Heater repair near me calls frequently involve thermostat settings, airflow restrictions or ignition problems. Thermostat batteries, breakers and safety switches can also stop a system from running. Gas furnace troubleshooting may include verifying ignition, checking sensors and confirming safe venting. Legacy Home Services provides heater repair new braunfels and nearby support, along with furnace and heat pump service.

Gas furnace troubleshooting may include verifying ignition, checking sensors and confirming safe venting. Legacy Home Services provides heater repair new braunfels and nearby support, along with furnace and heat pump service. Keeping filters clean, vents open and tune-ups scheduled can help reduce emergency calls.

Keeping filters clean, vents open and tune-ups scheduled can help reduce emergency calls.

Maghanap

Mga Sikat na Post

-

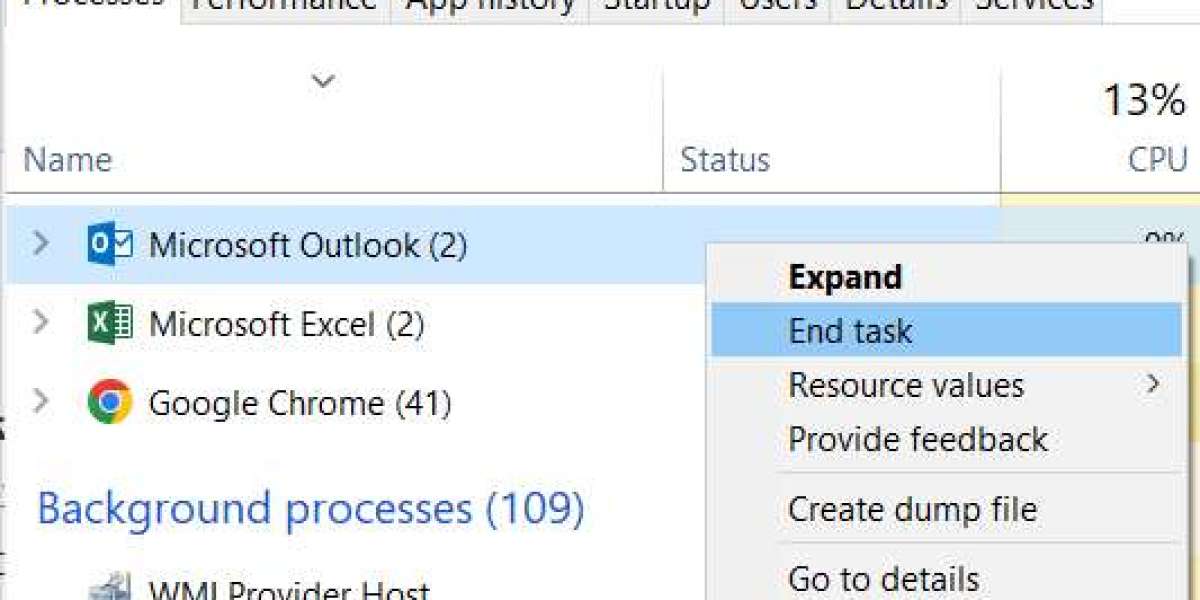

Classic Outlook not responding, stuck at "Processing," stopped working, or freezes

Sa pamamagitan ng randallspyer59 -

Repair an Office application

Sa pamamagitan ng ashlykime82679

Repair an Office application

Sa pamamagitan ng ashlykime82679 -

Contact HERE Customer Support

Sa pamamagitan ng kristangvy8105

Contact HERE Customer Support

Sa pamamagitan ng kristangvy8105 -

Reset passwords Microsoft 365 admin Microsoft Learn

Sa pamamagitan ng merrilllewin9

Reset passwords Microsoft 365 admin Microsoft Learn

Sa pamamagitan ng merrilllewin9 -

Casino Midnight bonus – Tips to Make It Work for You

Sa pamamagitan ng casinomidnight

Casino Midnight bonus – Tips to Make It Work for You

Sa pamamagitan ng casinomidnight

Mga kategorya

- Mga Kotse at Sasakyan

- Komedya

- Ekonomiks at Kalakalan

- Edukasyon

- Aliwan

- Mga Pelikula at Animasyon

- Paglalaro

- Kasaysayan at Katotohanan

- Live na Estilo

- Natural

- Balita at Pulitika

- Tao at Bansa

- Mga Alagang Hayop at Hayop

- Mga Lugar at Rehiyon

- Agham at teknolohiya

- Palakasan

- Paglalakbay at Mga Kaganapan

- Iba pa