How to Become SEBI Registered Investment Advisor – A Complete Guide with Taxation Consultancy Perspective

Have you ever wondered how some professionals confidently guide people on investments while building a respected career? If you’re passionate about finance, enjoy helping others make smarter money decisions, and want a career that combines trust, expertise, and impact, becoming a SEBI registered advisory professional could be your perfect path.

In simple terms, a SEBI Registered Investment Advisor (RIA) is someone officially authorized by SEBI (Securities and Exchange Board of India) to give investment advice. Think of it like earning a driving license before driving on public roads — registration ensures you are trained, responsible, and trustworthy. This guide will walk you through how to become SEBI registered investment advisor, explain the SEBI registration process, and show how taxation consultancy can strengthen your career.

Learn sebi registered advisory, how to become sebi registered investment advisor, sebi registration, and the complete sebi registration process step by step.

Understanding SEBI and Its Role

SEBI, or the Securities and Exchange Board of India, is the regulator of India’s financial markets. Its main job is to protect investors and ensure the market remains fair and transparent.

Why does this matter to you?

Because when you become a registered advisor, SEBI acts like a quality stamp. Clients feel safer knowing they are dealing with someone regulated by a powerful authority.

What is a SEBI Registered Investment Advisor?

A SEBI Registered Investment Advisor (RIA) is a professional who is legally allowed to provide investment advice for a fee. This advice can cover:

Mutual funds

Stocks

Bonds

Retirement planning

Financial planning

Tax-saving investments

Key point:

Without SEBI registration, charging fees for investment advice is not legally permitted.

Why Choose a Career in SEBI Registered Advisory?

Why is everyone suddenly interested in this career path?

Because it offers:

Credibility and trust

Long-term income potential

Flexible working options

Opportunity to genuinely help people

Imagine being a financial doctor — people come to you with money problems, and you prescribe solutions that improve their financial health.

Eligibility Criteria for SEBI Registration

Before learning how to become SEBI registered investment advisor, you must understand the basic eligibility:

SEBI divides applicants into two categories:

Individual Advisors

Non-Individual Advisors (Companies, LLPs, Firms)

Each category has slightly different requirements, but the foundation is the same: qualification, certification, and financial discipline.

Educational Qualifications You Need

To be eligible, you must have:

A professional qualification in finance, economics, accounting, business management, or similar fields

ORA postgraduate degree in the same areas

ORRelevant graduate degree with experience

Degrees like:

MBA (Finance)

CA, CS, CMA

CFA

M.Com

BBA (Finance)

can strongly support your application.

Certifications Required (NISM & More)

Certification is non-negotiable in the SEBI registration process.

You must clear:

NISM-Series-X-A: Investment Adviser (Level 1)

NISM-Series-X-B: Investment Adviser (Level 2)

These exams ensure you understand:

Financial planning

Risk profiling

Asset allocation

Ethics

Regulations

Think of these exams as the foundation stones of your advisory career.

Experience Requirements Explained

SEBI expects advisors to have practical exposure. Experience requirements generally include:

At least 5 years of experience in financial advisory, investment management, banking, or related fields

ORCombination of education and relevant experience

This ensures advisors don’t just know theory but understand real-world client behavior.

Net Worth and Infrastructure Requirements

SEBI wants advisors to be financially stable.

Individual advisors: Minimum net worth of ₹5 lakh

Non-individual advisors: Minimum net worth of ₹50 lakh

You also need:

Office setup

Secure data storage

Compliance systems

Record-keeping mechanisms

This isn’t just bureaucracy — it protects clients’ interests.

Step-by-Step SEBI Registration Process

Here’s the simplified roadmap for the SEBI registration process:

Check eligibility (education, experience, certification)

Clear NISM exams

Arrange net worth and infrastructure

Prepare documentation

Apply through SEBI Intermediary Portal (SI Portal)

Respond to SEBI queries (if any)

Receive SEBI Registration Certificate

It’s like applying for a passport: detailed, but totally achievable with the right preparation.

Documents Required for SEBI Registration

Some key documents include:

Educational certificates

NISM certificates

Identity and address proof

Net worth certificate from CA

Business plan

Infrastructure details

Compliance policies

Previous experience proof

Organizing documents properly can significantly speed up the approval process.

Fees Involved in the SEBI Registration Process

Costs vary, but typically include:

Application fees

Registration fees

NISM exam fees

Professional consultation fees (if using a consultant)

While there is an upfront cost, consider it an investment in a long-term professional career.

Role of Taxation Consultancy in Investment Advisory

Here’s where things get interesting.

Clients don’t just want investment advice. They ask:

How can I save tax?

Which investment gives tax benefits?

How do I plan for capital gains tax?

By combining SEBI registered advisory with taxation consultancy, you become a powerful one-stop solution.

You can help with:

Tax-efficient investment planning

Capital gains optimization

Retirement tax strategies

Business tax planning

It’s like being both the navigator and the engine of your client’s financial journey.

Common Mistakes to Avoid During Registration

Many applicants face rejection due to avoidable errors:

Incomplete documentation

Weak business plan

Poor compliance framework

Ignoring SEBI communication

Underestimating infrastructure requirements

Avoid rushing. Treat your application like a professional project.

Building Trust and Growing Your Advisory Practice

Getting registered is just the beginning. Growth depends on:

Transparency with clients

Ethical practices

Continuous learning

Strong communication skills

Client-first mindset

Remember: People trust advisors who listen more than they speak.

Future Scope of SEBI Registered Investment Advisors in India

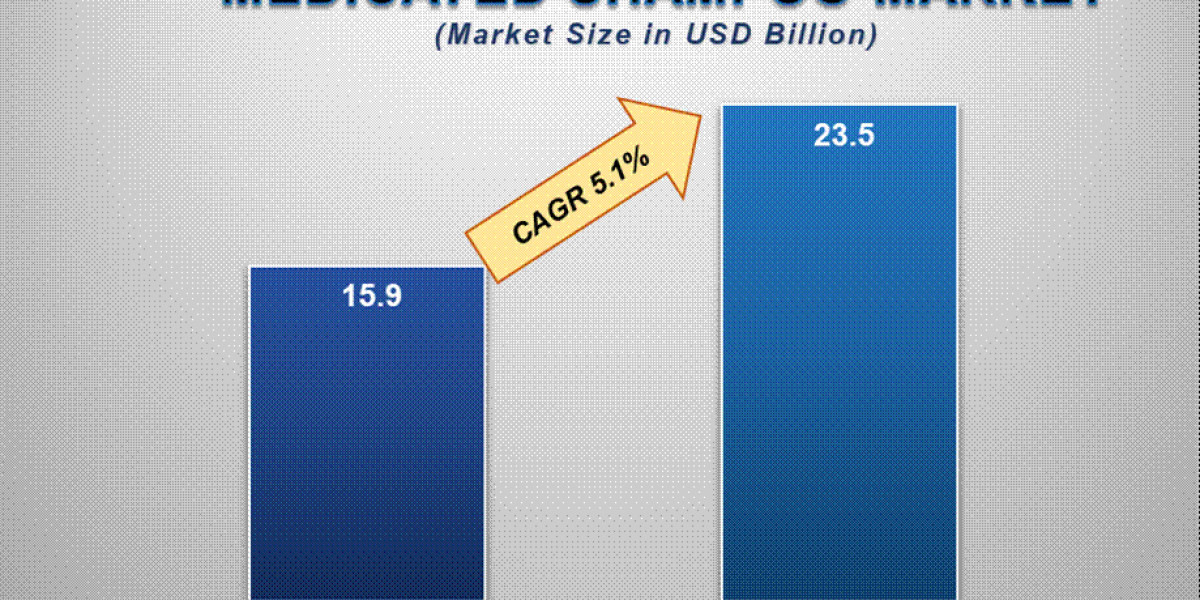

The future is extremely promising.

Why?

Financial awareness is growing

Mutual fund participation is increasing

People want personalized guidance

Regulations favor ethical advisors

The demand for qualified advisors will only rise. Those who start today are positioning themselves for a strong tomorrow.

Conclusion

Becoming a SEBI Registered Investment Advisor is not just about earning a certificate; it’s about building credibility, trust, and a meaningful career. If you’ve been searching for how to become SEBI registered investment advisor, the path is clear: gain the right education, clear NISM exams, meet eligibility, and follow the SEBI registration process step by step. When you combine sebi registered advisory services with taxation consultancy, you create exceptional value for clients and open doors to long-term success. The journey requires effort, but the rewards — professional respect, financial growth, and client impact — make it worth every step.

Frequently Asked Questions (FAQs)

1. What is the minimum qualification required to become a SEBI Registered Investment Advisor?

You need a graduate or postgraduate degree in finance, economics, accounting, business management, or related fields, along with relevant certifications like NISM.

2. How long does the SEBI registration process take?

The process can take anywhere from a few months to longer, depending on documentation quality and response to SEBI queries.

3. Can a CA or tax consultant become a SEBI Registered Investment Advisor?

Yes, absolutely. In fact, professionals with taxation consultancy experience have a strong advantage in providing holistic financial advice.

4. Is SEBI registration mandatory to give paid investment advice?

Yes. If you charge a fee for investment advice, SEBI registration is legally mandatory.

5. How much can a SEBI Registered Investment Advisor earn?

Earnings vary based on experience, client base, and specialization, but many advisors build highly profitable long-term practices.