In recent years, the world of retirement investing has seen a notable shift towards incorporating tangible assets, particularly gold bullion, into Individual Retirement Accounts (IRAs).

In recent years, the world of retirement investing has seen a notable shift towards incorporating tangible assets, particularly gold bullion, into Individual Retirement Accounts (IRAs). As economic uncertainties and inflationary pressures continue to influence market dynamics, investors are increasingly turning to gold as a hedge against volatility. This article explores the latest developments in the realm of gold bullion IRAs, focusing on the advancements that have made it easier and more beneficial for investors to include gold in their retirement portfolios.

The Evolution of Gold Bullion IRAs

Historically, IRAs were primarily limited to traditional assets such as stocks, bonds, best gold ira rollover and mutual funds. However, the passage of the Taxpayer Relief Act of 1997 opened the door for investors to include precious metals, including gold, silver, platinum, and palladium, in their retirement accounts. This legislative change marked a significant milestone, allowing investors to diversify their portfolios with physical assets that have intrinsic value.

Recent Advances in Gold Bullion IRAs

- Increased Accessibility and Awareness

The rise of online investment platforms and financial technology has made it easier for everyday investors to access gold bullion IRAs. Companies specializing in precious metals have developed user-friendly websites and mobile applications that allow investors to open accounts, purchase gold, and

best Gold ira rollover manage their investments with ease. Additionally, educational resources and webinars have become more prevalent, helping investors understand the benefits and processes involved in incorporating gold into their IRAs.

- Expanded Options for Gold Bullion

Investors now have a broader range of gold bullion products to choose from when setting up their IRAs. While American Gold Eagles and Canadian Gold Maple Leafs have long been popular choices,

best gold ira rollover many custodians now offer a variety of gold bars and coins from different mints around the world. This expansion allows investors to select products that align with their investment strategies and preferences, potentially enhancing their portfolio's performance.

- Improved Custodial Services

The custodial services that hold and

best gold ira rollover manage gold bullion in IRAs have seen significant improvements. Reputable custodians now offer enhanced security measures, such as fully insured storage facilities and advanced tracking systems. Some custodians also provide additional services, such as regular audits and transparent reporting, which can help investors feel more secure about their investments. This level of service is crucial, as the protection of physical assets is paramount for investors looking to include gold in their retirement accounts.

- Flexible Investment Strategies

Recent advancements have led to more flexible investment strategies for gold bullion IRAs. Many custodians now allow investors to set up self-directed IRAs, giving them greater control over their investment choices. This flexibility enables investors to actively manage their gold investments, including the ability to buy, sell, or trade bullion as market conditions change. Additionally, some custodians offer options for gold IRAs that allow for the inclusion of other precious metals, providing even more diversification within the retirement account.

- Tax Benefits and Regulations

Investors are increasingly aware of the tax advantages associated with gold bullion IRAs. Here is more information about

testgitea.educoder.net stop by our own page. While traditional IRAs offer tax-deferred growth, gold IRAs can also provide tax benefits if structured correctly. For example, when gold is held within a Roth IRA, any gains made on the investment can grow tax-free, provided certain conditions are met. Recent clarifications from the IRS regarding the treatment of precious metals in retirement accounts have also helped investors navigate the regulatory landscape more effectively.

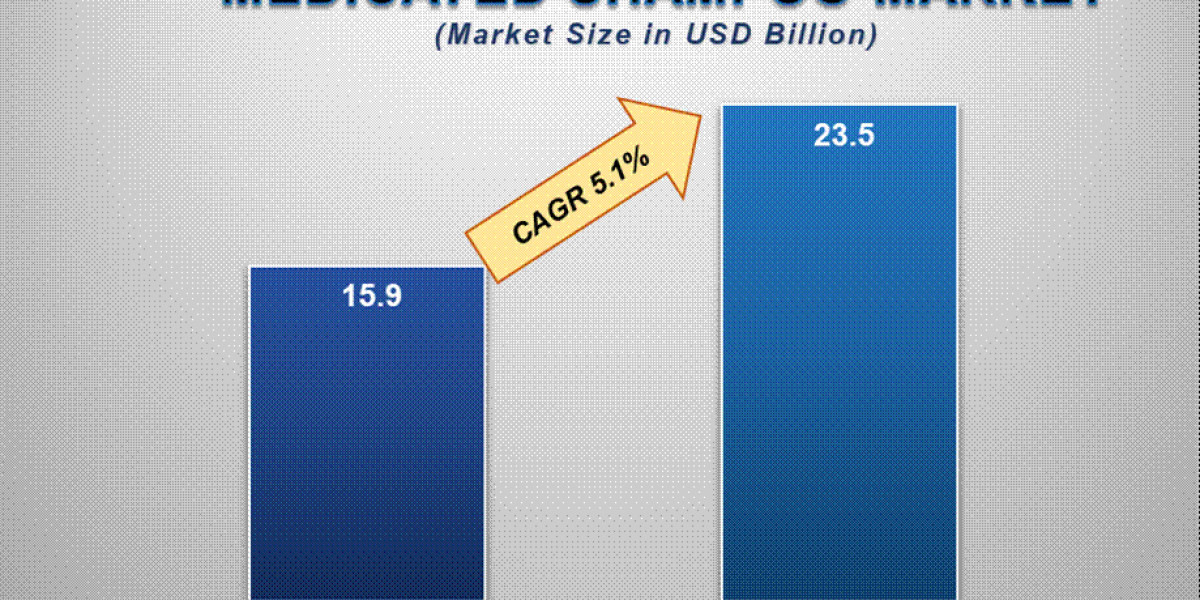

- Market Trends and Demand

The demand for gold as a safe-haven asset has surged in recent years, particularly during periods of economic uncertainty. This trend has prompted more investors to consider gold bullion IRAs as a viable option for preserving wealth and hedging against inflation. As a result, the market for gold bullion has become more robust, with increased liquidity and competitive pricing. Investors can now take advantage of favorable market conditions to acquire gold at lower premiums, enhancing their overall investment returns.

- Integration with Other Assets

Modern investment strategies increasingly emphasize the importance of diversification. Gold bullion IRAs can now be easily integrated with other asset classes, such as stocks, bonds, and real estate, to create a well-rounded retirement portfolio. Financial advisors are incorporating gold into their clients' investment plans more frequently, recognizing its potential to reduce overall portfolio risk and improve long-term returns.

- Educational Resources and Support

The rise of digital platforms has also led to a wealth of educational resources available to investors interested in gold bullion IRAs. From online courses to informative blog posts and video content, investors can access a variety of materials that explain the benefits, risks, and strategies associated with gold investments. Furthermore, many custodians now offer personalized support and consultations to help investors make informed decisions about their gold bullion IRAs.

Conclusion

The landscape of gold bullion in IRAs has evolved significantly in recent years, best gold ira rollover driven by advancements in accessibility, custodial services, and market demand. As investors seek to safeguard their retirement savings against economic uncertainties, gold bullion has emerged as a compelling option for Best Gold Ira Rollover diversification and wealth preservation. With increased awareness and improved resources, individuals can now confidently incorporate gold into their retirement portfolios, leveraging its potential to enhance long-term financial security. As the market continues to evolve, staying informed about the latest developments in gold bullion IRAs will be essential for investors looking to take advantage of this valuable asset class.