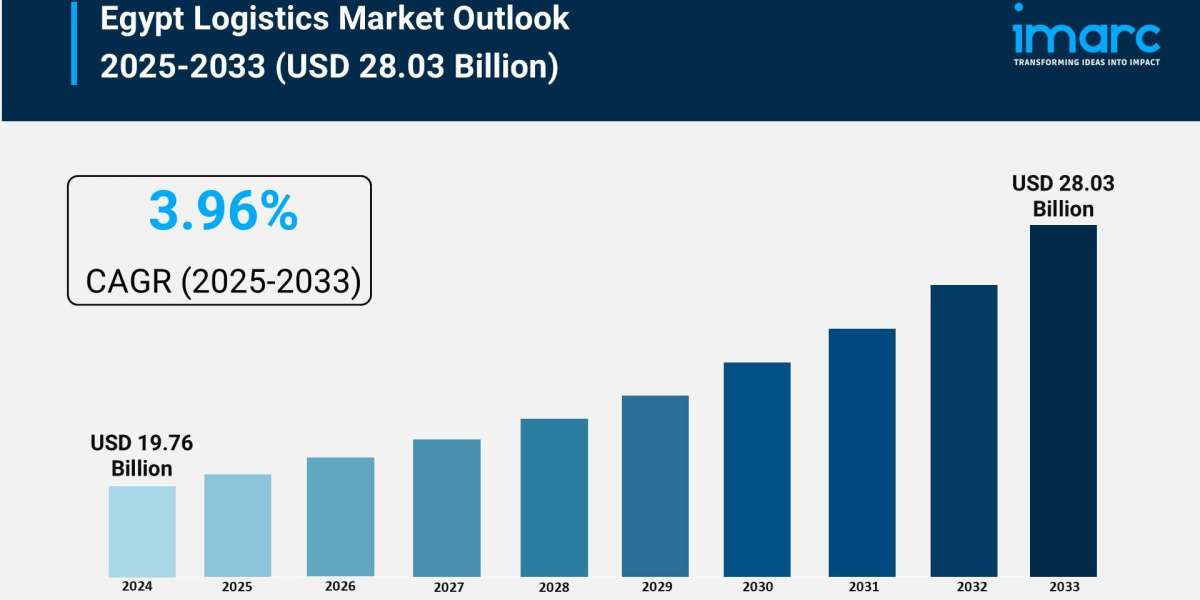

Market Overview

The Egypt logistics market size reached USD 19.76 Billion in 2024 and is projected to grow to USD 28.03 Billion by 2033. The market is expected to grow at a CAGR of 3.96% during the forecast period 2025-2033. The government's focus on infrastructure improvements such as new roads, expanded highways, and enhanced rail networks is boosting transportation effectiveness. Additionally, collaborations between retailers and shipping firms are enhancing customer satisfaction and delivery experiences, fueling the market growth.

How AI is Reshaping the Future of Egypt Logistics Market

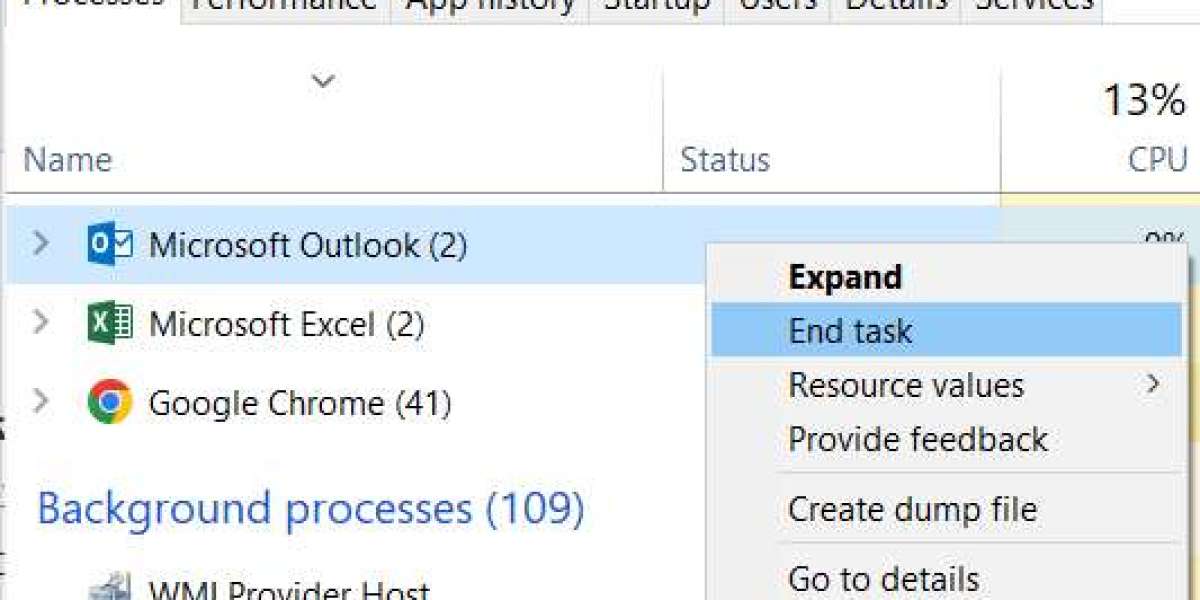

- AI enables real-time shipment tracking and digital system integration, as seen in the new Advanced Customs Logistics Centre investment of USD 60 Million, improving customs processing efficiency.

- Through predictive analytics, AI optimizes supply chain operations, enabling better fleet management and route optimization amid expanding infrastructure projects.

- AI-driven automation supports expanding e-commerce fulfillment centres near major cities, enhancing the speed and accuracy of last-mile delivery networks.

- Machine learning improves inventory management and demand forecasting, helping logistics players effectively manage rising small and frequent shipment volumes.

- AI-powered customer insights and behavior research enable logistics companies to tailor services to changing rural and urban online shopping patterns.

- Advanced robotics and AI in warehousing contribute to supporting local and regional delivery networks, meeting customer expectations for same-day or next-day delivery.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-logistics-market/requestsample

Market Growth Factors

Infrastructure investments by the Egyptian government are a key driver, focusing on new roads, expansion of highways, and rail network enhancements aimed at improving transportation efficiency. These initiatives reduce delays and lower fuel costs, facilitating faster goods movement across the country. Airport expansions enhance air cargo capacity, while the development of industrial zones and logistics parks supports warehousing services. These efforts attract local and international companies, encourage supply chain investment, broaden technology adoption, and create employment, all fostering sustained market growth.

The rapid expansion of e-commerce portals significantly fuels market growth. The Egyptian e-commerce market generated USD 1,485 Million in revenue with an estimated growth rate of 20-25%. This surge in online shopping, especially via mobile devices, promotes the development of more robust logistics infrastructure: better technology, inventory, and last-mile delivery systems. E-commerce growth encourages the establishment of fulfillment centers near major cities and extends delivery networks into rural areas, thereby increasing shipment volumes and necessitating innovations in payment and returns processing.

The strategic collaborations and investments in logistics hubs are accelerating market expansion. Notably, a 50-year concession deal signed with Abu Dhabi Ports Group involves a USD 120 Million investment to develop a 20-square km logistics and industrial zone at Suez Canal Economic Zone. This and similar projects incorporate advanced technologies for shipment handling and customs processing, promising to create thousands of jobs and enhance operational efficiencies. These partnerships bolster logistics infrastructure resilience and competitiveness within Egypt’s growing economy.

Market Segmentation

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Recent Development & News

- May 2025: Egypt's Suez Canal Economic Zone concluded a 50-year concession with Abu Dhabi Ports Group, allocating USD 120 Million to develop a 20-square km logistics and industrial zone east of Port Said, enhancing logistics infrastructure and maritime capabilities.

- March 2025: Egypt's Prime Minister launched the Advanced Customs Logistics Centre at the Economic Zone, involving USD 60 Million investment with Agility, introducing a 100,000 square metre facility equipped with digital systems for prompt shipment and customs processing, expected to generate 2,500 direct and indirect jobs.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302