Los Angeles spa retreats often feature candlelit treatment rooms, aromatherapy experiences, and heated pools with city views.

Los Angeles spa retreats often feature candlelit treatment rooms, aromatherapy experiences, and heated pools with city views. Melt away daily stress with a luxury spa experience designed specifically for nighttime relaxation. Discover more sophisticated 자막야동 North Carolina experiences for your evening itinerary. Find more delectable Chicago experiences to satisfy your evening cravings. Discover more breathtaking San Francisco experiences for your Bay Area evenings. If you’re wondering things to do right now at night that combine history with thrills, ghost tours delive

Adult Star Fuck Manuel Like an Amateur Trailers Compilation 7 min 16 minMOON FORCE - 3.9M Views - Amateur Asian turned audition into hardcore porn show, Japanese Adult Video! Tanya dominates ass 자막야동 - Free Porn, Adult Videos, Amateur Videos, Amateur Porn, TV Sex Porno XXX- yuvut 75 sec Free Porn, Adult Videos, Amateur Videos, Amateur Porn Adultspace.com 4 min 17 minMOON FORCE - 2.5M Views -

16 minMOON FORCE - 1.3M Views - 16 minMOON FORCE - 7.2M Views - Watch beautiful women fuck and cum as they spread eagle in your face and you can almost taste that juicy pussy on your screen. Offering exclusive content not available on Pornhub.com Offering exclusive content not available on Pornhub.co

Adult film actresses Anime Filter Compilation #13 (SEXY ADULT FILM ACTRESS EDITION) 6 min A twenty-year-old barmaid with natural saggy breasts applies to be an adult-movie performer 71 sec Real life amateur couple want to do porn and visited the Adult Film School 6 min Yui Nishikawa's powerful sexual encounter in the restroom has been described as a killer and messy experience. Sandra Chappelle's Back Gets Blasted Full of Cum, POV Version 6 m

Categories Related to Adult Movie

The movie demonstrates her providing a bj before having sexual intercourse. It is important that responsible parents and guardians take the necessary steps to prevent minors from accessing unsuitable content online, especially age-restricted content. Upload free legal age teenager sex movies Enjoy our exclusive catalogs with over 300 channels, 60,000 episodes, and new releases every day!

Watch this exclusive video only on pornhub premium.

Offering exclusive content not available on Pornhub.com Offering exclusive content not available on Pornhub.com. XVideos.com - the best

자막야동 free porn videos on internet, 100% fre

Mina Moon Sucks Dick and Gets Fucked Twice 11 min For example, they allow us to carry out statistical analysis of page use, interactions, and paths you take through the Website to improve its performance. This website is only intended for users over the age of 18. Maki Aimoto, a huge-chested Milf from Japan, flashes her dirty, NSFW skills in this hardcore porn

For those 자막야동 seeking late night fun activities that connect you with nature, this is hard to beat. Discover more thrilling Los Angeles experiences to elevate your evening plans. These high-energy nightly activities prove that there are plenty of activities far beyond bars and restaurants. So put down your phone, close the Netflix app, and discover fun things to do at night that might just become your new favorite traditions. Moreover, advancements in digital platforms and social media have reshaped how people discover and engage with nightlife, amplifying its influence and reach. Some sociologists have argued that vibrant city nightlife scenes contribute to the development of culture as well as political movement

POV (Point Of View)

As a couple we enjoy looking at porn by find the main sites are not for us as lots of it is huge cocks, fake boobs and perfect bodys. Reddit is good for viewing and posting but the categories do seem to be taken over by only fans etc… there is places on Reddit that are amateur only no fans allowed. Don't forget to register for a free membership account to upload your videos, leave comments, save videos and utilize other advanced features! Since 2006 YourAmateurPorn is by far the best real user submitted tube around, and we are proud to serve you only high quality hardcore erotic scenes. These are real people having real fun and not just someone doing it for money and faking everything.

Japanese Homemade

I’ve often said we should post some of our clips & stuff there as they’d get a million likes in comparison (yes I know there is going to be really severe content, but not thinking that way) I mean for kinksters like us on LH. Isn’t the majority of the general stuff out there really quite tame

Nighttime Sailing Cruise in San Francisco

From sun-drenched cocktails to oceanfront lounges, this is 자막야동 where coastal breezes, cold drinks, and carefree vibes roll in with the tide. The VÜE Rooftop Bar at The Claridge Hotel offers the ultimate rooftop experience in Atlantic City… The Lobby Bar is the lively social hub of Hard Rock Hotel, offering the perfect spot to relax and… Tango’s is the place to sip premium cocktails at… Phil's Carousel Bar offers stunning 360-degree views of the casino and hotel lobb

Repair an Office application

Repair an Office application

Poker Room Online Non AAMS: Analisi delle Dinamiche Competitive e Implicazioni per il Giocatore Italiano

От devidweb

Poker Room Online Non AAMS: Analisi delle Dinamiche Competitive e Implicazioni per il Giocatore Italiano

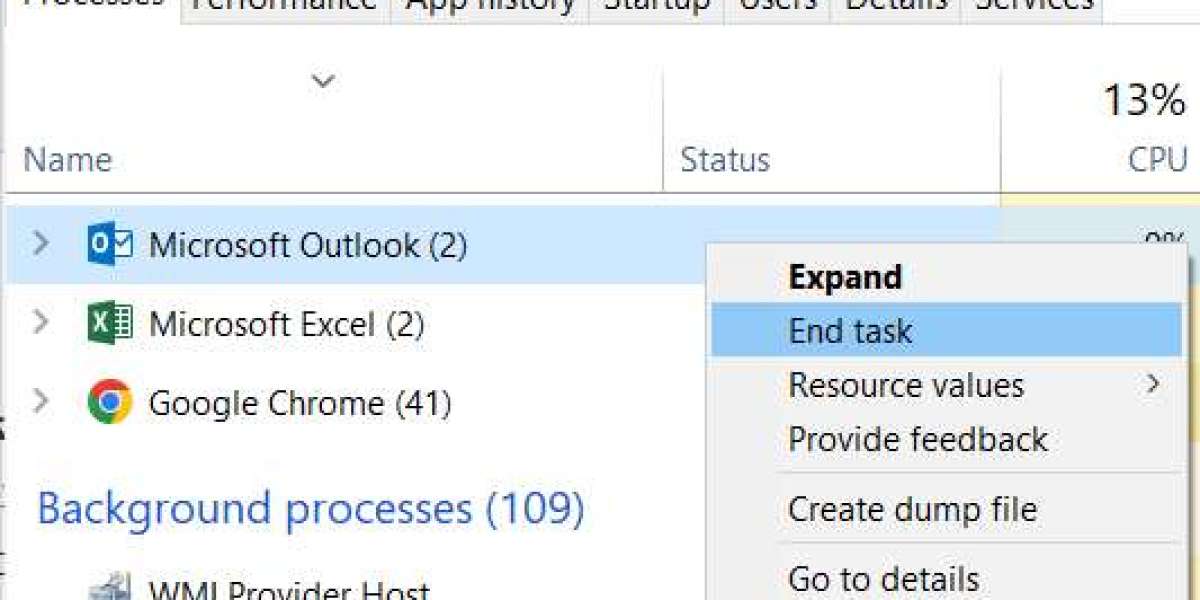

От devidweb Outlook 2013 2016 stuck on "loading profile" for about 30 seconds Software & Applications

Outlook 2013 2016 stuck on "loading profile" for about 30 seconds Software & Applications

Global Power Steering Fluids Market Industry Insights, Trends, Outlook, Opportunity Analysis Forecast To 2025-2034

От kertina2

Global Power Steering Fluids Market Industry Insights, Trends, Outlook, Opportunity Analysis Forecast To 2025-2034

От kertina2Tree Service Springfield Tips for Safer Trees