Introduction to Capital Figures

In the world of business, capital is a crucial element. It's the financial foundation that supports daily operations, investments, and growth strategies. Capital figures play a key role in understanding the financial health and viability of a business. Whether you're a startup founder or a seasoned entrepreneur, mastering capital figures is essential for making informed financial decisions. In this article, we will explore what capital figures are, why they matter, and how they influence business strategy.

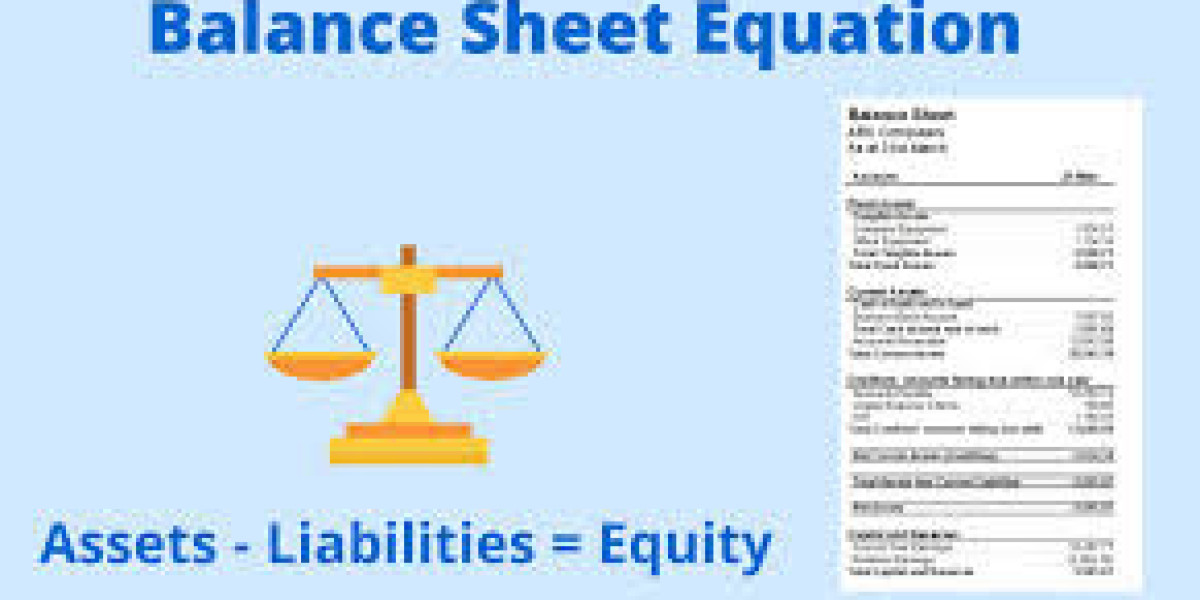

What Are Capital Figures?

Capital figures refer to the numerical representations of a company's available capital. These figures encompass a variety of financial data, including equity, debt, assets, and liabilities. Capital figures help businesses understand how much money they have at their disposal for expansion, investment, and operations. The more accurate these figures are, the more precise a company’s financial planning can be.

Types of Capital Figures

There are several different types of capital figures that businesses must monitor and manage. Some of the most important ones include:

Equity Capital: This is the money invested by the business's owners or shareholders. It represents the ownership value in a company and is a key metric in determining the company's worth.

Debt Capital: This refers to funds that a company borrows, typically from banks or other financial institutions. Debt capital is crucial for companies that need funding but do not want to dilute ownership through equity.

Working Capital: This figure measures a company's short-term liquidity and its ability to cover day-to-day expenses. It's calculated by subtracting current liabilities from current assets.

Retained Earnings: These are the profits a company retains rather than distributing them as dividends. Retained earnings are crucial for reinvestment into the business and its long-term growth.

Venture Capital: This is a specific type of funding, usually provided to high-growth businesses in exchange for equity. Venture capital is often essential for startups aiming to scale quickly.

Why Are Capital Figures Important?

Capital figures are not just a set of numbers—they are the lifeblood of a business. They provide insights into financial stability, growth potential, and operational efficiency. Below are some key reasons why capital figures are so critical for any business.

1. Financial Planning and Strategy

Capital figures form the foundation of financial planning. Without a clear understanding of available capital, it’s impossible to set realistic growth targets, create budgets, or plan for investments. Accurate capital figures help business owners and managers make informed decisions about expenditures, cost management, and resource allocation.

2. Business Valuation

When valuing a business for investment, acquisition, or partnerships, capital figures are among the first metrics that potential buyers and investors review. The value of a company is often determined by the amount of equity capital, the level of debt, and overall financial performance.

3. Investment Decisions

For companies seeking to raise funds or make investments, capital figures provide a clear picture of whether or not they can afford to take on new opportunities. Investors look closely at these figures to assess the risk of investing in the business.

4. Risk Management

Capital figures also play a crucial role in risk management. Understanding the balance between debt and equity, for example, can help a business avoid over-leveraging itself and risking bankruptcy. Similarly, working capital management ensures that a company can meet its short-term obligations.

5. Debt Management

Businesses often rely on debt to fund operations or expansion. Monitoring capital figures related to debt allows a company to manage its obligations and avoid financial strain. It also helps ensure that the cost of debt is manageable and sustainable in the long term.

How to Manage Capital Figures Effectively

Managing capital figures requires a systematic approach to financial oversight. Below are some strategies that businesses can adopt to ensure that their capital figures are aligned with their strategic goals.

1. Regular Monitoring and Reporting

One of the most effective ways to manage capital figures is by setting up regular financial reporting and monitoring systems. These should provide real-time insights into equity, debt, and working capital. Monthly or quarterly reports can highlight any discrepancies and help businesses stay on track with their financial goals.

2. Optimize Working Capital

Efficient management of working capital is essential for smooth operations. Companies should focus on reducing inventory turnover time, optimizing receivables and payables, and improving cash flow management. By doing so, businesses can ensure that they have enough liquidity to meet their day-to-day needs.

3. Debt-to-Equity Ratio Management

Keeping an eye on the debt-to-equity ratio is vital for avoiding financial distress. A high ratio may indicate that a company is relying too much on borrowed funds, which can be risky during economic downturns. Conversely, a low ratio may signal underutilized capital. The key is finding a balanced approach that aligns with the business’s growth and risk tolerance.

4. Reinvest Profits

Retained earnings are a valuable source of capital for business growth. Reinvesting profits into the company rather than distributing them as dividends can fund new projects, research and development, or expansion efforts. This strategy allows businesses to maintain control over their capital while funding their growth initiatives.

5. Attracting External Investment

For businesses looking to scale quickly, venture capital or private equity investment can provide the necessary funds. However, it’s important to maintain transparency and showcase strong capital figures to attract investors. A well-managed capital structure will make the business more appealing to potential backers.

Capital Figures in Business Growth Strategy

Capital figures are closely tied to business growth. Without the right balance of equity, debt, and retained earnings, a business cannot fund its expansion plans effectively. Whether a business is launching a new product line, expanding into new markets, or acquiring competitors, it needs a strong capital foundation.

1. Expansion and Scaling

Growth often requires significant investment. Capital figures determine whether a business has the necessary funds for expansion. Without sufficient capital, businesses may struggle to scale, whether by investing in infrastructure, marketing, or new hires.

2. Strategic Investments

A well-capitalized business is better positioned to make strategic investments in technology, acquisitions, and other opportunities that can drive long-term success. Capital figures allow companies to identify how much they can afford to invest without risking financial stability.

3. Mergers and Acquisitions

In some cases, businesses may opt to acquire other companies or merge with competitors. These decisions require strong capital figures to ensure that the business can afford the acquisition and that the post-merger company remains financially healthy.

Conclusion

Capital figures are an essential part of any business's financial toolkit. They provide key insights into a company’s financial health, its ability to grow, and how well it manages its resources. By understanding and managing these figures effectively, businesses can make informed decisions that support sustainable growth, minimize risk, and optimize financial performance. Whether you're a new entrepreneur or a seasoned business owner, mastering capital figures is crucial for long-term success.