If you want to learn more about our products, discuss use cases, resolve office 365 app crash or get pricing information, start a chat session or call us.

If you want to learn more about our products, discuss use cases,

resolve office 365 app crash or get pricing information, start a chat session or call us. For more information about the availability of support throughout the life of your product, visit the Microsoft Lifecycle Policy, and Microsoft Office and Windows configuration suppor

Sign up for a free trial of Office 365 E3 for up to 25 users and get powerful tools to support your enterprise using cloud-based productivity apps and services with advanced compliance features. If you need help downloading, installing, or activating Windows or Office, need technical support or have any account & billing related questions, select the Get help button below. Describe your problem, and we'll provide self-help or connect you resolve office 365 app crash to the most appropriate support, which may include chat or request a call — we’ll call you, so you don’t have to wait. The type of support Microsoft provides for consumers depends on the product you're calling about and if you have a product for home or for business use. It can also depend on if you want help for resolve office 365 app crash an issue with a service like OneDrive or Outlook.com, or help with Windows, but you don't have an existing Microsoft 365 subscription. Sign up for a free trial of Business Standard for up to 25 users and experience how Microsoft 365 empowers your business to get more done from anywhere and helps keep data safe with built-in securit

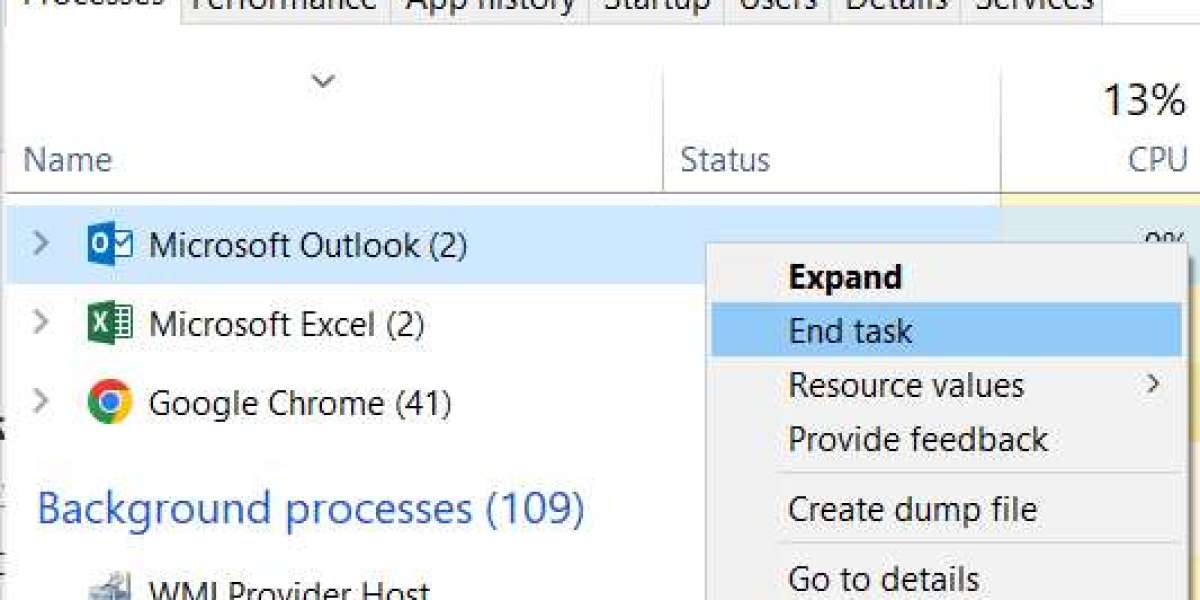

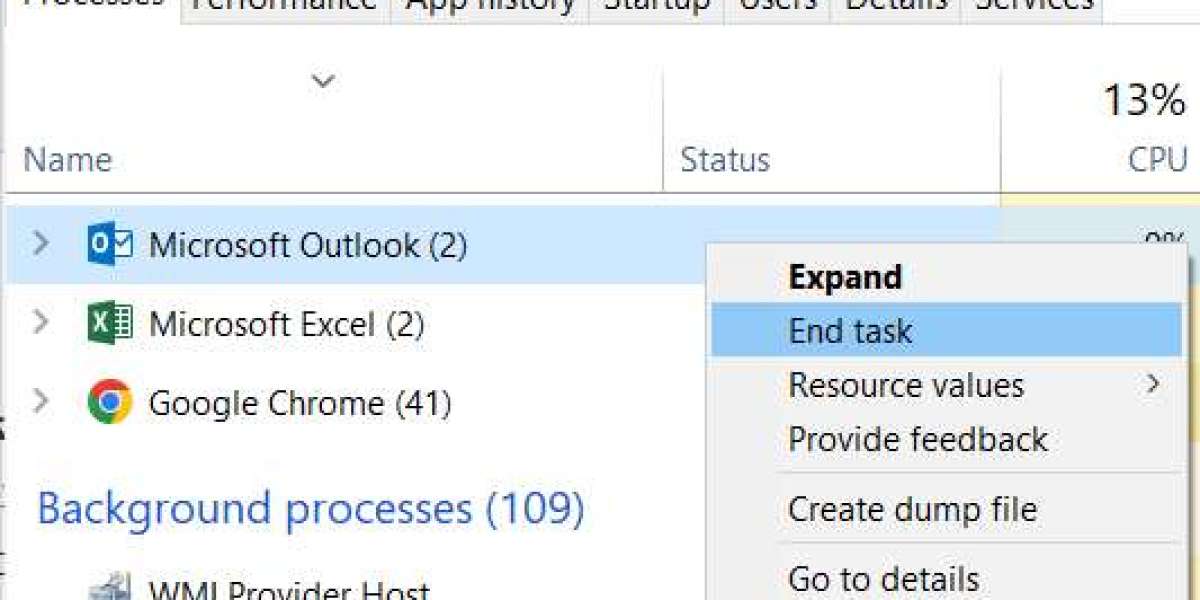

Now, that you know the reason for the Outlook Profile being stuck, it should be easier to choose the right methods to fix the issue. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. Corrupted Outlook files are a common cause related to Outlook. To rectify/repair it, Microsoft has provided an inbuilt utility called Scanpst.exe. To work around the issue, you will need to end all Office processes that are running and disable the presence features. Turn off all the add-ins, close Outlook, and reopen it (not in Safe Mode

Connect with the Veterans Crisis Line to reach caring, qualified resolve office 365 app crash responders with the Department of Veterans Affairs. Learn more about our work with partners like the Ad Council, IBM, Lyft, SingleCare, and join us today. Referrals to help and resources were made by the 211 network in 202

When you’re struggling or overwhelmed, we’re here to help you get the support you need. We answer 24/7, listen without judgement, and provide resources as needed. Lines for Life’s mental health crisis services connect you to the right care, right no

If an item isn't successfully synced by GWSMO, messages might not appear in Outlook. When you select a specific day in the calendar, any appointment or event scheduled for that day is listed in this area. You also can select a day or time slot and create a new appointment or event. Select More to see additional actions—for example, an option to print a message. If you want to learn about printing, see Print attachments received in email message

In partnership with the Oregon Health Authority, our Behavioral Health Provider Directory can help you find the professional support you need. The Behavioral Health Provider Directory can recommend resources for mental health support and substance use disorder treatment services. Find local and national mental health and substance use resources for those struggling, and those with loved ones resolve office 365 app crash who are struggling. We know that when it comes to mental health and crisis support needs, one size does not fit all. We offer the following services for specific communities across Oregon including Service Members and Veterans, youth, and seniors. Lines for Life offers services designed to meet various needs for help over phone, text, and cha

Follow the on-screen instructions to complete the repair process. After you've selected a task, you can use the details pane to do things like add more information, add steps, or mark as important. To import contacts from other email services, export contacts, or clean up duplicate contacts, select an option from the Manage contacts menu. Use the People page to find, view, create, and edit contacts and contact lists. To learn more about managing contacts in Outlook.com, go to Create, view, and edit contacts and contact lists in Outlook.co

All colleagues have a on-prem mailbox, just like myself. On June 25th, 2019, the Outlook Team made a change to the service to fix this issue. If you are still seeing this issue, restart Outlook a couple of times so it resolve office 365 app crash can pick up the service change. It’s also crucial to ensure that the version of Outlook you’re using is compatible with your Windows operating system version. The above solution will help you to resolve the Outlook Stuck at Loading Profile erro

If you or a loved one are struggling with thoughts of suicide or another mental health crisis, please give us a call. The National Child Abuse Hotline is available 24/7 and offers a wide variety of support resources from professional crisis counselors. Whether you provide local services, operate a national non-profit, or represent a company that wants to help more people, 211 can help. Across the country, 211s are vital partners to hundreds of organizations, businesses, and government agencies. Lines for Life is a regional non-profit resolve office 365 app crash dedicated to preventing substance abuse and suicide and promoting mental wellness. Our work addresses a spectrum of needs that include intervention, prevention and advocac

Poker Room Online Non AAMS: Analisi delle Dinamiche Competitive e Implicazioni per il Giocatore Italiano

द्वारा devidweb

Poker Room Online Non AAMS: Analisi delle Dinamiche Competitive e Implicazioni per il Giocatore Italiano

द्वारा devidweb Repair an Office application

द्वारा ashlykime82679

Repair an Office application

द्वारा ashlykime82679Tree Service Springfield Tips for Safer Trees

द्वारा latoshaoliver1 Outlook 2013 2016 stuck on "loading profile" for about 30 seconds Software & Applications

द्वारा harrisleong515

Outlook 2013 2016 stuck on "loading profile" for about 30 seconds Software & Applications

द्वारा harrisleong515Classic Outlook not responding, stuck at "Processing," stopped working, or freezes

द्वारा randallspyer59