South Africa Vodka Market Overview

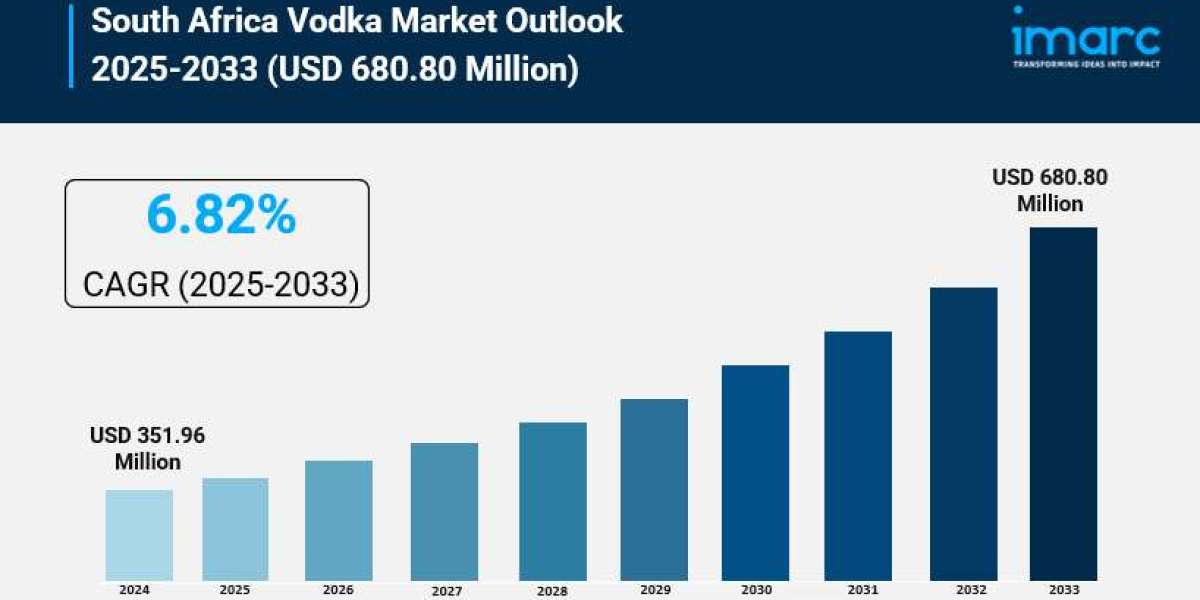

Market Size in 2024: USD 351.96 Million

Market Size in 2033: USD 680.80 Million

Market Growth Rate 2025-2033: 6.82%

According to IMARC Group's latest research publication, "South Africa Vodka Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa vodka market size reached USD 351.96 Million in 2024. The market is projected to reach USD 680.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.82% during 2025-2033.

How AI is Reshaping the Future of South Africa Vodka Market

- AI-driven consumer insights and behavior research enable detailed analysis of consumer preferences, improving product targeting and marketing strategies.

- Intelligent supply chain optimization powered by AI enhances logistics efficiency, ensuring steady product availability in urban and densely populated areas.

- AI-powered e-commerce platforms facilitate tailored product recommendations, rapid comparison of vodka brands, and streamlined purchasing processes enhancing consumer engagement.

- Machine learning models aid pricing and procurement services by analyzing market trends and competitive pricing, optimizing profitability.

- AI-enabled brand perception and loyalty surveys provide dynamic feedback loops for product improvement and customer relationship management.

- Automated product concept testing accelerates innovation cycles by simulating consumer responses prior to launch, helping companies launch more impactful products.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-vodka-market/requestsample

Market Growth Factors

Factors supporting growth of South Africa vodka consumption include urbanization, and the increase in the size of the middle class and its disposable income. Vodka consumption increases in cities like Johannesburg and Cape Town, where the populace is adopting modern lifestyles and consuming more mainstream liquor when going out and clubbing. Customarily, vodka is the most popular base for cocktails as it is a neutral spirit, and this trend is continuing amongst younger drinkers. With the rise of tourism and the expatriate population, international brand line-ups have also started appearing in on-trade venues. These trends are also driving growth as urban consumers seek experiences surrounding their consumption occasions as opposed to consuming alone.

Premiumization continues to drive the vodka market, as affluent consumers increasingly seek more premium and unique brands to express their lifestyle and social status. Enthusiastic consumers are happy to spend more money on smoother, more complex vodkas, often produced by internationally known companies, although some consumers appear to be trading down in the face of an economic downturn. This has created a two-speed marketplace catering to both premium and aspirational consumers. Innovative packaging and branding attracts prestige-seeking consumers. Global market developments, including celebrity endorsements and more efficient marketing strategies, have prompted consumers to explore higher-priced products, and vodka fits society's image of an advanced but accessible beverage in this context.

Vodka's popularity remains common through the culture of cocktails and modern mixology, with bartenders and home cocktail enthusiasts striving to find new drinks and ideas that display vodka's versatility. Flavored and premixed vodka-based drinks are popular for an on-the-go lifestyle when compared to the unflavored product. Social media and lifestyle are key drivers of cocktail popularity among South African millennials and Gen Z customers at the onsite venues where cocktails make for lively nightlife moments. As a cocktail ingredient or for seasonal and occasion-based consumption, vodka continues to remain fashionable, whether as a refreshing drink or simply part of South Africa's diverse drinking environment.

We explore the factors propelling the South Africa vodka market growth, including technological advancements, consumer behaviors, and regulatory changes.

Market Segmentation

Type Insights:

- Flavored

- Non-Flavored

Quality Insights:

- Standard

- Premium

- Ultra-Premium

Distribution Channel Insights:

- Off Trade

- On Trade

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Recent Development & News

- November 2024: Premiumisation trend accelerates vodka sales, with premium brands capturing 25% market share through flavored variants like citrus-infused options from local distilleries.

- October 2024: RTD vodka cocktails surge 15% in urban markets, driven by convenient 330ml cans using sustainable aluminum packaging to reduce plastic waste by 40%.

- September 2024: Local innovation in low-calorie vodka launches, incorporating baobab fruit extracts for natural sweetness, boosting health-focused consumption by 12% among millennials.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302