The global Indian diaspora continues to grow, with millions of Indians living and working outside the country while maintaining economic and personal ties with India. These connections often involve property ownership, investments, bank accounts, or family-related financial arrangements. As a result, understanding nri taxation in India has become an essential responsibility for Non-Resident Indians (NRIs).

Indian tax laws applicable to NRIs are detailed, technical, and subject to frequent interpretation through circulars, judicial rulings, and treaty provisions. This article is designed as a people-first, experience-driven guide to help readers understand how NRI taxation works in practice, the importance of compliance, and the role played by nri tax consultants in India in interpreting the law correctly.

Understanding NRI Status: The Foundation of Taxation

The starting point of nri taxation in India is the determination of residential status. Under the Income-tax Act, 1961, residential status is determined every financial year based on physical presence in India.

An individual qualifies as a Non-Resident Indian if they do not meet the prescribed conditions for being treated as a resident. This classification is not permanent and can change from year to year depending on travel patterns.

From a practical standpoint, incorrect determination of residential status is one of the most common reasons for tax mismatches, incorrect filings, and avoidable notices from tax authorities. Accurate assessment requires careful review of travel history and legal provisions.

Scope of NRI Taxation in India

Unlike residents, NRIs are taxed in India only on income that has a direct Indian connection. The scope of nri taxation in India generally includes income that:

Is received or deemed to be received in India

Accrues or arises, or is deemed to accrue or arise, in India

Income earned and received outside India is typically outside the Indian tax net for NRIs. However, identifying whether income “accrues” in India often requires detailed factual and legal analysis.

Common Indian income sources for NRIs include:

Rental income from immovable property in India

Capital gains from sale of Indian real estate or securities

Interest income from NRO bank accounts

Dividend income from Indian companies

Income connected with a business or profession in India

Each category is governed by separate tax provisions and rates, making holistic understanding essential.

NRI Tax Return in India: Who Needs to File?

Filing an nri tax return in India is mandatory in several situations, including:

When total taxable income exceeds the basic exemption limit

When capital gains arise from sale of Indian assets

When tax has been deducted at source and a refund is claimed

When compliance is required to carry forward losses

Even in cases where tax liability is fully covered by TDS, return filing may still be necessary for reporting purposes or future compliance.

From an experience perspective, many NRIs face challenges such as time zone differences, document availability, and lack of familiarity with Indian filing systems. These practical difficulties highlight the importance of structured compliance support.

TDS and Its Impact on NRIs

Tax Deducted at Source plays a significant role in NRI taxation. In many cases, TDS rates applicable to NRIs are higher than those for residents. Examples include:

Sale of property by an NRI, where TDS applies on capital gains

Interest income from NRO accounts

Certain payments for professional or contractual services

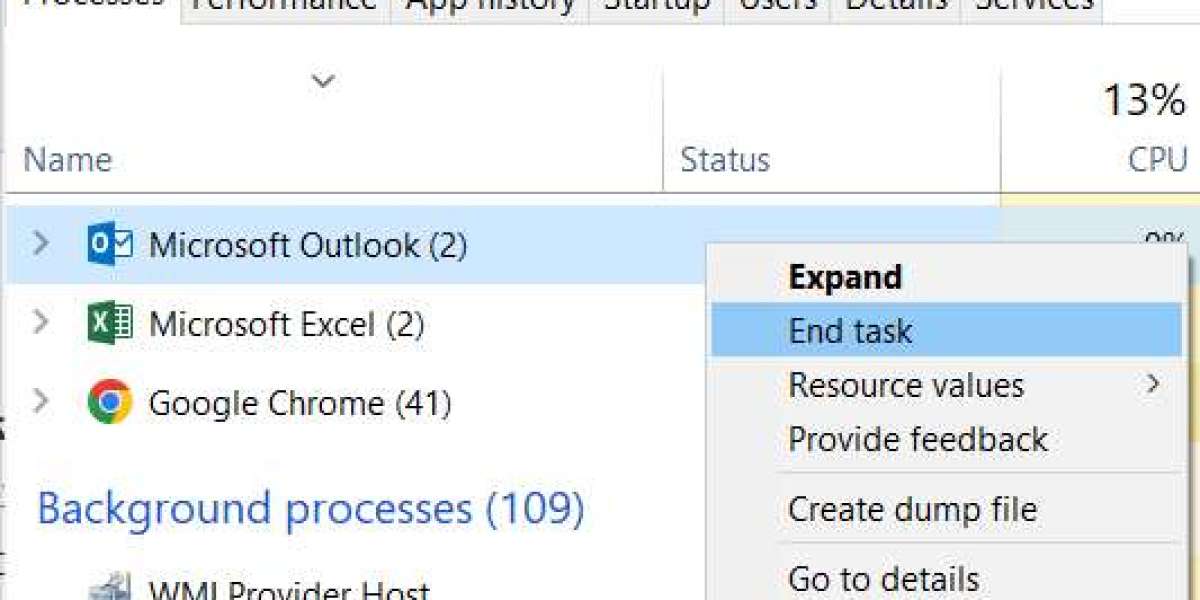

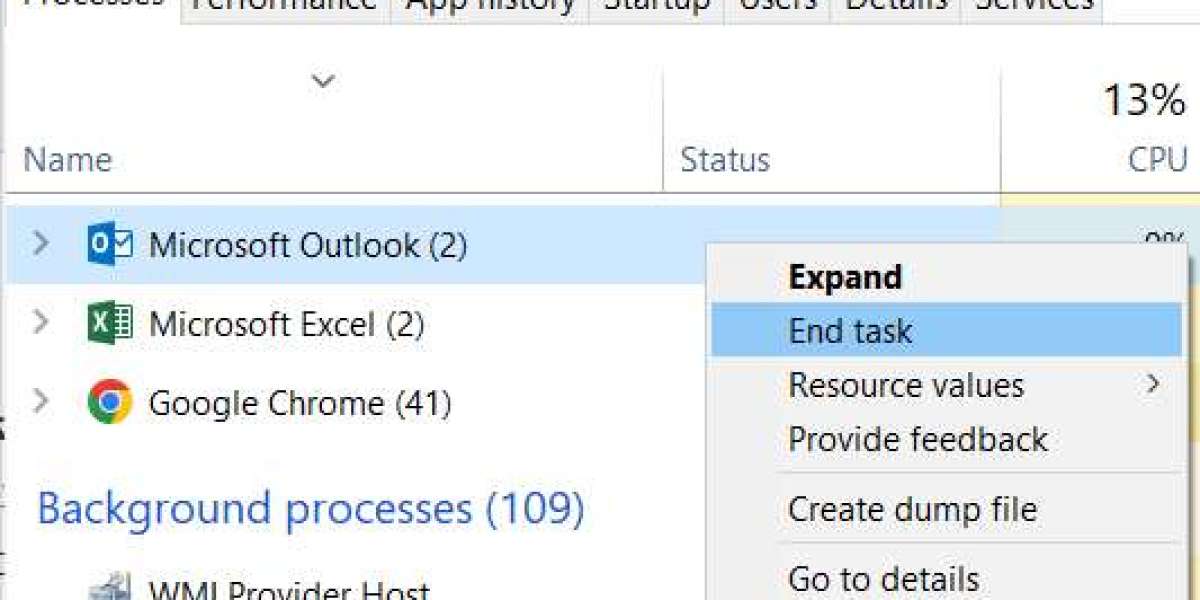

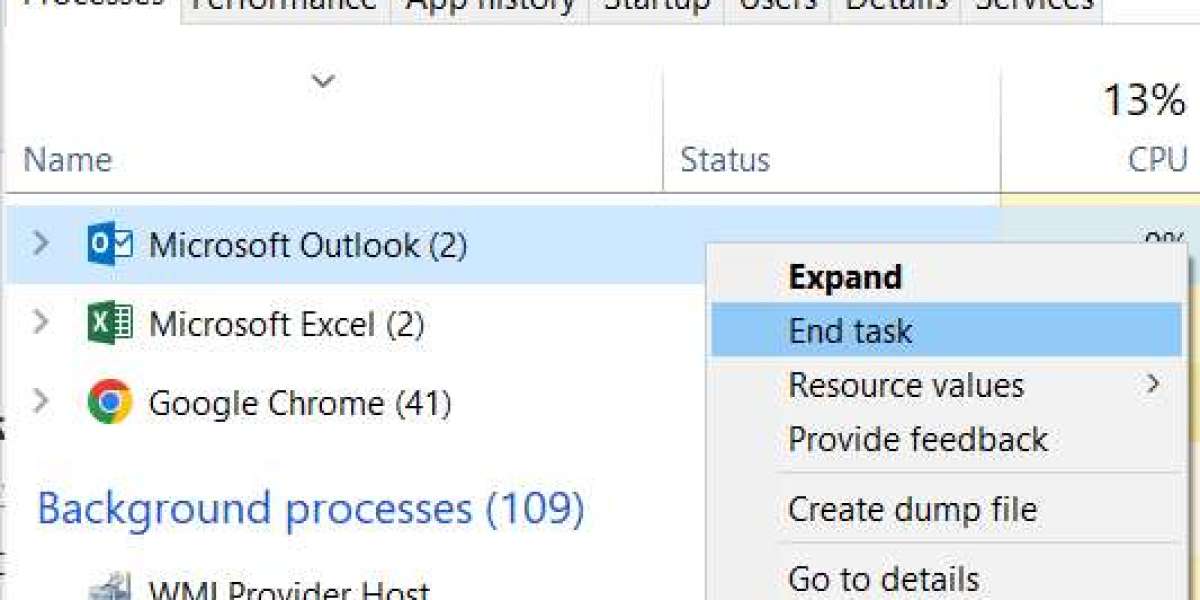

TDS compliance affects cash flows and often results in refund claims, making it a critical component of nri tax filing services India. Proper reconciliation of Form 26AS and accurate reporting in returns are essential to avoid delays or mismatches.

Capital Gains and Property Transactions

Capital gains arising from the sale of Indian assets are among the most complex areas of nri taxation in India. Issues commonly encountered include:

Determining holding period (short-term vs long-term)

Applying indexation benefits where permitted

Understanding applicable tax rates

Claiming exemptions through reinvestment

Property transactions also intersect with FEMA regulations, especially in relation to repatriation of sale proceeds. Compliance requires coordinated understanding of both tax and foreign exchange laws.

Double Taxation Avoidance Agreements (DTAA)

India has entered into Double Taxation Avoidance Agreements with several countries to prevent income from being taxed twice. DTAA provisions may offer:

Reduced tax rates on interest, dividends, or capital gains

Exemption of certain income in one jurisdiction

Foreign tax credit for taxes paid abroad

Applying DTAA benefits is not automatic. It requires procedural compliance, documentation, and accurate interpretation of treaty articles. This area involves a high level of technical expertise and practical judgment.

FEMA Considerations Alongside Tax Compliance

While income tax laws govern taxation, the Foreign Exchange Management Act (FEMA) regulates how NRIs can hold, invest, and repatriate funds in India. FEMA provisions cover:

Classification of bank accounts (NRE, NRO, FCNR)

Repatriation limits and procedures

Permitted investments in Indian assets

From a compliance standpoint, tax reporting and FEMA regulations often overlap, particularly in property and investment-related matters.

Role of NRI Tax Consultants in India

The role of nri tax consultants in India extends beyond return filing. Their work is rooted in interpretation, experience, and procedural understanding of Indian tax laws as they apply to non-residents.

Key areas where they contribute include:

Determining residential status based on facts and law

Assessing taxability of different income streams

Supporting accurate nri tax return in India filing

Interpreting DTAA provisions and foreign tax credit rules

Addressing TDS, refunds, and compliance queries

Responding to notices or assessments from tax authorities

Their role is primarily advisory and compliance-oriented, ensuring that reporting aligns with statutory requirements.

People-First Perspective on Professional Practice

From a people-first viewpoint, NRI taxation is not merely about numbers and forms. It involves understanding individual circumstances, life transitions, cross-border responsibilities, and long-term financial planning considerations.

In India, professional firms operating in taxation and compliance contribute to this ecosystem through structured advisory work. R Pareva & Company is one such professional firm engaged in taxation and regulatory compliance, including matters relevant to NRIs. This reference is provided purely for informational context and reflects the broader professional environment supporting nri tax filing services India.

Conclusion

The framework governing nri taxation in India is detailed and multi-layered, involving income tax law, international tax principles, DTAA interpretation, and FEMA regulations. Filing an nri tax return in India requires careful attention to facts, documentation, and legal provisions.

Understanding the role of nri tax consultants in India helps NRIs appreciate how professional expertise supports compliance in a complex regulatory landscape. A people-first, informed, and compliant approach not only reduces the risk of disputes but also builds long-term confidence in managing Indian financial affairs from abroad.

Staying updated, maintaining accurate records, and approaching compliance thoughtfully remain essential aspects of responsible NRI tax management.