Market Overview:

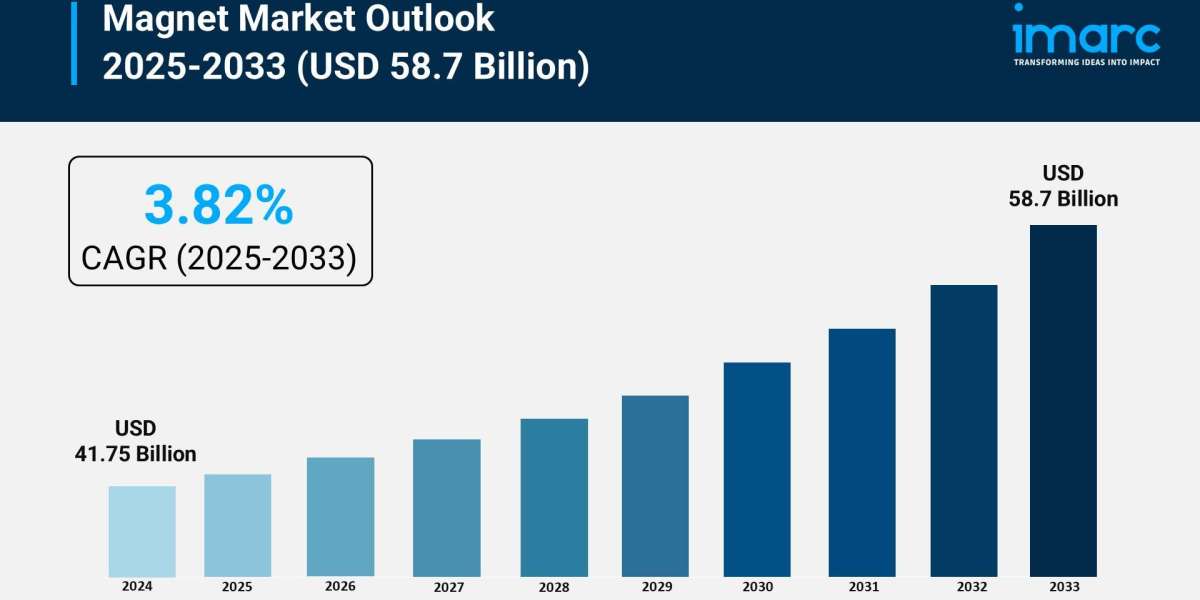

The magnet market is experiencing rapid growth, driven by global government initiatives and grid modernization, rising demand for energy efficiency and transparency, and integration of renewable energy and electric vehicles. According to IMARC Group’s latest research publication, “Magnet Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the global magnet market size reached USD 41.75 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 58.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/magnet-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Magnet Market

- Global Government Initiatives and Grid Modernization

Governments across the world are accelerating the deployment of smart meters to modernize aging power grids and meet ambitious climate goals. In India, the Revamped Distribution Sector Scheme (RDSS) serves as a monumental driver, with a sanctioned outlay of 3.03 trillion INR aimed at installing 250 million prepaid smart meters by 2026. This initiative is designed to reduce aggregate technical and commercial losses and bridge the gap between supply costs and revenue realized. Similarly, in North America, federal and state-level support continues to push the total installed base toward 180 million units by the end of the decade. These large-scale rollouts are complemented by mandatory digitization policies in Europe, where nations like Italy and France have achieved nearly universal smart meter coverage. Such public-sector backing ensures a steady demand for Advanced Metering Infrastructure (AMI) and creates a robust foundation for next-generation energy management.

- Rising Demand for Energy Efficiency and Transparency

A significant shift in consumer behavior and industrial requirements is fueling the growth of the smart meter industry. Modern residential users increasingly demand transparency in their energy consumption to manage rising utility costs and reduce their environmental footprint. Studies indicate that real-time data provided by smart meters can help households reduce energy consumption by as much as 15% through more informed decision-making. In the industrial sector, the need for operational efficiency is driving the adoption of meters that provide granular data for predictive maintenance and load optimization. For instance, the hardware segment, which includes the physical meters and sensors, currently accounts for nearly 63% of the total market value. This demand is further amplified by the integration of smart meters into smart city projects, where they serve as critical data points for managing urban resources and improving overall grid reliability for millions.

- Integration of Renewable Energy and Electric Vehicles

The global transition toward a decentralized energy landscape is a primary catalyst for smart meter adoption. As countries integrate higher volumes of intermittent renewable energy sources, such as solar and wind, smart meters provide the two-way communication necessary to balance supply and demand dynamically. In Europe, the expansion of new grids to accommodate renewable sources is a major growth factor, as smart meters allow utilities to manage peak loads and implement flexible pricing. Furthermore, the rapid rise of electric vehicles (EVs) has created a need for smart charging solutions that avoid overloading local distribution networks. Companies like Bharti Airtel and IntelliSmart are partnering to connect millions of meters via IoT platforms to support these complex energy ecosystems. By enabling consumers to sell excess solar power back to the grid and charge EVs during off-peak hours, smart meters have become indispensable tools for the modern green economy.

Key Trends in the Magnet Market

- Proliferation of Artificial Intelligence and Edge Analytics

The integration of Artificial Intelligence (AI) and edge computing is transforming smart meters from simple recording devices into intelligent grid assets. Modern meters are now capable of processing data locally to detect anomalies, such as voltage fluctuations or harmonic distortions, before they lead to equipment failure. This trend is particularly evident in the 2026 landscape, where AI-driven "predictive fingerprints" allow maintenance teams to intervene in the grid with high precision. For example, utilities are using AI to analyze input and output data continuously to identify patterns of energy theft or leakage in water systems. By moving data processing to the "edge" of the network, providers can respond to grid events in milliseconds, significantly reducing the downtime associated with traditional centralized analysis. This evolution supports more resilient infrastructure and empowers utilities to offer personalized energy-saving recommendations based on unique consumer usage profiles.

- Shift Toward Cellular-Based IoT Connectivity

A decisive trend in the smart meter market is the transition from traditional radio frequency (RF) mesh networks to advanced cellular IoT standards like NB-IoT and 5G. This shift is driven by the need for faster, more reliable, and more secure data transmission across vast geographic areas. Recent industry insights suggest that cellular connectivity is becoming the preferred medium for real-time monitoring, with a significant majority of new shipments adopting these protocols. For instance, in 2026, major partnerships between telecom giants and meter manufacturers are facilitating the connection of tens of millions of devices to centralized hubs. Cellular networks eliminate the need for utilities to maintain their own communication infrastructure, reducing long-term operational complexity. This connectivity trend is essential for supporting "Smart Meter as a Service" (SMaaS) models, where utilities can manage entire fleets of devices through cloud-based platforms to ensure seamless billing and outage management.

- Expansion into Smart Water and Gas Metering

While electricity meters have historically dominated the market, there is an emerging and rapid expansion into the smart water and gas sectors. Driven by global water scarcity and the need for leak detection, the smart water meter segment is seeing massive investments from major utilities. In late 2024 and 2025, companies like Thames Water and Anglian Water implemented multi-million dollar framework deals to deploy smart sensors that have already prevented millions of liters of daily water waste. These devices utilize advanced acoustic sensors to identify tiny cracks in pipes that would otherwise go undetected for months. Similarly, smart gas meters are being deployed to enhance safety through automatic shut-off features and to provide accurate, real-time billing for consumers. This diversification represents a holistic approach to resource management, where a single integrated platform can monitor multiple utilities, providing a comprehensive view of a household's or a city's total environmental impact.

Our report provides a deep dive into the magnet market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Leading Companies Operating in the Global Magnet Industry:

- Adams Magnetic Products, LLC

- Arnold Magnetic Technologies

- BGRIMM Technology Group

- Daido Kogyo Co., Ltd.

- DMEGC

- Electron Energy Corporation

- Goudsmit Magnetics

- Lynas Rare Earths Ltd

- Magnequench International, LLC

- Proterial, Ltd

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

- Yantai Dongxing Magnetic Materials Inc

Magnet Market Report Segmentation:

By Magnet Type:

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminium Nickel Cobalt (AlNiCo)

- Samarium Cobalt (SmCo)

The permanent magnet market is segmented by magnet type, with NdFeB dominating due to its superior strength, followed by ferrite for cost-effectiveness, AlNiCo for temperature stability, and SmCo for extreme conditions.

By Application:

- Computer Hard Disk Drives (HDD), CD, DVD

- Hybrid Electric Vehicles

- Electric Bicycles

- Heating, Ventilating and Air Conditioners (HVAC)

- Wind Turbines

- Other Applications

- Transducers and Loudspeakers

- Magnetic Separation Equipment and Sorters

- Magnetic Resonance Imaging (MRI)

- Magnetic Braking Systems

- Magnetically Levitated Transportation Systems

- Medicine and Health

- Credit Cards and other ID Cards

- Traveling Waves Tubes (TWT)

- Advertising and Promotional Products

- Magnetic Refrigeration system

- Nanotechnology

- Military and Aerospace

- Energy Storage Systems

The permanent magnet market is dominated by computer hard disk drives (HDD), CD, DVD applications, with significant growth in hybrid/electric vehicles, e-bikes, HVAC, and wind turbines, driven by demand for efficient, reliable, and high-performance magnetic solutions.

Regional Insights:

- China

- Japan

- USA

- Europe

- Other Regions

China leads the permanent magnet market due to its manufacturing capacity and rare earth dominance, while Japan, the USA, and Europe emphasize technological innovation and sustainable applications.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302