UAE Travel Insurance Market Overview

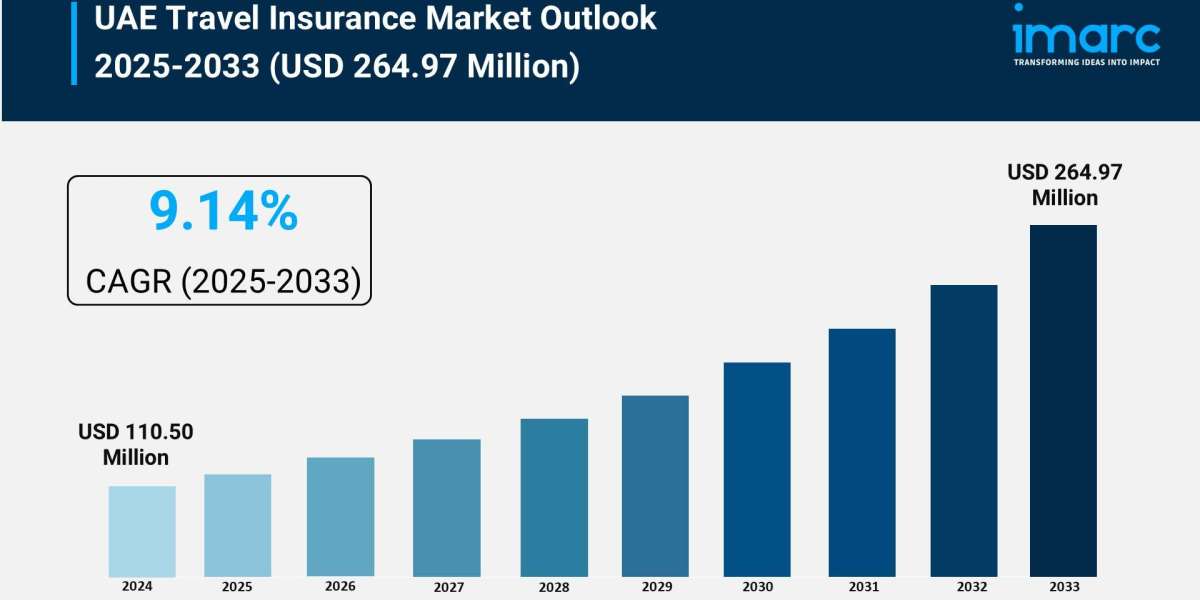

Market Size in 2024: USD 110.50 Million

Market Size in 2033: USD 264.97 Million

Market Growth Rate 2025-2033: 9.14%

According to IMARC Group's latest research publication, "UAE Travel Insurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE travel insurance market size was valued at USD 110.50 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 264.97 Million by 2033, exhibiting a growth rate of 9.14% during 2025-2033.

How AI is Reshaping the Future of UAE Travel Insurance Market

- Streamlining Claims Processing: AI-powered systems are helping insurers process travel claims faster, with platforms like Policybazaar.ae reporting a 182% surge in customer enquiries, handled efficiently through chatbot technology and automated support.

- Enabling Smart Risk Assessment: Artificial intelligence and machine learning tools are helping insurers analyze traveler behavior patterns, enabling personalized policy creation and accurate risk evaluation for UAE's 11.06 million expatriate population.

- Powering Digital Insurance Platforms: InsurTech solutions are making policy purchases seamless, with mobile apps allowing travelers to compare plans, customize coverage, and buy policies in minutes without traditional agent dependencies.

- Enhancing Fraud Detection: Advanced AI algorithms quickly scrutinize extensive datasets to identify patterns synonymous with fraudulent behavior, reducing risks for both insurers and policyholders across the UAE market.

- Supporting Parametric Insurance: AI-driven parametric coverage is gaining traction, offering quicker claims processes based on predefined parameters like flight delays or weather conditions, providing immediate financial assistance to travelers.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-travel-insurance-market/requestsample

UAE Travel Insurance Market Trends & Drivers:

The demand for travel insurance products has continued to grow in the UAE, buoyed by record traffic growth in tourism, with Dubai receiving 18.72 million inbound international tourists in 2024, establishing the UAE as a key travel hub. With UAE residents spending an estimated 80 billion dirhams on travel and tourism, awareness of the need for travel insurance is increasing. This is largely due to the high level of travel undertaken by the UAE's expatriate community of 11.06 million by mid-2025, who will likely travel internationally, requiring cover for trip cancellations, lost baggage, delays, and health problems abroad. With over 92 million passengers passing through Dubai International Airport annually, and the UAE acting as a hub for East-West travel, travel insurance is gaining importance in the region.

Digital transformation is changing the way residents in the UAE are buying travel insurance plans. The rise of mobile apps and online sales allows travelers to compare and purchase travel plans within minutes. Major insurers, including Allianz, AXA Gulf and Zurich Insurance, use digital distribution channels to better connect with customers, and much of the product distribution is online. As an example, insurance portal Policybazaar.ae has seen a 182% increase in queries from travelers in 2024, with 85% of queries coming from a tech-savvy cohort of travelers aged 25 to 40 who prefer online to insurance agents. The family traveler segment forms 60% of this business. Thorough travel insurance is now an integral part of UAE travelers' trip planning to some of the world's most popular travel destinations, including the US, Azerbaijan, Georgia and Armenia.

The introduction of mandatory health insurance in the Northern Emirates of Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah and Fujairah in January 2025 is seen as a landmark development in the UAE insurance market. With annual premiums starting at 320 dirhams, the new coverage rolls out health care and insurance awareness to a new area. RAK Hospital has also reported a 7% growth in patient numbers, mainly driven by insured blue-collar workers. RAK Hospital says this insurance awareness is also translating into the travel insurance market where residents who are now aware of health insurance value are beginning to buy more thorough travel policies. The summer vacation period is causing problems again this year, with more baggage lost by the airline system in general. From the UAE to Europe more baggage and medical claims are being made by travelers. Insurers are responding with higher levels of baggage cover and wider policies.

UAE Travel Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Insurance Type Insights:

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Long-Stay Travel Insurance

Coverage Insights:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

Distribution Channel Insights:

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

- Others

End User Insights:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Travel Insurance Market

- March 2024: Zurich Insurance partnered with Klook, a travel and leisure e-commerce platform, to launch FlyEasy coverage utilizing the Zurich Edge platform with parametric insurance features, addressing customer anxiety from extended flight delays at airports.

- August 2024: Policybazaar.ae reported a 182% increase in travel insurance enquiries compared to the previous year, driven primarily by travelers aged 25-40 who account for 85% of enquiries, with family travelers representing 60% of the total market share.

- January 2025: The UAE introduced mandatory health insurance for the Northern Emirates, with basic coverage starting at 320 dirhams annually, significantly expanding insurance awareness and creating spillover demand for complementary travel insurance products across the country.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302