand supports material consumption, often with specialized alloys engineered for bonding and wear resistance.

Sustainability and cost optimization are shaping powder production and recycling. Atomization is energy intensive, and powder wastage can be significant if not managed. Manufacturers are improving powder yield, recycling practices, and closed-loop powder programs to reduce lifecycle cost and improve sustainability credentials. Some end users are also evaluating recycled feedstock and reclaimed powder conditioning, balancing cost savings against qualification requirements.

Core Drivers of Demand

The primary driver is increasing adoption of metal additive manufacturing in aerospace, medical, and energy applications where performance and design freedom justify material premiums. A second driver is supply chain resilience and lead time reduction. Additive manufacturing enables on-demand production and localized manufacturing, which supports demand for readily available qualified powders and wires. A third driver is lightweighting and performance optimization, particularly in aerospace and automotive, where additive manufacturing enables topology-optimized designs and part consolidation that reduce weight and improve efficiency.

Additionally, the growth of industrial tooling, conformal cooling inserts, and specialized manufacturing fixtures drives demand for tool steels and high-performance alloys. The expansion of defense and space programs also supports demand for titanium and nickel alloys in high-value components.

Browse more information

https://www.oganalysis.com/industry-reports/laser-additive-manufacturing-materials-market

Challenges and Constraints

Cost remains a key constraint. Metal powders are expensive, and qualification costs can be significant. Powder bed fusion also has relatively low deposition rates, which limits cost competitiveness for large parts unless performance benefits justify it. Powder quality and consistency are critical; variations in particle size distribution, oxygen content, or flowability can affect build stability and part properties. Managing powder recycling without degrading quality is a major operational challenge, especially for oxygen-sensitive materials like titanium.

Supply chain and capacity constraints can occur during demand surges, particularly for aerospace-grade titanium and nickel powders. Atomization capacity, quality control throughput, and certified packaging can become bottlenecks. Another constraint is health and safety. Fine metal powders pose inhalation and explosion risks, requiring strict handling, storage, and facility controls. These requirements add operational cost and complexity.

Technical constraints include cracking, residual stress, and anisotropy in printed parts that can require post-processing such as heat treatment and hot isostatic pressing. Materials that print well may still require extensive post-processing to meet fatigue and fracture requirements, influencing total cost and adoption.

Market Segmentation Outlook

By material type, the market includes titanium alloys, nickel superalloys, stainless and maraging steels, tool steels, aluminum alloys, cobalt-chromium alloys, copper alloys, and emerging advanced alloys. By format, the market includes laser powder bed fusion powders, directed energy deposition powders, wire feedstocks, and cladding powders. By end user, demand is driven by aerospace and defense OEMs and tier suppliers, medical implant and dental manufacturers, energy and turbomachinery companies, automotive and motorsports manufacturers, industrial tooling producers, and additive manufacturing service bureaus. By application, segments include production parts, prototyping, tooling, repair and remanufacturing, and surface engineering.

Key Market Players

- Carpenter Technology Corporation

- Sandvik AB

- Höganäs AB

- EOS GmbH

- 3D Systems Corporation

- GE Additive (General Electric)

- Heraeus Group

- Renishaw plc

- Arcam AB (a GE Additive company)

- GKN Additive

- Praxair Surface Technologies (Linde plc)

- AP&C (Advanced Powders & Coatings, part of GE Additive)

- DMG Mori AG

- Sintavia, LLC

- Amastan Technologies (now part of 6K Additive)

Competitive Landscape and Strategy Themes

Competition is driven by powder quality, certification and traceability, alloy portfolio breadth, and ability to support customer qualification. Leading suppliers differentiate through advanced atomization technology, low-oxygen and low-inclusion powders, consistent particle morphology, and robust documentation. Strategic themes through 2034 include development of additive-optimized alloys, expansion of certified powder programs tied to machine OEM ecosystems, investment in recycling and powder lifecycle management services, and partnerships with aerospace, medical, and energy customers for co-development and qualification. Suppliers are also expected to expand regional production footprints to reduce logistics risk and support localized supply chain requirements.

Regional Dynamics

Regionally, North America and Europe are expected to remain strong demand centers due to aerospace and medical manufacturing, defense programs, and established additive ecosystems. Asia-Pacific is expected to be a high-growth region driven by expanding industrial manufacturing, increasing adoption of additive manufacturing in aerospace and automotive, and investment in domestic supply chains for critical materials. Other regions will see selective growth tied to energy, defense, and industrial modernization.

Forecast Perspective (2025–2034)

From 2025 to 2034, the laser additive manufacturing materials market is positioned for strong growth as metal additive manufacturing transitions into broader production adoption. Demand will be strongest for certified powders and wires that support regulated applications, additive-optimized alloys that improve printability and reduce post-processing burden, and service-oriented material programs that help customers manage powder lifecycle and cost. Suppliers that deliver consistent quality, scalable certified capacity, and collaborative qualification support will be best positioned to capture durable growth over the forecast period.

Browse Related Reports

https://www.oganalysis.com/industry-reports/methyl-isobutyl-ketone-mibk-market

https://www.oganalysis.com/industry-reports/sodium-sulfate-market

https://www.oganalysis.com/industry-reports/glyphosate-market

https://www.oganalysis.com/industry-reports/formic-acid-market

https://www.oganalysis.com/industry-reports/fermentation-chemicals-market