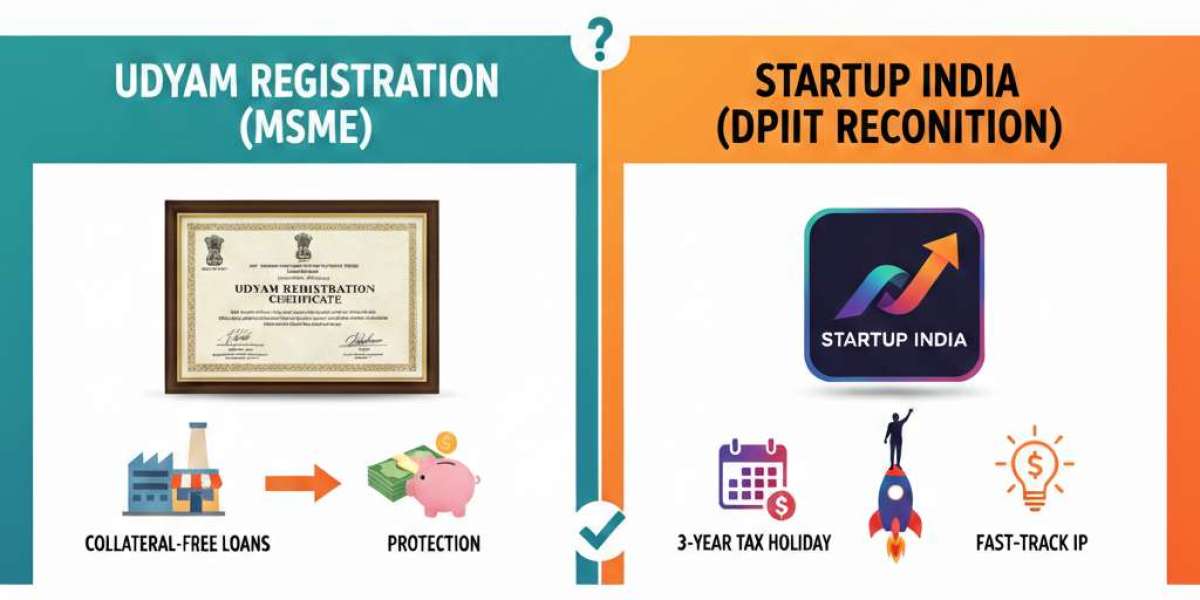

In 2026, the Indian business landscape has changed a lot however for a new founder being document ready is important. There are two heavyweights registration Udyam Registration and Startup India (DPIIT) Recognition.

Both might look the same but fundamentally they are different and designed for different businesses. In this blog I will help you to decide which registration your business actually needs.

What is Udyam Registration?

The Udyam Registration is governed by the Ministry of MSME that provides a 12-digit Udyam Registration Number (URN) to MSMEs. This certificate is a permanent proof of business and its classification as a Micro, Small, or Medium enterprise based on investment and turnover.

As of April 1, 2025, the government updated the classification for MSME Business

· Micro: Turnover up to ₹10 Crore.

· Small: Turnover up to ₹100 Crore.

· Medium: Turnover up to ₹500 Crore.

Udyam Registration Benefits

Udyam certificate unlocks several benefits from the Government like :-

Collateral-Free Loans: Banks prioritize Udyam-registered businesses for credit under the CGTMSE scheme.

Lower Interest Rates: Most banks offer a 1% to 1.5% interest rate concession for registered MSMEs.

Subsidy on Patent & Trademark: Get up to a 50% discount on government fees for filing patents and trademarks.

Protection Against Delayed Payments: Under the MSME Samadhaan portal, buyers are legally required to pay you within 45 days.

Electricity & Tax Concessions: Many states offer exemptions on electricity bills and direct tax laws for Udyam holders.

If you have already registered your business with udyam and want to download your udyam certificate. Visit the Udyog register portal and navigate to the header and click on Udyam Certificate Download .

What is Startup India Recognition?

Startup India Managed by the DPIIT (Department for Promotion of Industry and Internal Trade), this is an elite recognition for businesses that are innovative, scalable, and less than 10 years old (20 years for Deep Tech). Unlike Udyam, which welcomes almost any legal business activity, Startup India requires you to prove that your business model is unique or significantly better than existing solutions.

Benefit of Startup India

The "Startup India" Edge: Innovation and Tax Savings

Startup India is a launchpad. It is built for businesses that want to burn bright and scale fast.

· 80-IAC Income Tax Holiday: Eligible startups can apply for a 100% tax exemption for 3 consecutive years within their first decade.

· Angel Tax Exemption: This is vital for founders raising capital. It prevents the tax department from taxing the "premium" paid by investors on your shares.

· Self-Certification: You can self-certify compliance for 6 labor laws and 3 environmental laws for up to 5 years, keeping inspectors at bay while you build.

· IPR Fast-Tracking: Startups get an 80% rebate on patent filings and a 50% rebate on trademark fees, plus access to fast-track examiners.

Eligibility: Who Can Apply?

One of the biggest differences lies in the legal structure of your business.

Entity Type | Udyam (MSME) | Startup India (DPIIT) |

Sole Proprietorship | ✅ Yes | ❌ No |

Partnership Firm | ✅ Yes | ✅ Yes (Registered) |

Limited Liability Partnership (LLP) | ✅ Yes | ✅ Yes |

Private Limited Company | ✅ Yes | ✅ Yes |

Cooperative Societies | ✅ Yes | ✅ Yes (New for 2026) |

Key Takeaway: If you are a freelancer or a small shop owner operating as a Sole Proprietorship, Udyam is your only option. Startup India requires a more formal, registered corporate structure.

Final Verdict: Which is for you?

· Choose Udyam ONLY if: You are a traditional business (trader, service provider, or manufacturer), a sole proprietor, or if you primarily need bank support and protection from payment delays.

· Choose Startup India ONLY if: You have a unique, scalable tech product, you are a Pvt Ltd/LLP, and you are aiming for high-growth or investor funding.

· Choose BOTH if: You are a registered company building something new. This gives you the "Shield" of Udyam and the "Sword" of Startup India.

In 2026, the Indian government is literally handing you the tools to succeed. Whether it's the 45-day payment security of Udyam or the tax-free growth of Startup India, make sure you don't leave these benefits on the table.